Last Update23 Aug 25Fair value Decreased 20%

Despite Omada’s stronger-than-expected growth in members and revenue, robust gross margin gains, and improving clinical partnerships, analysts have lowered the price target from NOK44.00 to NOK35.00 due to a more cautious broader outlook.

Analyst Commentary

- Bullish analysts highlight Omada’s member and revenue growth significantly surpassing expectations, with first-quarter figures beating estimates by 6.7% and 11.5%, respectively.

- The company’s AI-powered virtual care platform is viewed as differentiated and effective in driving better engagement and health outcomes, giving Omada a distinct competitive edge in the crowded chronic-care market.

- Improved financial metrics, notably in gross margins, alongside a proven track record of clinically validated outcomes (supported by 29 peer-reviewed studies), strengthen confidence in Omada’s long-term prospects.

- Strong and expanding channel and PBM partnerships are cited as key growth levers, enhancing Omada’s ability to win new business as employers reassess chronic disease management strategies amid rising medical costs and the emergence of GLP-1 drug utilization.

- Rapid market share gains are attributed to Omada’s clinical leadership and ability to provide compelling alternatives to costly drug therapies, supporting forecasts for sustained 35%+ top-line growth and progress toward adjusted EBITDA breakeven.

Valuation Changes

Summary of Valuation Changes for Omda

- The Consensus Analyst Price Target has significantly fallen from NOK44.00 to NOK35.00.

- The Future P/E for Omda has significantly fallen from 87.38x to 52.54x.

- The Net Profit Margin for Omda has significantly risen from 2.51% to 3.28%.

Key Takeaways

- High reliance on public sector and Nordic-European contracts exposes Omda to risks from budget constraints, regulatory changes, and potential cuts in IT spending.

- Sustained competitiveness demands heavy investment in R&D and cyber compliance, which could hinder margin growth amid intensifying international competition.

- Strong recurring revenue, robust customer retention, digital health expansion, and strategic cost and M&A initiatives are driving Omda's sustainable growth and margin improvement.

Catalysts

About Omda- Provides software solutions for the healthcare and emergency response sector in Norway, Sweden, Denmark, Finland, and internationally.

- Investors may be overestimating Omda's ability to maintain strong revenue growth rates, as much of its expansion relies on ongoing digitization in healthcare and public investment, which can be challenged by potential macroeconomic pressures or austerity measures-raising the risk of future revenue disappointments if public sector IT spending slows.

- The company's heavy dependence on publicly funded, Nordic and European contracts creates long-term exposure to regulatory tightening and cyclically constrained government budgets, suggesting margins and recurring revenues could be impacted by compliance cost increases or contract cutbacks.

- Although the company highlights strong, resilient recurring revenues and successful margin expansion, the required pace of R&D and platform upgrades to remain competitive (including integration of AI and data analytics) may keep operating expenses higher for longer, compressing net margins over time.

- Market valuations may not fully account for Omda's vulnerability to increasing data privacy regulation complexity and the continually evolving cyber-threat landscape, both of which carry the potential for higher costs, reputational risks, and lower profitability in the future.

- Despite positive outlooks regarding geographic and product expansion, Omda faces intensifying competition from large established international health tech firms and startups; this could erode its pricing power and market share, placing future revenue and earnings growth at risk if growth expectations are priced for near-perfection.

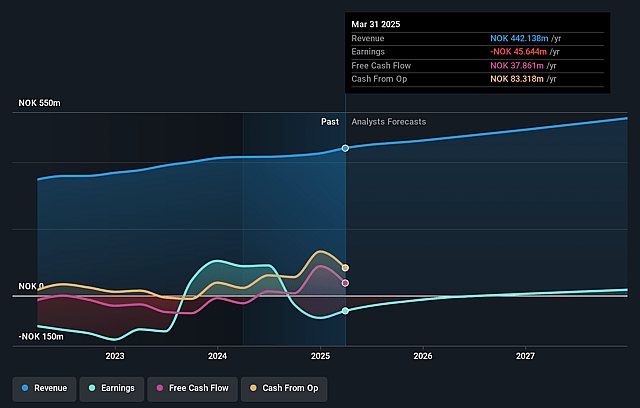

Omda Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Omda's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.6% today to 4.5% in 3 years time.

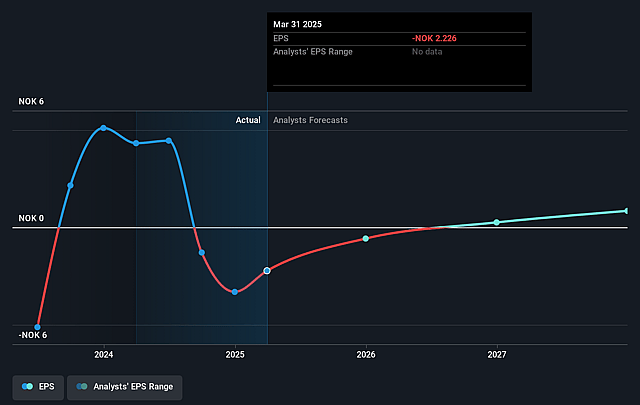

- Analysts expect earnings to reach NOK 24.5 million (and earnings per share of NOK 0.85) by about September 2028, up from NOK -25.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.0x on those 2028 earnings, up from -38.6x today. This future PE is greater than the current PE for the NO Healthcare Services industry at 35.5x.

- Analysts expect the number of shares outstanding to grow by 1.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

Omda Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The aging global population and increasing demand for efficient, digitalized healthcare solutions are likely to drive sustained volume growth for Omda, as evidenced by their expanding footprint in specialized sectors (e.g., Emergency and fertility areas), supporting long-term revenue stability and growth.

- The company's highly diversified revenue base-over 750 active contracts across 26 countries, with >79% recurring revenues and ultra-low churn (<2%)-demonstrates strong customer retention, resilience, and predictability, countering risks of revenue decline.

- Ongoing digital transformation in healthcare, including adoption of patient-centric IT platforms and integration of AI-driven modules, positions Omda well to capture both organic growth (guided at 5–10% per year) and higher-margin value-added sales, enhancing future gross margins and earnings.

- Strategic cost efficiencies (such as COGS reduction toward 5%, selective FTE reductions, and productivity gains via AI-assisted development) have led to significant EBITDA margin improvement (from 12% to 20% YoY, aiming for 28%–32% in 2026), supporting robust future net margin and earnings expansion.

- Prudent, disciplined M&A activity-focused on acquiring complementary software and domain expertise within existing verticals-and the ability to leverage favorable market conditions for acquisitions (lower upfront cash, earnouts) suggest further scalable inorganic growth, diversification, and upside for both revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK35.0 for Omda based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK545.8 million, earnings will come to NOK24.5 million, and it would be trading on a PE ratio of 38.0x, assuming you use a discount rate of 8.2%.

- Given the current share price of NOK48.1, the analyst price target of NOK35.0 is 37.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.