Key Takeaways

- Focus on premium card acquisitions from younger generations and new card product innovations aims to boost card fee revenue and customer loyalty.

- Expansion of partnership ecosystem and strategic focus on SMEs, paired with controlled operational expenses and marketing investments, designed to foster long-term revenue and EPS growth.

- Challenges in Travel & Entertainment spending, SME sector growth struggles, rising credit risk, and global economic shifts could affect American Express revenues and net income.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Acceleration in premium card acquisitions, particularly from Millennials and Gen Z, which are expected to enhance card fee revenue growth and long-term wallet share expansion, positively impacting net card fee revenues and spend volume.

- Continued investment in new card product innovations and refreshes, with plans to refresh around 40 products globally, aimed at attracting premium customers and reinforcing customer loyalty, which should contribute to both card fee revenue and spend-based revenue growth.

- Expansion and enhancement of the partnership ecosystem, including strong performance and growth from co-brand partnerships like Delta Air Lines, supporting increased billings growth and engagement levels among new and existing card members, thus driving discount revenue and net card fee revenues.

- Strategic focus on small and medium-sized enterprises (SMEs) despite current organic spend moderation, with ongoing strong demand for new account acquisitions and small business products, indicating potential for rebound and growth in commercial services segment as spending rebalances.

- Commitment to maintaining a low-operating expense growth rate, alongside planned increases in marketing investments to drive efficient card member acquisition and engagement, supporting long-term revenue growth and mid-teens EPS growth aspiration, while managing operational leverage effectively.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

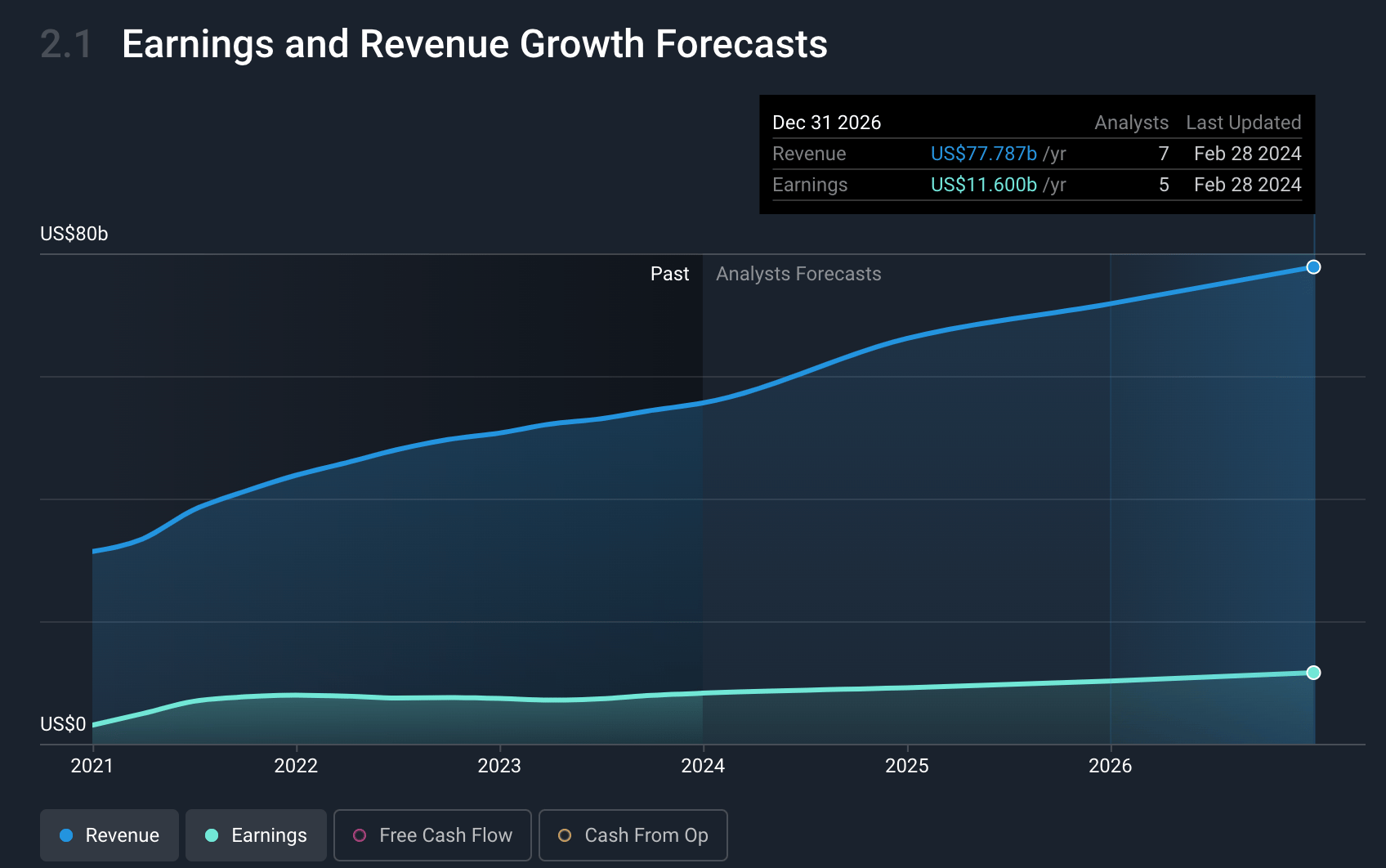

- Analysts are assuming American Express's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 14.9% in 3 years time.

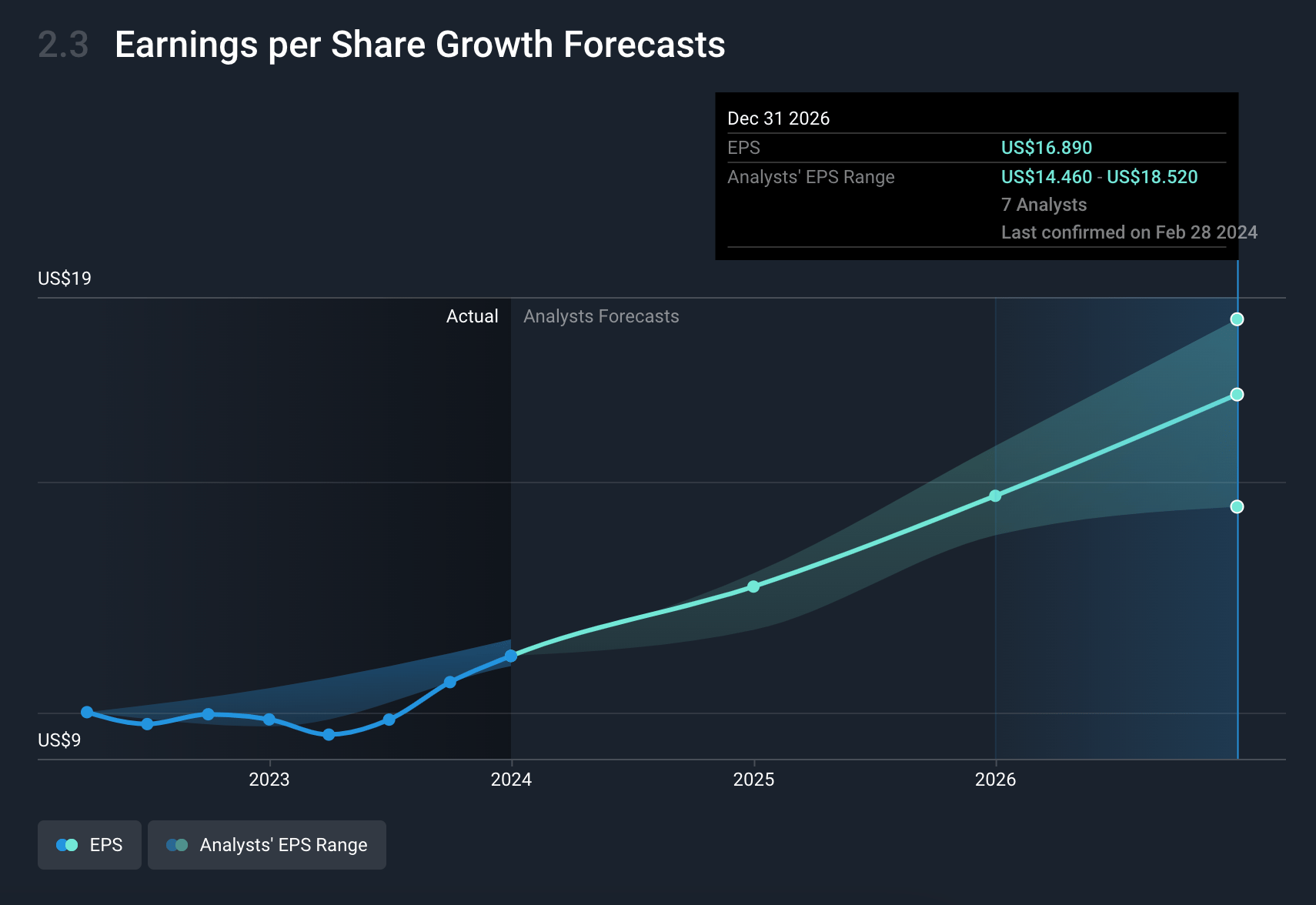

- Analysts expect EPS to reach $16.94 ($11.6 billion in earnings) by about February 2027, up from $11.4 today.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- Softness in Travel & Entertainment (T&E) spending growth, as seen with a slowdown in airline expenditure, could impact revenues from a sector historically significant for American Express.

- The gradual increase in loan and Card Member receivables delinquency rates, despite being best-in-class, suggests a normalization that could lead to a higher provision expense, affecting net income.

- The performance of small and medium-sized enterprise (SME) customers showing modest growth due to specific dynamics post-pandemic, indicating revenue growth in this segment might face challenges.

- Potential impacts from global economic conditions or shifts in consumer spending behavior, as suggested by slower growth in Q4 billings and spend softness, which could affect overall billing growth and, consequently, discount revenues.

- The planned increase in reserve rates moving through 2024 could indicate anticipation of some credit risk normalization, impacting earnings due to higher provision expenses.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.