Key Takeaways

- Airbnb faces saturation and regulatory hurdles that may limit expansion and revenue, alongside stiff competition increasing costs and affecting margins.

- While international expansion and tech investments offer growth, they also bring execution risks and uncertain returns, possibly impacting earnings and margins.

- Airbnb's strong financial growth, strategic expansions, and focus on innovation suggest potential for share price stability and improved profitability.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Concerns about market saturation and regulatory challenges may hinder Airbnb's ability to expand and increase supply, potentially impacting revenue growth.

- Intense competition from hotel chains and other short-term rental platforms could lead to increased marketing and operational costs, affecting net margins.

- The company’s ambitious expansion into underpenetrated international markets, while offering growth potential, also introduces risks related to execution and local regulations, potentially impacting earnings.

- Investments in AI and new technologies, while potentially transformative for Airbnb's service, represent significant upfront costs and uncertainty regarding return on investment, which could affect net margins in the short to medium term.

- The planned repurchase of shares indicates confidence in the company's value but could also signal a lack of other investment opportunities to drive growth, potentially affecting future earnings growth prospects.

Assumptions

How have these above catalysts been quantified?

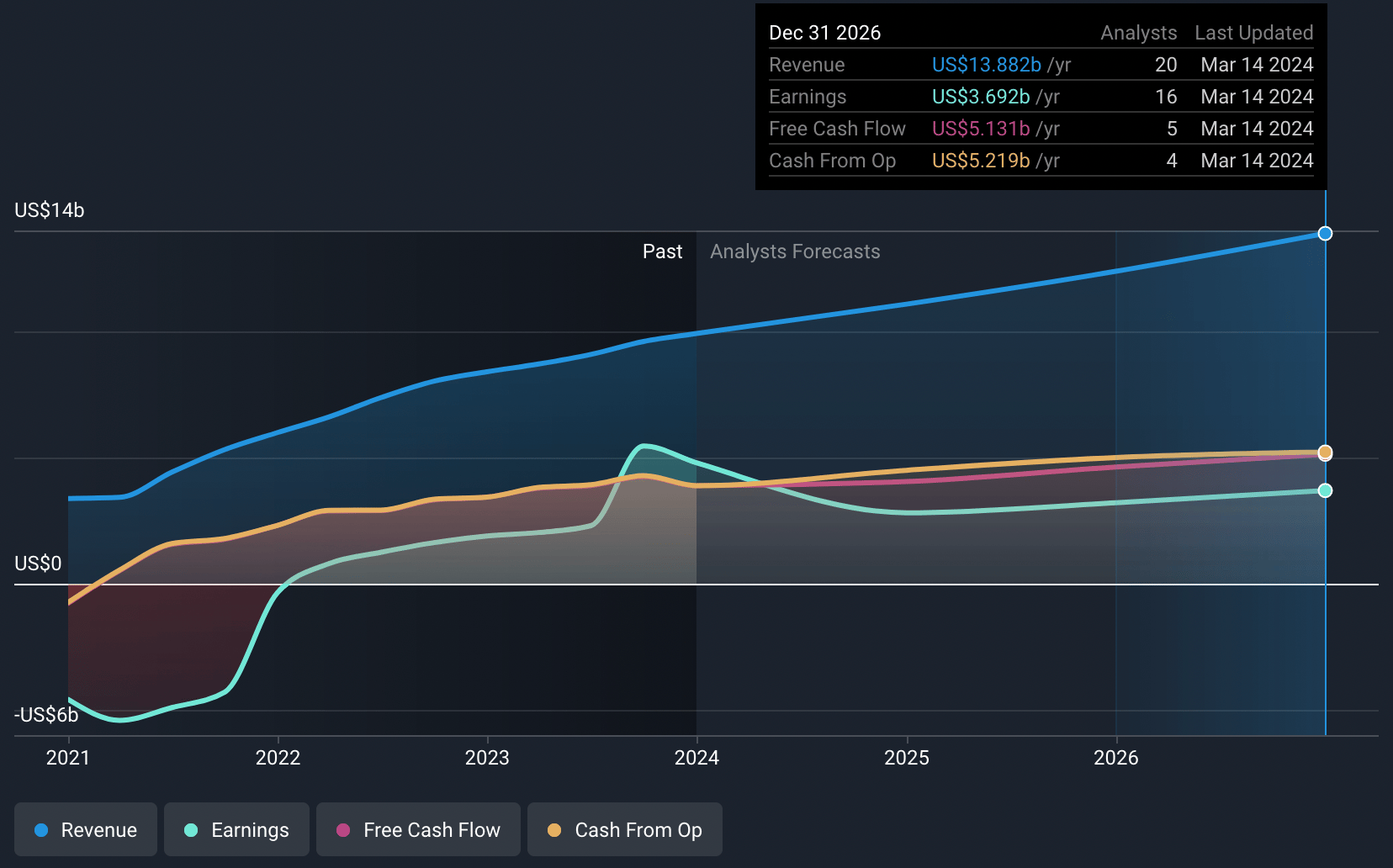

- Analysts are assuming Airbnb's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.3% today to 26.6% in 3 years time.

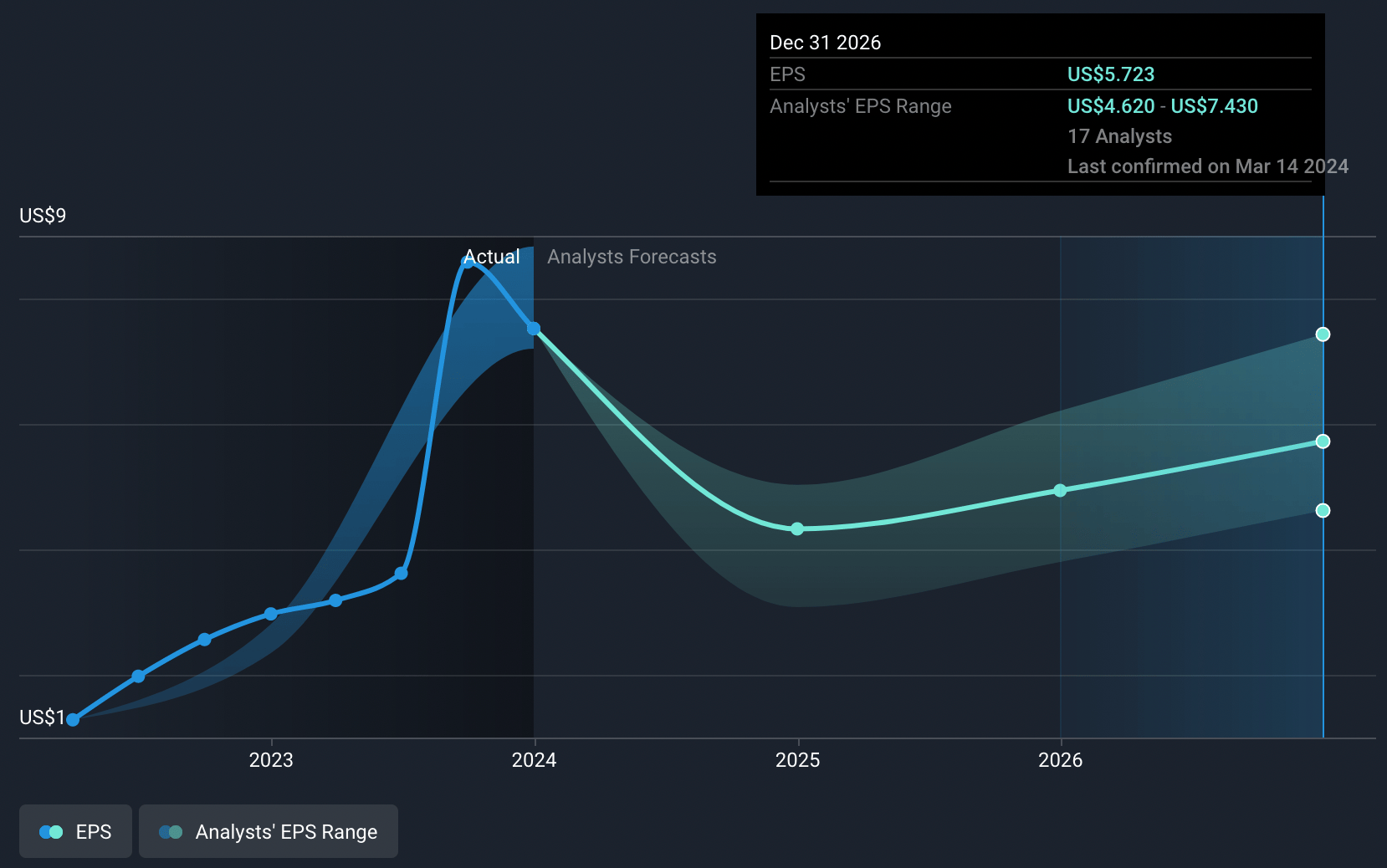

- Analysts expect earnings to reach $3.7 billion (and earnings per share of $5.72) by about March 2027, down from $4.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.3x on those 2027 earnings, up from 22.2x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Airbnb's impressive growth and strong quarter figures, including a 70% year-over-year revenue growth and a record free cash flow of $3.8 billion, suggest robust financial health that could support share price stability or growth, impacting revenue and net margins positively.

- The company's strategic priorities, including making hosting mainstream and expanding its global host community, which grew to 5 million hosts, along with a 22% adjusted net income margin, indicate a scalable and profitable business model that could counter share price decline, affecting net income margins.

- Introduction of more than 430 new features and upgrades aimed at perfecting core services and enhancing user experience, coupled with a 36% decrease in post cancellations, demonstrates an innovative and customer-focused approach that can drive sustained demand and positively impact revenue.

- Airbnb’s focus on expanding beyond the core by investing in underpenetrated international markets could unlock significant growth opportunities, potentially improving revenue streams and diversifying income sources, which could positively influence earnings.

- The company’s aggressive push into leveraging AI for creating innovative and personalized interfaces, along with the strategic acquisition of GamePlanner AI, signifies a forward-looking approach that could redefine the marketplace and user experience, potentially leading to a competitive advantage and positively affecting revenue and earnings.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $145.53 for Airbnb based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $13.9 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 29.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $166.44, the analyst's price target of $145.53 is 14.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.