Key Takeaways

- Altria's initiatives, including acquiring NJOY and expanding the distribution of on! oral nicotine pouches, aim to enhance its market presence in smoke-free products.

- Strategic focus on innovation and regulatory compliance via products like NJOY's Bluetooth device and investment in R&D, expected to drive long-term growth.

- Regulatory, legal, and economic challenges, alongside the growth of the illicit market, could significantly affect sales volumes, market share, and financial performance.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Altria’s acquisition and integration of NJOY, with steps to solidify its supply chain and expand distribution, likely boosting future sales and affecting revenue positively.

- The introduction of NJOY’s first retail trade program to secure premium positioning and visibility at retail, intended to enhance brand awareness and potentially increase market share in the e-vapor category, subsequently impacting revenue.

- Plans to submit a PMTA for NJOY’s age-restricted Bluetooth device with non-tobacco flavors, aiming for regulatory approval to capture a larger market share and drive growth in the e-vapor category, likely impacting future earnings.

- Expanding the distribution of on! oral nicotine pouches, including on! PLUS in Sweden, indicating a strategic move to capture share in the growing smoke-free product segment, which can boost revenue and margins through product differentiation.

- Strategic investments towards smoke-free product research, development, and regulatory preparations, signaling a commitment to innovation and regulatory compliance expected to fuel long-term growth in smoke-free categories, thus impacting future earnings and revenue.

Assumptions

How have these above catalysts been quantified?

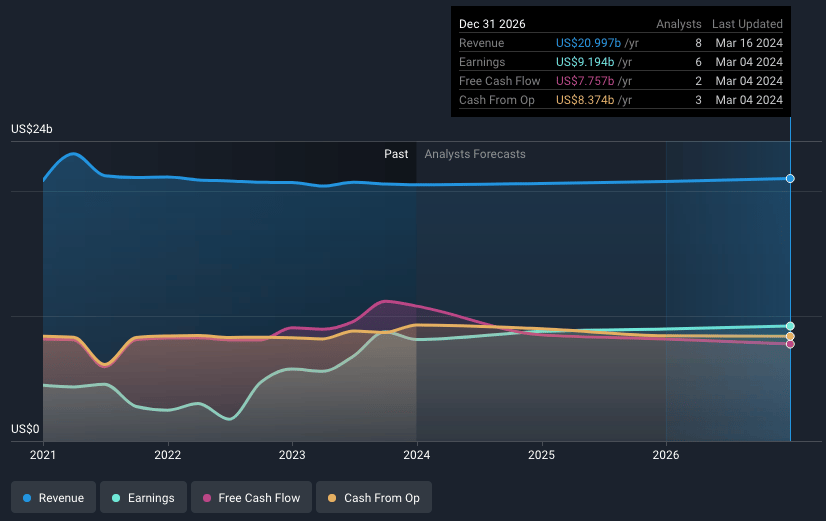

- Analysts are assuming Altria Group's revenue will grow by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 39.6% today to 43.8% in 3 years time.

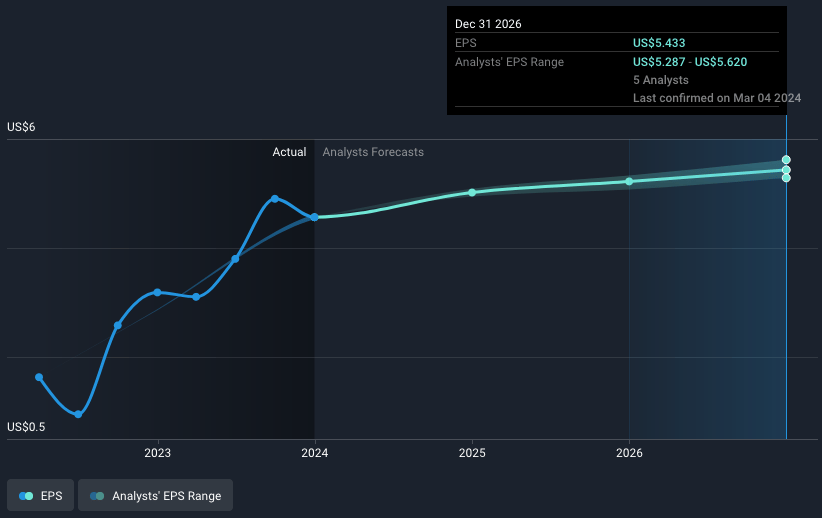

- Analysts expect earnings to reach $9.2 billion (and earnings per share of $5.43) by about March 2027, up from $8.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2027 earnings, up from 9.7x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.79%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Regulatory and legal challenges, especially around the marketing and sale of flavored e-vapor and modern oral products, could adversely impact sales volumes and market share.

- Economic pressures on tobacco consumers, leading to increased price sensitivity and potential shifts towards lower-margin products or illicit market alternatives, affecting net revenue and margins.

- Continued growth in illicit flavored disposable e-vapor products may erode market share of regulated products, impacting revenue from e-vapor category.

- Potential federal or state regulatory actions, including menthol cigarette bans, could lead to significant market disruptions and impact sales volumes of high-margin products.

- Increased promotional and marketing investments necessary to compete in the e-vapor and modern oral categories could compress overall margins and reduce net earnings.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $46.83 for Altria Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $21.0 billion, earnings will come to $9.2 billion, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $44.51, the analyst's price target of $46.83 is 5.0% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.