Key Takeaways

- McKesson's adoption of automation and artificial intelligence across their networks aims to boost net margins by increasing efficiency and reducing costs.

- Expansion in the oncology sector and investments in technology highlight McKesson's strategy for revenue growth and operational efficiency in the U.S. and Canada.

- Extended credit risks, slowing growth in specific medication categories, rising operating expenses, dependency on key segments, and international market challenges may impact profitability and revenue.

Catalysts

What are the underlying business or industry changes driving this perspective?

- McKesson’s focus on operational efficiencies in their distribution network, through investments in automation and technology, directly supports enhanced profitability and net margins by reducing redundant tasks and improving employee productivity.

- Expansion of the U.S. Oncology Network, including entering new states and adding practices, directly impacts revenue growth in the oncology and biopharma services, strengthening McKesson's market position in these high-growth areas.

- The introduction and integration of artificial intelligence capabilities into the U.S. Oncology Network for revenue cycle management and evaluating clinical solutions can potentially reduce operational costs, improving net margins by enabling more efficient insurance coverage and reimbursement processes.

- Strong market demand for McKesson’s differentiated solutions in prescription technology, particularly in access solutions like prior authorizations for branded pharmaceuticals, can significantly impact revenue growth, especially from high-margin service offerings.

- Investments in novel distribution center technologies and modernization initiatives in the Canadian segment demonstrate a commitment to growth and operational efficiency, which should contribute to both revenue growth and improved net margins by enhancing service value to employees and customers alike.

Assumptions

How have these above catalysts been quantified?

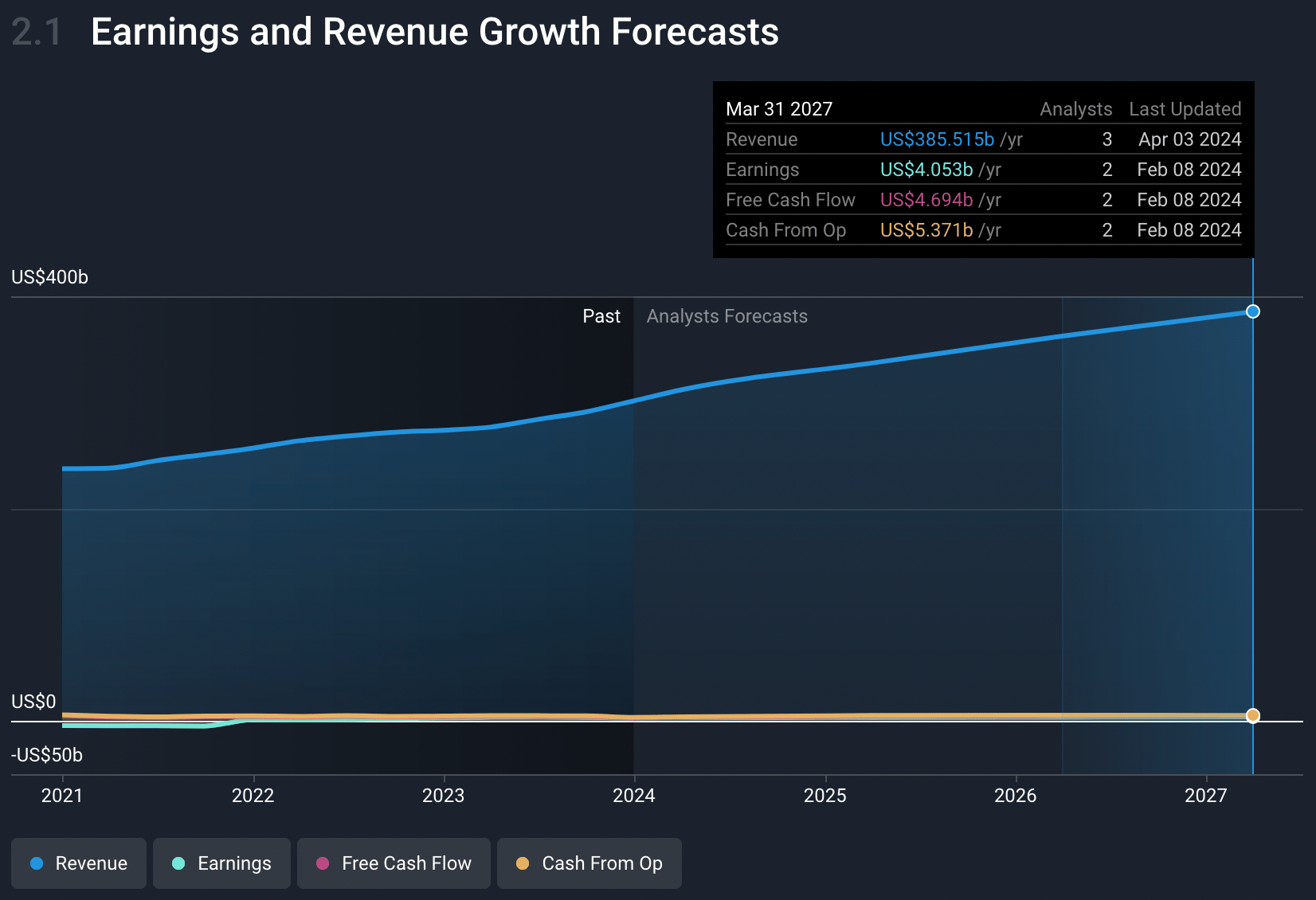

- Analysts are assuming McKesson's revenue will grow by 8.0% annually over the next 3 years.

- Analysts are assuming McKesson's profit margins will remain the same at 1.0% over the next 3 years.

- Analysts expect earnings to reach $4.0 billion (and earnings per share of $33.84) by about April 2027, up from $3.0 billion today. However, there is a large amount of disagreement amongst the analysts, with the most bullish analysts expecting $4.0 billion in earnings and the most bearish analysts expecting $3.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2027 earnings, down from 22.9x today. This future PE is lower than the current PE for the US Healthcare industry at 24.2x.

- Analysts expect the number of shares outstanding to decline by 3.73% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The provision for bad debt of $515 million related to Rite Aid's bankruptcy suggests potential risks in extended credit to customers that may impact net margins and earnings.

- The growth from GLP-1 medications is expected to slow, indicating reliance on specific product categories that may affect future revenue growth.

- An increase in operating expenses, particularly from investments in technology and automation, may pressure profit margins if not offset by sufficient revenue growth.

- The dependency on the performance of the U.S. Pharmaceutical and Prescription Technology Solutions segments for growth could be risky if expected strong utilization trends or demand for access solutions shift, impacting operating profit.

- International revenue declined due to divestitures within McKesson's European business, showing potential risks in maintaining growth levels in international markets which could affect overall revenue.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $558.0 for McKesson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $620.0, and the most bearish reporting a price target of just $410.0.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $379.8 billion, earnings will come to $4.0 billion, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 6.0%.

- Given the current share price of $523.37, the analyst's price target of $558.0 is 6.2% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.