Key Takeaways

- Acquisition of Carlisle Interconnect Technologies is seen as augmenting revenue and profitability, signifying an optimistic future financial outlook.

- Strong orders and significant growth in the IT and data communications market highlight a potential upward trajectory in future revenues.

- Amphenol's strategies and market focus may impact profitability, cash flow, and operational efficiency, influenced by acquisitions, technology shifts, and competition in high-growth sectors.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

- The anticipated acquisition of Carlisle Interconnect Technologies (CIT) is expected to generate approximately $900 million in annual sales with an EBITDA margin of approximately 20%, implying a potential boost to Amphenol's revenues and profitability once the transaction is completed by the end of the second quarter of 2024. This could impact revenue and net income positively.

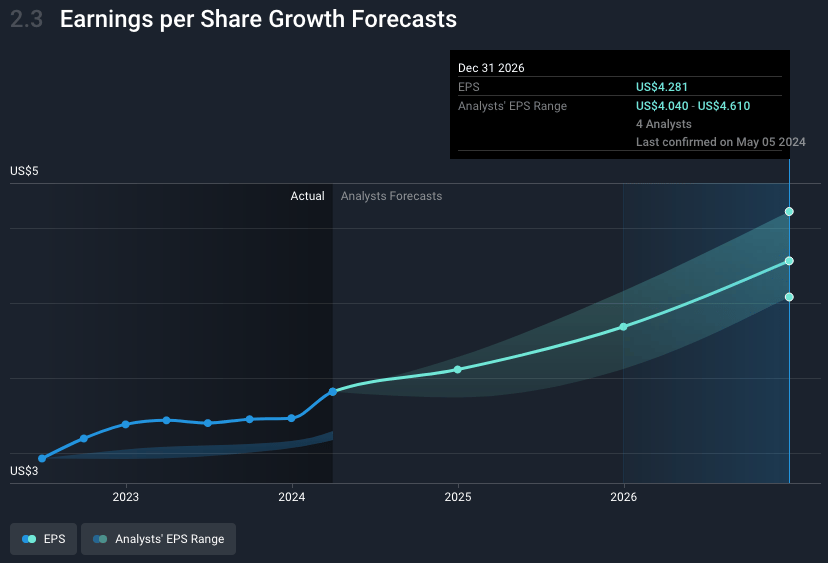

- A new $2 billion 3-year open-market stock repurchase plan approved by the company’s Board of Directors signals a commitment to returning value to shareholders, potentially influencing earnings per share (EPS) growth positively.

- Strong orders with a book-to-bill ratio of 1.03:1 indicate a healthy demand across Amphenol's product range, suggesting potential for future revenue growth.

- Significant growth in the IT and data communications market, particularly from products used in artificial intelligence data centers, drove a 29% increase in sales in this segment. This trend is expected to continue into the second quarter, indicating a strong growth trajectory that could positively impact future revenues.

- The robust free cash flow yield and disciplined capital investment, including slightly elevated levels of CapEx to support growth in certain markets, reflect strategic financial management that could enhance Amphenol's long-term growth prospects, potentially influencing both revenue growth and margin expansion.

Assumptions

How have these above catalysts been quantified?

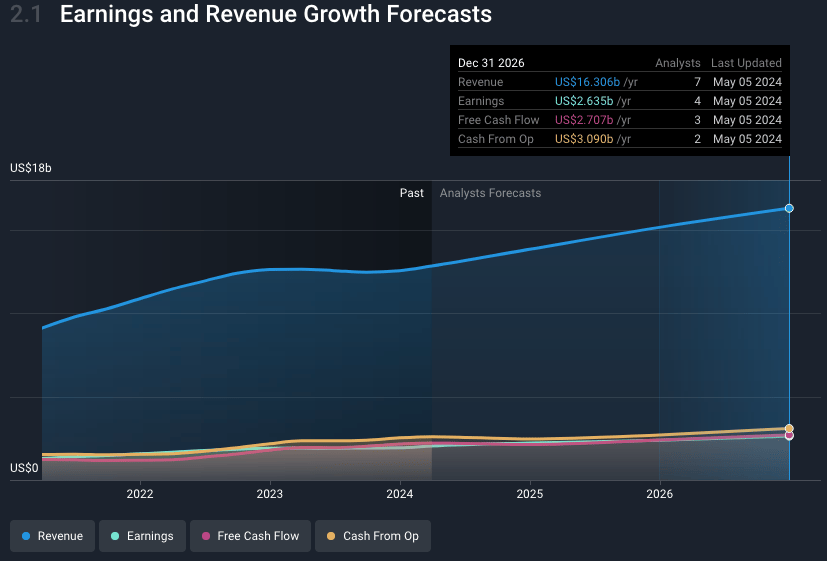

- Analysts are assuming Amphenol's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.9% today to 16.1% in 3 years time.

- Analysts expect earnings to reach $2.6 billion (and earnings per share of $4.32) by about May 2027, up from $2.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.6x on those 2027 earnings, down from 37.3x today. This future PE is greater than the current PE for the US Electronic industry at 19.2x.

- Analysts expect the number of shares outstanding to grow by 0.62% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The potential dilution impact of acquisitions, such as the pending acquisition of Carlisle Interconnect Technologies, could lead to short-term decreases in operating margin and affect overall profitability.

- Heavy reliance on AI-related product demand within the IT and Datacom market segments could expose Amphenol to market volatility and rapid shifts in technology, potentially impacting revenue sustainability.

- Elevated levels of capital expenditure to support growth in markets like AI and Defense may strain cash flow and reduce free cash flow available for other investments or shareholder returns.

- Intense competition in high-growth markets, such as automotive and AI data centers, could pressure margins and market share, affecting revenue and earnings growth.

- Operational risks associated with scaling production to meet the demands of next-generation technology markets, including AI, may lead to inefficiencies or increased costs that could impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $125.29 for Amphenol based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $138.0, and the most bearish reporting a price target of just $90.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $16.4 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 33.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of $126.61, the analyst's price target of $125.29 is 1.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.