Last Update 30 Nov 25

Fair value Increased 3.56%RMBS: Data Center DRAM Demand Will Drive Share Price Momentum Through 2027

The analyst price target for Rambus has increased from $115.88 to $120.00. This change reflects analysts' positive outlook on the company's strong demand drivers, sustained data center growth, and robust free cash flow projections.

Analyst Commentary

Recent analyst research highlights a prevailing optimism around Rambus, with several price target increases reflecting confidence in the company’s execution and position in the market. These outlooks address Rambus’ growth trajectory, strategic strengths, and the factors shaping future valuation.

Bullish Takeaways- Bullish analysts emphasize Rambus’ critical role as a pure-play leader in data center DRAM. They note the company’s broad portfolio and market leadership.

- Sustained demand is anticipated through at least 2026, supported by recent data center deployment announcements and robust order activity.

- There is notable acceleration in revenue growth catalysts, especially with an expected rise in registered dual in-line memory module growth from mid-teens in 2025 to high-teens in 2026.

- The company’s strong revenue and earnings projections, combined with a favorable competitive landscape, are viewed as justification for raised price targets and bullish ratings.

What's in the News

- Rambus Inc reported that it completed the repurchase of 14,437,037 shares, representing 13.01% of outstanding shares, for $462.67 million under the buyback announced on November 2, 2020 (Company Filing).

- The company provided fourth quarter 2025 guidance, expecting revenue between $184 million and $190 million, licensing billings between $60 million and $66 million, royalty revenue between $59 million and $65 million, product revenue between $94 million and $100 million, and contract and other revenue between $25 million and $31 million (Company Guidance).

- Rambus Inc was added to the PHLX Semiconductor Sector Index, which strengthens its profile among key semiconductor companies (Index Announcement).

Valuation Changes

- Consensus Analyst Price Target has risen from $115.88 to $120.00, reflecting a moderate increase in valuation expectations.

- Discount Rate has fallen slightly from 10.51% to 10.38%, indicating a minor decrease in perceived risk or cost of capital.

- Revenue Growth projections remain steady at approximately 18.91%, showing no change in growth expectations.

- Net Profit Margin projections are unchanged, holding at 38.05%, suggesting consistent profitability estimates.

- Future P/E ratio has risen slightly from 39.63x to 40.90x, indicating a modest increase in anticipated future earnings multiples.

Key Takeaways

- Surging AI and data center demand, along with industry shifts like MRDIMM adoption, are expected to drive robust, multi-year growth across Rambus's memory-focused products.

- Strategic expansion into companion chips and a core focus on licensing and semiconductor solutions are enhancing revenue diversification and profit margins.

- Reliance on key memory products, slow diversification, delayed new tech adoption, rising competition, and end-market volatility pose risks to Rambus's revenue growth and profit stability.

Catalysts

About Rambus- Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

- Ongoing rapid growth in AI and data center workloads is accelerating the industry's need for high-speed memory interfaces and connectivity, driving demand for Rambus's DDR5, HBM4, and PCIe 7.0 solutions-this positions the company for sustained top-line revenue growth as new design wins and customer qualifications convert into production orders.

- Expansion of Rambus's product portfolio into companion chips (such as power management and client clock drivers) for high-end PCs and next-gen platforms is opening up incremental markets; while initial contributions are modest, management expects revenue from these new products to grow into 2026 and beyond, underpinning future product revenue growth.

- The upcoming industry transition to MRDIMM technology, slated for full-scale adoption beginning in the second half of 2026, will significantly increase the silicon content per module-Rambus is well-positioned to benefit from this shift, which could materially expand its addressable market and drive multi-year revenue growth.

- The company's sharpened focus on a core IP licensing and semiconductor business model is creating more diversified and recurring revenue streams, while supporting structurally higher net margins due to the scalable nature of licensing and improved product mix.

- Strong customer engagement in cutting-edge ASIC and XPU development for AI/ML workloads is boosting demand for customized and off-the-shelf silicon IP, with licensing deals recognized 12–24 months ahead of chip launches; this supports robust medium-term earnings visibility as the next wave of AI accelerators come to market.

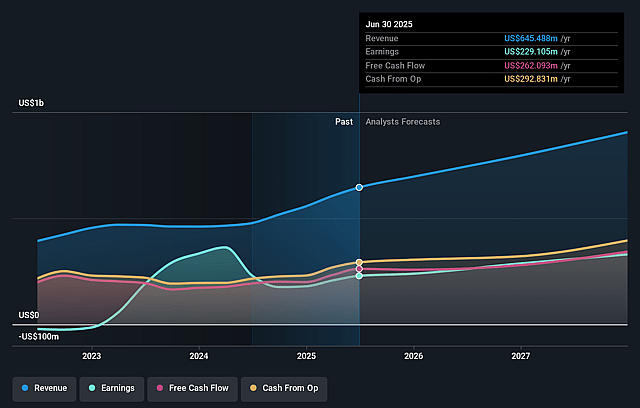

Rambus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rambus's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.5% today to 36.9% in 3 years time.

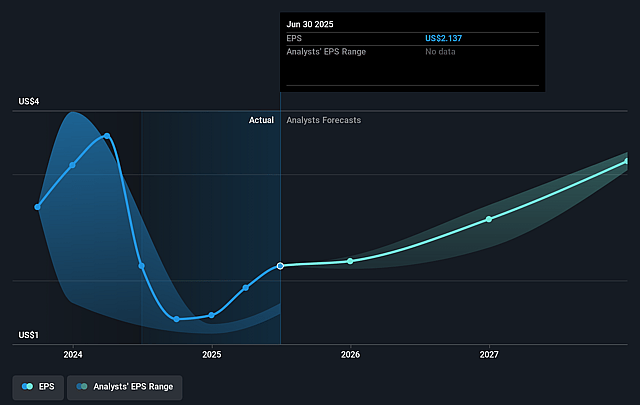

- Analysts expect earnings to reach $355.6 million (and earnings per share of $3.52) by about September 2028, up from $229.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.7x on those 2028 earnings, down from 35.0x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.97%, as per the Simply Wall St company report.

Rambus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on DDR5 and related high-margin RCD product lines creates concentration risk; if technology transitions stall or alternative memory architectures (like CXL or chiplet-based systems) gain less adoption than expected, Rambus's revenue growth and margins could stagnate or decline.

- Late-stage and still-modest contributions from new companion and power management chips suggest Rambus's transition into diversified product offerings is unproven; if adoption is slower or customer acceptance weaker than predicted, both top-line growth and long-term earnings expansion may fall short.

- Large anticipated market opportunities around MRDIMM and next-gen interfaces such as HBM4 may materialize later than forecasted (2026+), while delayed platform deployments (e.g., CXL 3.0 and client-side PMICs) risk creating gaps in growth and elevating near-to-medium term revenue volatility.

- Increasing market competition-from in-house development by customers, start-ups, and traditional DRAM vendors-could pressure pricing on high-value IP, reduce licensing revenues, and erode Rambus's net margins as more buyers seek alternatives to proprietary memory interface solutions.

- Significant exposure to cyclical end markets (AI, data center, and PC) and dependence on successful execution of multiple new technology ramps makes Rambus vulnerable to industry slowdowns, customer inventory corrections, or shifts in computing architectures, all of which risk lower revenue visibility and potential negative impacts on future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $81.875 for Rambus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $91.0, and the most bearish reporting a price target of just $73.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $963.4 million, earnings will come to $355.6 million, and it would be trading on a PE ratio of 33.7x, assuming you use a discount rate of 10.0%.

- Given the current share price of $74.55, the analyst price target of $81.88 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.