Last Update 12 Feb 26

Fair value Decreased 2.63%MULTI: Defence Contract And New Leadership Will Support Future Earnings

Analysts have trimmed their Multiconsult price target from NOK 190 to NOK 185, reflecting updated assumptions for slightly higher discount rates, more measured revenue growth, modestly lower profit margins, and a higher future P/E multiple.

What's in the News

- The board plans to propose a dividend of NOK 5.00 per share for the 2025 financial year at the annual general meeting scheduled for 16 April 2026. Payment is expected on or around 20 April 2026, subject to shareholder approval (company announcement).

- Karsten Warloe has been appointed Chief Executive Officer, effective 1 June 2026. Current CEO Grethe Bergly will stay on until the transition is completed to support a smooth handover (company announcement).

- Multiconsult Norge AS has been nominated as the A level supplier in a framework agreement for strategic property, buildings and infrastructure advisory services with the Norwegian Defence Estates Agency. This is part of a total estimated agreement value of NOK 275 million for all suppliers, running initially for 2 years with options up to 2030, subject to a standstill period expiring 22 December 2025 (company announcement).

- The company has completed a share buyback program, repurchasing 936,954 shares, equal to 3.39% of the company, for a total of NOK 179.63 million under the mandate announced on 24 February 2025 (company announcement).

Valuation Changes

- Fair Value: Trimmed from NOK 190 to NOK 185, representing a small reduction in the central valuation estimate.

- Discount Rate: Raised from 8.51% to 8.84%, indicating a slightly higher required return in the model.

- Revenue Growth: Assumed long term growth rate eased from 8.15% to 6.43%, implying more measured top line expectations.

- Net Profit Margin: Adjusted from 7.01% to 6.50%, reflecting a modestly lower profitability assumption.

- Future P/E: Target exit multiple increased from 12.28x to 14.00x, pointing to a higher assumed valuation level at the end of the forecast period.

Key Takeaways

- Focus on sustainability, digital expertise, and workforce development strengthens Multiconsult's competitive edge and supports long-term growth and margin expansion.

- Robust order backlog from major public sector projects ensures strong revenue visibility, while cost control measures help mitigate margin pressures.

- Rising costs, reliance on public contracts, and intensifying competition threaten margins, while expansion and acquisition integration increase operational risks and revenue volatility.

Catalysts

About Multiconsult- Engages in the provision of engineering design, consultancy, and architecture services in Norway, Sweden, Denmark, Poland, and internationally.

- The ongoing emphasis on sustainability and energy transition, highlighted by new hydropower and carbon capture projects, positions Multiconsult to capture higher-margin, future-proof mandates and drive long-term revenue and earnings growth.

- Secular demand from increased infrastructure renewal and public sector investments is evidenced by record order backlog and major contracts in hospitals, defense, and transportation, providing strong medium-term visibility for revenue and cash flow growth.

- The acquisition of ViaNova and related digital/BIM capabilities expands Multiconsult's expertise in smart infrastructure, enabling improved operational efficiency and differentiation, which should support both higher net margins and future top-line opportunities.

- Management's continued focus on cost control and synergy realization, particularly through operational integration and digital investments, is expected to offset wage inflation and margin pressures, preserving earnings quality and supporting margin expansion over time.

- Investments in workforce development, organizational excellence, and being a preferred employer among technical graduates help ensure talent pipeline strength, supporting sustained productivity and competitive advantage-which underpins future growth and margins.

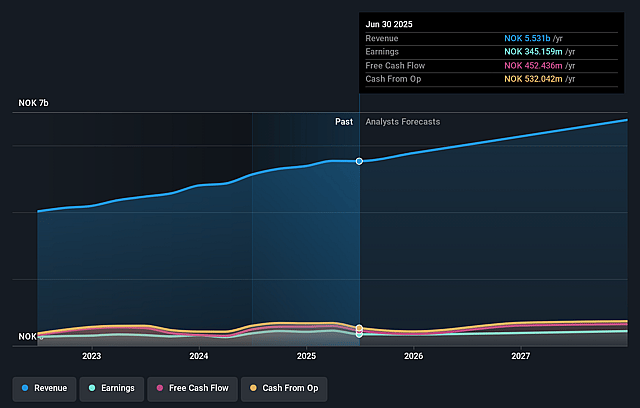

Multiconsult Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Multiconsult's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 6.4% in 3 years time.

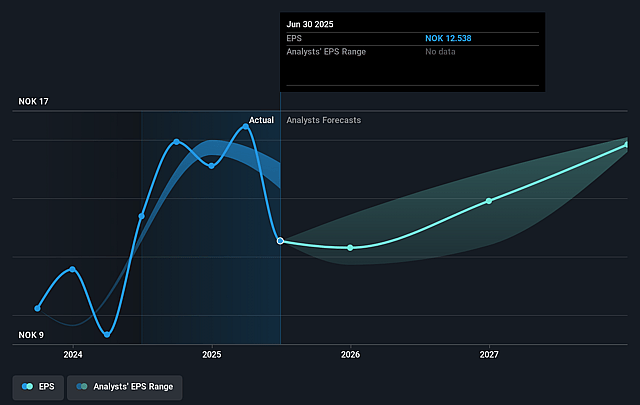

- Analysts expect earnings to reach NOK 450.5 million (and earnings per share of NOK 15.83) by about September 2028, up from NOK 345.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 13.9x today. This future PE is greater than the current PE for the GB Construction industry at 14.5x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Multiconsult Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent cost inflation, including rising employee benefit expenses and IT costs, has outpaced revenue growth, compressing EBITA margins and potentially threatening future net margins and earnings.

- Heavy reliance on public sector spending and defense/infrastructure frame agreements-particularly in Norway-creates vulnerability to fiscal tightening or shifts in government priorities, increasing long-term revenue volatility.

- Intensifying price competition and margin pressures in core business areas (initially building and property, now spreading to others) threatens Multiconsult's ability to maintain pricing power and could further erode net margins and earnings growth.

- Lower billing ratios, driven by changing project portfolio mix and ramp-up delays in new frame agreements, may persist or recur, resulting in reduced revenue per employee and limiting overall revenue and profit expansion.

- Ongoing integration of acquisitions and expansion into new markets exposes Multiconsult to operational complexity and risk of underperformance outside core geographies, potentially impacting top-line growth and operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK199.333 for Multiconsult based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK7.0 billion, earnings will come to NOK450.5 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of NOK175.5, the analyst price target of NOK199.33 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Multiconsult?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.