Key Takeaways

- Accelerated enterprise and cloud networking growth, driven by high bandwidth and AI demand, is anticipated to significantly boost revenues.

- Strategic focus on AI/ML era Ethernet networking and innovations like packet spring may enhance product competitiveness and lead to market share gains.

- Supply chain issues, leadership changes, customer concentration, competition in AI Ethernet solutions, and spending trends may all impact revenue, margins, and earnings.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Accelerated growth in enterprise and cloud networking, driven by the demand for higher bandwidth and robust AI networking backbones, is expected to significantly boost revenues.

- Strategic focus on AI and ML era Ethernet networking, with innovative solutions like packet spring and flexible ordering, is set to enhance product competitiveness, potentially leading to market share gains and positive impact on revenue.

- Expansion of 400-gig and the advent of 800-gig Ethernet for AI back-end GPU clusters as critical pilots heralds new product cycles, which may drive higher revenue from hardware sales.

- Investments in network software and subscription-based services, as evidenced by the growth in customers for CloudVision, aim at higher recurring revenue contribution and improved net margins.

- Enhanced operational efficiencies and supply chain improvements, as indicated by better gross margins and reduced inventory commitments, are expected to bolster net margins and earnings, contributing to the undervaluation correction.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Arista Networks's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.6% today to 34.6% in 3 years time.

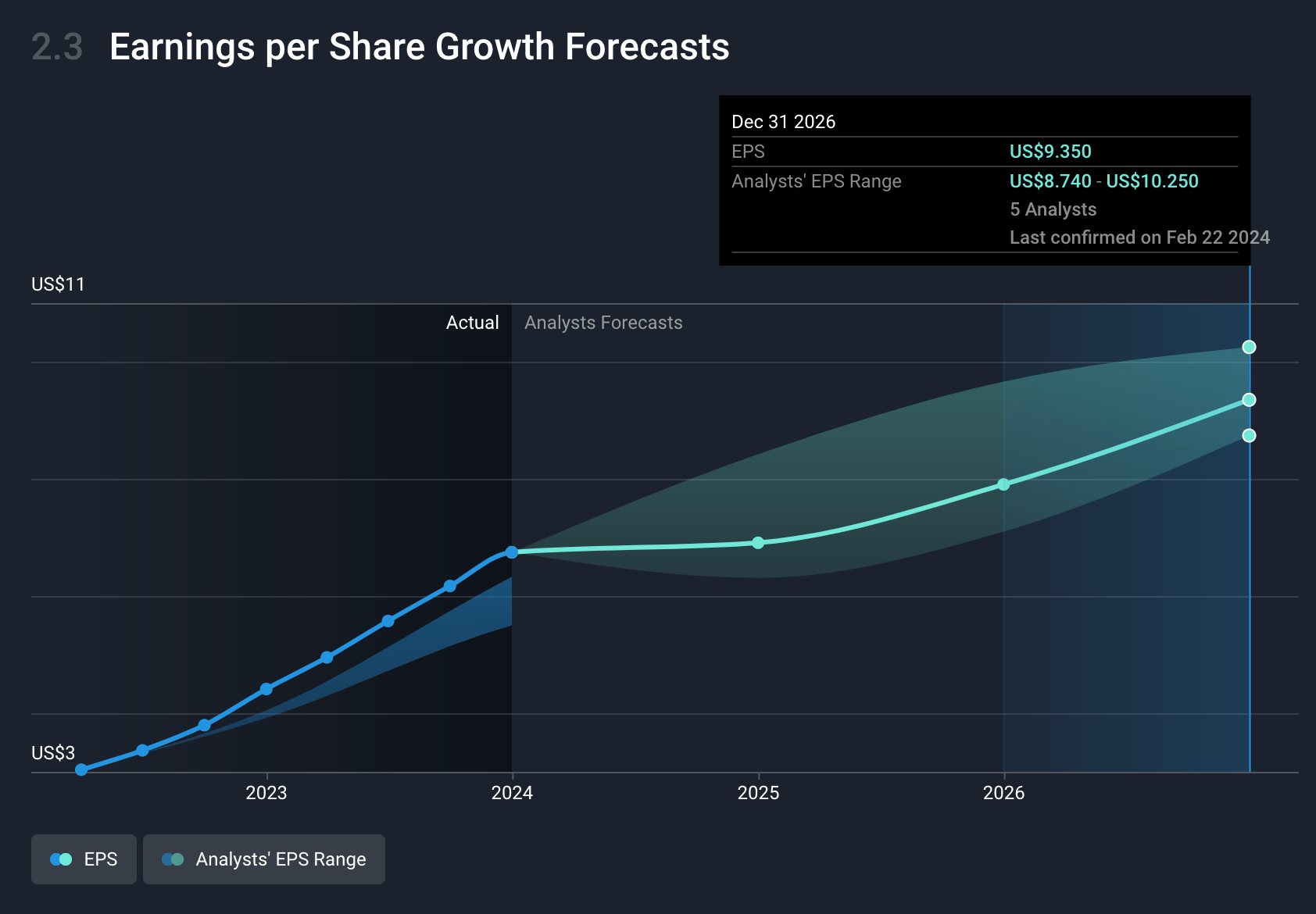

- Analysts expect earnings to reach $3.0 billion (and earnings per share of $9.35) by about March 2027, up from $2.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.6x on those 2027 earnings, down from 43.3x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Supply chain constraints and component costs could continue to present risks, impacting the company's ability to meet demand, affecting revenue growth.

- Transition of leadership with the outgoing and incoming Chief Financial Officers may introduce execution risks, potentially impacting financial oversight and strategy execution.

- Dependence on a few large customers, including Meta and Microsoft, for a significant portion of revenue, presents concentration risk, which could impact revenue if these key relationships are adversely affected.

- The evolving competition in Ethernet solutions for AI workloads may impact Arista Networks' market share and ability to secure new large-scale deployments, affecting future revenues.

- Projected moderate cloud spending growth and the expected increase in gross spending faster than revenue in 2024 could compress margins, impacting net margins and earnings.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $293.05 for Arista Networks based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $8.7 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 35.6x, assuming you use a discount rate of 6.6%.

- Given the current share price of $289.32, the analyst's price target of $293.05 is 1.3% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.