Key Takeaways

- Strategic focus on premium products and expansion of service rep investments aim to drive revenue growth, particularly in architectural coatings.

- Price increases and new store openings are strategies to improve net margins and market penetration, alongside targeted acquisitions for positive revenue and earnings impact.

- Investments in SG&A and uncertain raw material costs, combined with shaky market gains and rising non-material costs, may significantly hinder profitability and revenue growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Strategic focus on premium product offerings aims to enhance volume and mix, positively impacting revenue and gross margins.

- Expansion of sales and technical service rep investments aims to drive above-market growth and share gains, particularly in the architectural coatings segment, thereby potentially improving revenue.

- The announced 5% price increase, effective February 1, 2024, across several product lines, is expected to improve net margins by offsetting increased raw material and operational costs.

- Continued investments in new store openings (80 to 100 anticipated in 2024) are designed to increase market penetration and accessibility, contributing to revenue growth.

- A targeted approach to capturing new business and increasing share of wallet in every business segment and region, boosted by strategic acquisitions and operational efficiencies, aims to impact overall revenue and earnings positively.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Sherwin-Williams's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.4% today to 12.0% in 3 years time.

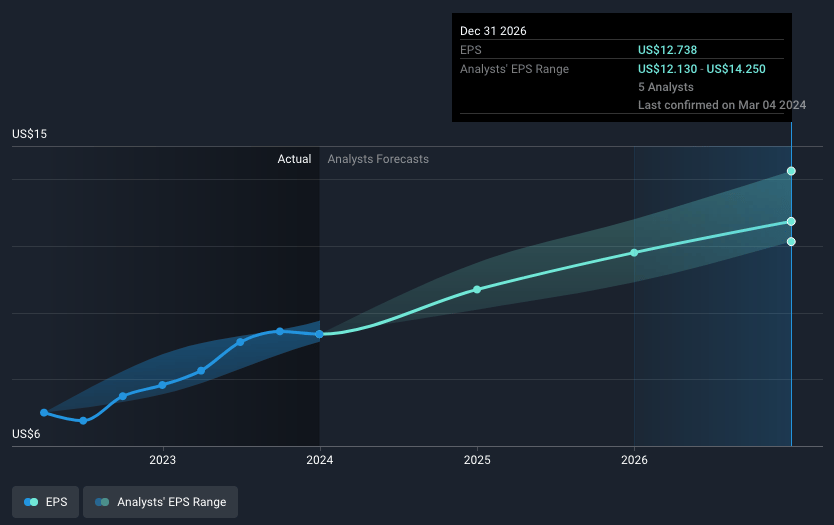

- Analysts expect earnings to reach $3.2 billion (and earnings per share of $12.74) by about March 2027, up from $2.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2027 earnings, down from 35.7x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.98%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The significant investment in SG&A (Selling, General, & Administrative expenses) to drive above-market growth may not yield the expected return, impacting net margins negatively if growth investments do not meet performance expectations.

- Expected raw material costs reduction by a low single-digit percentage might not materialize if supply and demand dynamics change unexpectedly, affecting gross margins.

- The reliance on continued share gains in the residential repaint market without a clear macroeconomic catalyst for consumer demand improvement could limit revenue growth potential.

- The potential impact from the transitioning of new commercial starts slowing down in 2023, which may affect sales mid-way through 2024 if commercial completions decline as anticipated.

- Increases in non-raw material costs such as wages, health care, energy, and transportation expected to rise in the mid- to high single-digit range in 2024, could pressure profitability if they cannot be offset by pricing actions or operational efficiencies.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $327.91 for Sherwin-Williams based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $26.3 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of $335.27, the analyst's price target of $327.91 is 2.2% lower. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.