Key Takeaways

- Strategic focus on Intelligent System Design strategy and partnerships with industry leaders expands market reach and enhances product portfolio, impacting revenue and margins.

- Growth in AI portfolio and System Design & Analysis (SD&A) drives adoption of high-margin products and services, promising significant revenue impact from emerging sectors.

- Reliance on AI and semiconductor industry trends, alongside competitive and operational challenges, could significantly impact Cadence's revenue and margins.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The AI super cycle, particularly in digital transformation, hyperscale computing, and autonomous driving, is fueling strong broad-based design activity, impacting future revenue growth.

- Cadence's strategic focus on its Intelligent System Design strategy, which expands their total addressable market (TAM) and has led to a significant increase in their product portfolio, notably with products like the Millennium M1 platform, is poised to substantially impact earnings through both market share gains and entry into new markets.

- Partnerships with industry leaders such as Intel, NVIDIA, and Arm, which bolster Cadence's position in providing advanced node design software, IP, and AI-driven design solutions, are likely to enhance revenue and margins through broader market access and innovation leadership.

- Cadence's AI portfolio, including tools like Cerebrus Gen AI and comprehensive AI offerings across chip to system design, has demonstrated considerable growth in adoption, potentially leading to increased revenue from high-margin AI-enabled products and services.

- The company's substantial growth in System Design & Analysis (SD&A), driven by advancements in PCB, packaging technologies, and multiphysics analysis, and reinforced by strategic acquisitions, suggests potential for significant impact on revenue from emerging sectors like chiplets and 3D-IC design.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

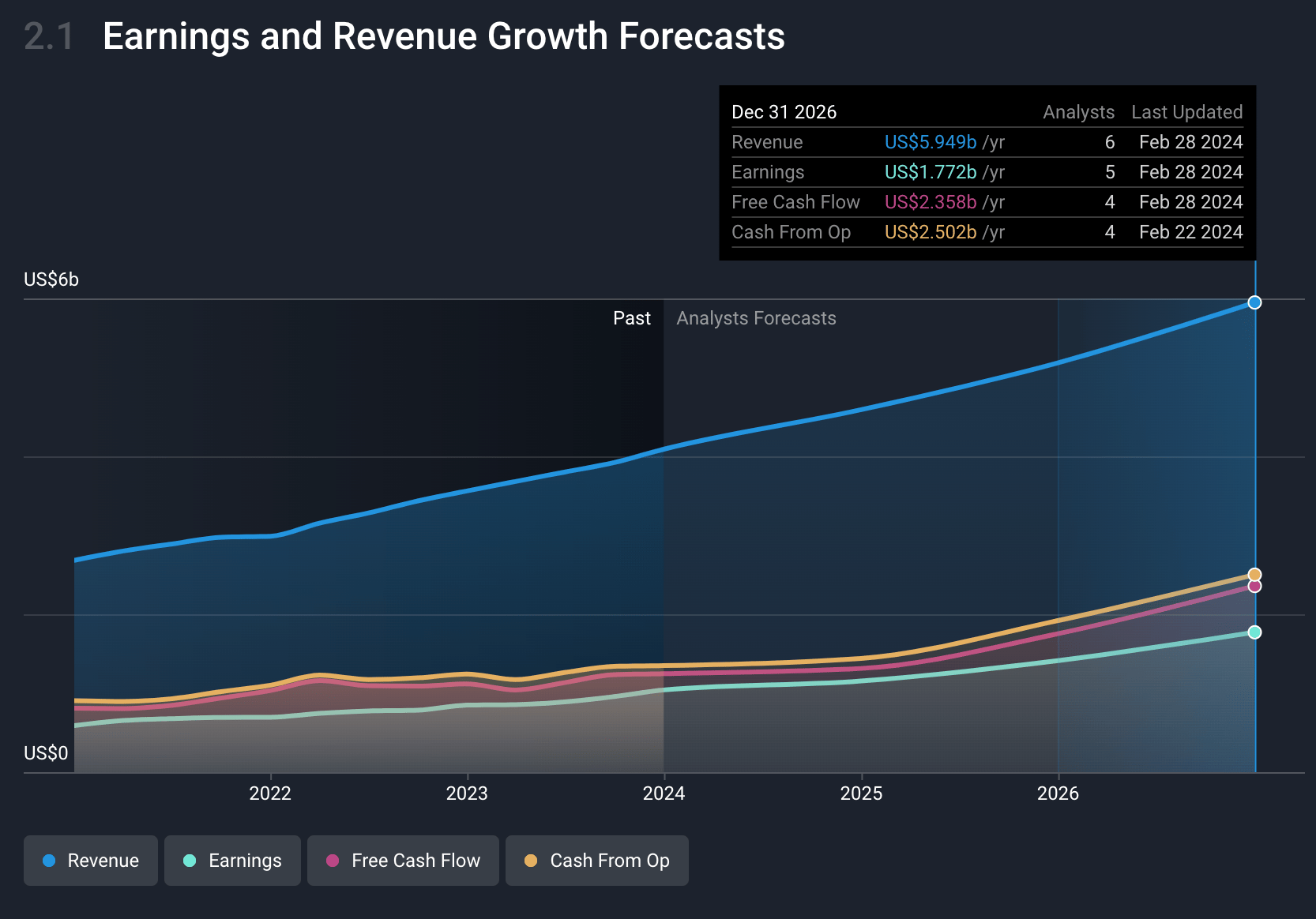

- Analysts are assuming Cadence Design Systems's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.5% today to 29.8% in 3 years time.

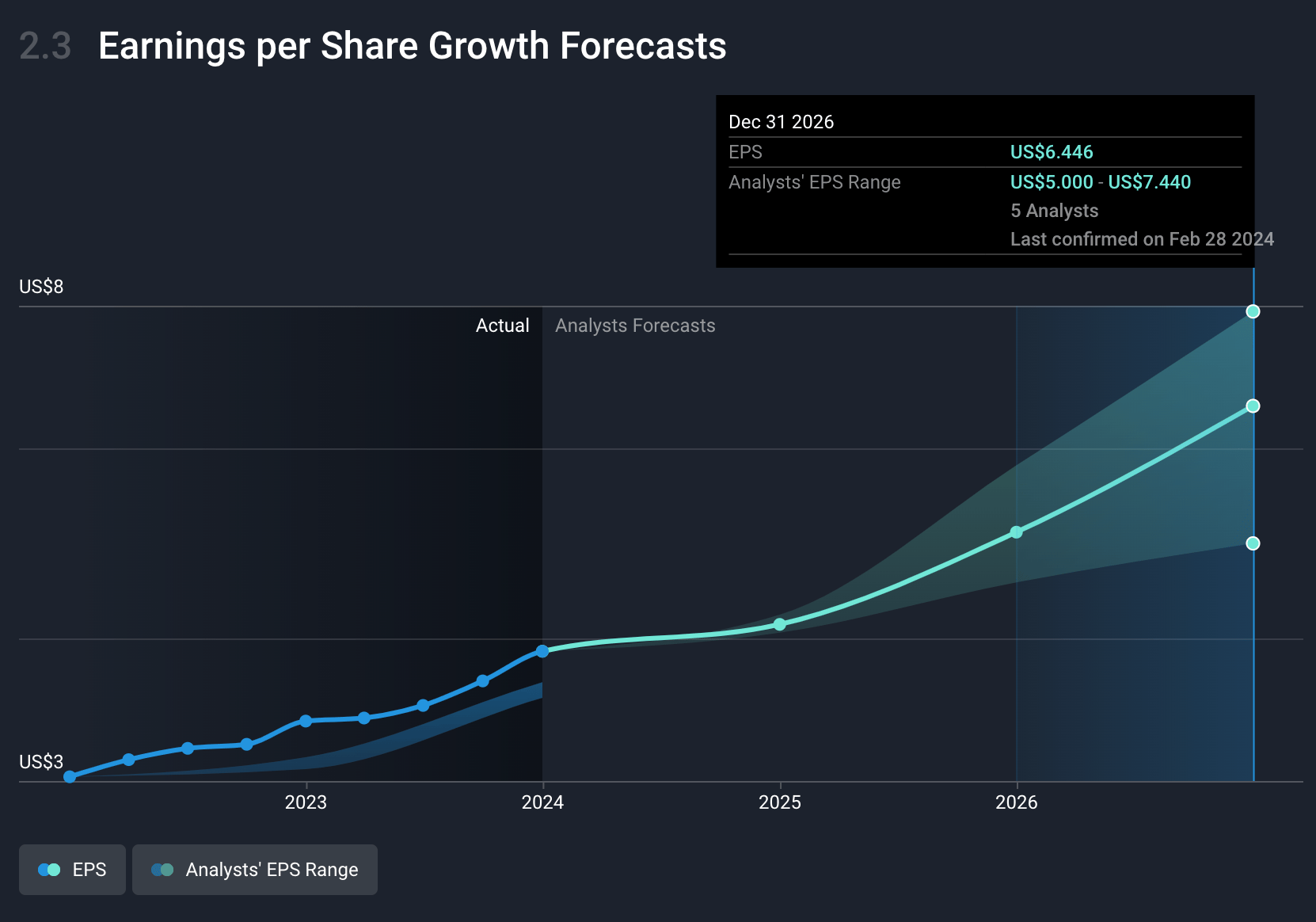

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $6.45) by about March 2027, up from $1.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.2x on those 2027 earnings, down from 78.8x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- The reliance on the AI super cycle to fuel design activity may introduce volatility if the anticipated growth in AI does not materialize, affecting revenue and net margins.

- A potential shift in the semiconductor industry towards reduced R&D spending could directly impact Cadence's growth, as the company's revenue is closely tied to the R&D budgets of its customers, potentially influencing earnings negatively.

- The increasing upfront revenue mix, expected to rise to approximately 17.5%, may present risks if anticipated hardware demand and IP growth do not meet projections, impacting overall profitability and cash flow.

- The competitive landscape could shift, particularly with potential consolidation or strategic moves by competitors (e.g., Synopsys's merger with ANSYS), which might affect Cadence’s market share and revenue growth in both the EDA and System Design & Analysis (SD&A) markets.

- The normalization of hardware delivery lead times, from over six months to more standard eight weeks, if not managed properly, could lead to challenges in meeting the demand for another record hardware revenue year, affecting the revenue and operating margins.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $316.89 for Cadence Design Systems based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $5.9 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 56.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $300.93, the analyst's price target of $316.89 is 5.0% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.