Key Takeaways

- The decision to pay dividends in stock points to potential cash flow concerns or a strategic move to conserve cash, affecting shareholder returns and confidence.

- Volatility in by-product prices and significant capital expenditures may strain finances, impacting profitability and operational efficiency.

- Decarbonization and resilient U.S. economy may drive copper demand, expansions, and ESG focus could boost production, attract investors, and enhance revenue.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

- The decision to pay dividends in stock instead of cash may suggest concerns about the company's cash flow or a desire to conserve cash for future projects or debt management, potentially impacting shareholder returns and confidence.

- A significant portion of the company's sales value comes from by-products like molybdenum, whose price dropped by 38% and silver, where despite an increase in price, sales dropped due to a decline in volume. This volatility in by-product prices can lead to fluctuations in revenue and earnings.

- The company is undertaking extensive capital investments exceeding $15 billion, including several new projects and infrastructure investments. These expenditures could strain the company's finances in the short to medium term, potentially affecting profit margins and return on investment if project returns do not meet expectations.

- Southern Copper experienced a decrease in sales value by 7% and a drop in net income by 9.5% compared to the previous year, indicating current profitability pressures. This trend could continue if copper and by-product prices remain unfavorable or costs escalate, impacting net margins and earnings negatively.

- Concerns about water supply issues at the Buenavista operations and the need to transport water by truck could lead to higher operational costs and supply chain inefficiencies. Although temporarily resolved, any future disruptions or the failure to obtain necessary permits for a more permanent solution could adversely affect production costs and operational efficiency.

Assumptions

How have these above catalysts been quantified?

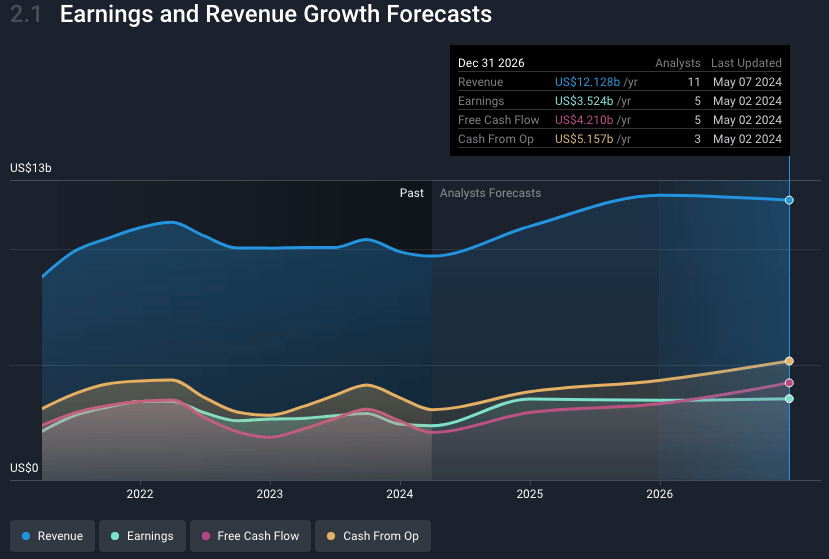

- Analysts are assuming Southern Copper's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.2% today to 27.4% in 3 years time.

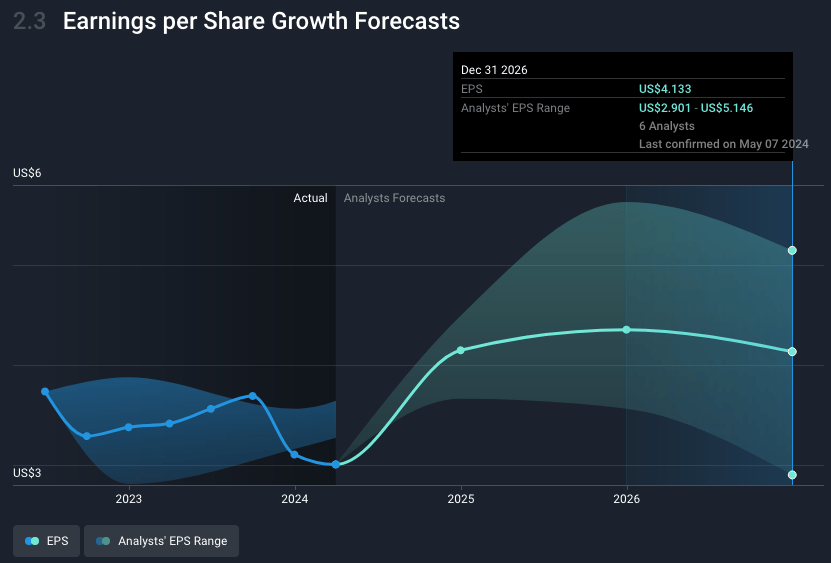

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $4.24) by about May 2027, up from $2.3 billion today. However, there is a considerable amount of disagreement amongst the analysts, with the most bullish analysts expecting $4.6 billion in earnings, and the most bearish analysts expecting $2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2027 earnings, down from 37.6x today. This future PE is greater than the current PE for the US Metals and Mining industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.86%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Increased demand for copper due to decarbonization technologies and a resilient U.S. economy could drive up copper prices, positively impacting revenue.

- The new Buenavista zinc concentrator's ramp-up, contributing significantly to both zinc and copper production, may enhance productivity and revenue, positively influencing earnings.

- Reduction in global copper production estimates, creating a potential market deficit, could elevate copper prices, benefiting revenue and net margins.

- Successful expansion projects like Tia Maria, Los Chancas, and Michiquillay, once operational, are expected to significantly increase production capacity, boosting revenue.

- Strong focus on Environmental, Social, and Governance (ESG) initiatives, improving the company's sustainability profile, could attract environmentally conscious investors, potentially increasing share demand and value.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $82.92 for Southern Copper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $134.11, and the most bearish reporting a price target of just $54.43.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $12.2 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $112.98, the analyst's price target of $82.92 is 36.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.