Key Takeaways

- Rapid digital banking adoption and branch optimization are projected to increase efficiency, lower costs, and support stronger profit margins and returns.

- Strategic lending growth and investments in green financing position the company to benefit from macroeconomic trends and drive sustained topline and earnings expansion.

- Rising regulatory costs, reliance on the domestic market, and increasing fintech competition threaten profitability and shareholder returns amidst uncertain dividend outlook and required digital investments.

Catalysts

About BRD - Groupe Société Générale- Provides a range of banking and financial services to corporates and individuals in Romania.

- Rapid expansion in digital banking usage, with a 20% annual increase in mobile app users and nearly all corporate and retail transactions processed through digital channels, is expected to boost operational efficiency, lower the cost-to-income ratio, and drive net margin improvement over the long term.

- Sustained growth in lending activity, evidenced by 19% year-on-year growth in the loan portfolio and significant market share gains in both SME and retail loans, positions the company to benefit from rising urbanization and increasing middle-class income in Romania, supporting future revenue and earnings growth.

- Strategic investments in green financing and sustainable products, having already surpassed 2025 targets and entered new partnerships (e.g., with IFC and EIF), are likely to expand the corporate loan portfolio and increase fee and commission income, supporting topline growth and future profitability.

- Ongoing optimization of the physical branch network, with a reduction of 35 branches year-on-year and expansion of cashless/self-service points, is expected to lower operational expenses, improve overall efficiency, and support higher returns on equity.

- A resilient balance sheet, strong liquidity coverage ratio (>220%), low NPL ratio (2.1%), and high coverage levels provide a solid foundation to weather macroeconomic fluctuations and leverage further lending and business expansion for future net income growth.

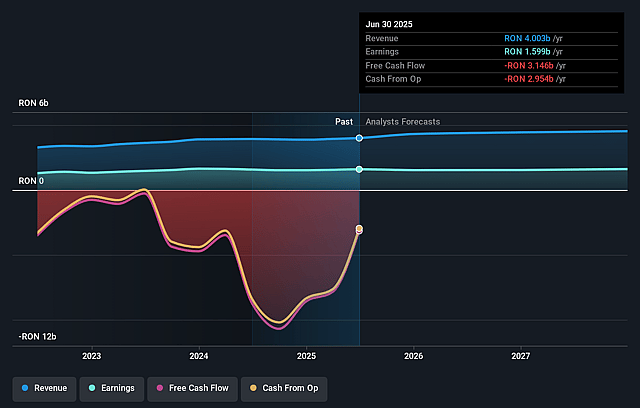

BRD - Groupe Société Générale Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BRD - Groupe Société Générale's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 39.9% today to 34.9% in 3 years time.

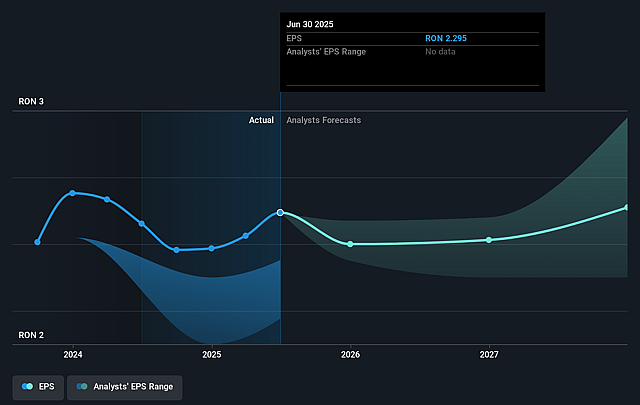

- Analysts expect earnings to reach RON 1.7 billion (and earnings per share of RON 2.38) by about September 2028, up from RON 1.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as RON1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 8.6x today. This future PE is greater than the current PE for the RO Banks industry at 7.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.45%, as per the Simply Wall St company report.

BRD - Groupe Société Générale Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The new 2% tax on gross turnover, which significantly increased operating expenses in 2024, directly pressures net margins and future profitability-especially if further regulatory or fiscal burdens emerge in the Romanian market.

- The company's high reliance on the Romanian market exposes it to local economic slowing, as highlighted by decreasing GDP growth (from over 2% in 2023 to approximately 1% in 2024), increasing earnings volatility and sensitivity to domestic economic shocks.

- While digital adoption is growing, increasing competition from fintechs and digital-first banks may compress BRD's fee and commission revenues over time, particularly if the pace of innovation or customer engagement slows compared to more agile competitors.

- Extensive investments in digital transformation and IT are required to maintain competitiveness, and if BRD's execution slows or fails to keep up with industry standards, cost-to-income ratios may rise and net margins could suffer.

- The absence of a confirmed dividend announcement and ongoing negotiation with the National Bank of Romania on payout approvals introduce uncertainty around shareholder returns, which could impact investor sentiment and affect the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of RON19.893 for BRD - Groupe Société Générale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON22.14, and the most bearish reporting a price target of just RON17.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be RON4.8 billion, earnings will come to RON1.7 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 14.4%.

- Given the current share price of RON19.7, the analyst price target of RON19.89 is 1.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on BRD - Groupe Société Générale?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.