Key Takeaways

- Strong infrastructure demand, digitalization, and EU-backed projects are boosting PORR's backlog and providing resilience and growth prospects across Europe.

- Expansion in high-margin segments and investment in construction technology are enhancing profitability and operational efficiency.

- Persistent low profitability, exposure to political and market risks, project delays, rising costs, and weak construction markets threaten future earnings stability and growth.

Catalysts

About PORR- Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Italy, Romania, Switzerland, Serbia, Great Britain, Slovakia, Norway, Belgium, and internationally.

- Accelerating infrastructure investment across Central and Eastern Europe, particularly in Poland and Romania, is driving sustained growth in PORR's order backlog, paving the way for revenue and earnings expansion from 2026 onwards as these large-scale projects move from design to active construction.

- Significant demand for modernization, decarbonization, and expansion of railway, road, and civil infrastructure throughout Europe-heavily supported by EU funding and national programs-positions PORR for a multi-year uplift in revenues and increased stability across economic cycles, especially as governments address aging infrastructure and climate targets.

- Ongoing advancement into high-margin specialties, such as railway construction, tunneling, and data center projects, is expected to structurally improve PORR's EBITDA and net margins as these segments become a larger share of the portfolio and deliver better project economics.

- Early specialization and proven track record in constructing sustainable data centers and various affordable housing solutions uniquely qualifies PORR to benefit from the surge in digital infrastructure and urbanization, supporting both top-line growth and enhanced profitability in key European markets.

- Investment in process optimization, modular building, and digital construction technologies continues to increase operational efficiency, which should drive sustainable margin improvements and higher free cash flow conversion as labor costs rise and project complexity grows.

PORR Future Earnings and Revenue Growth

Assumptions

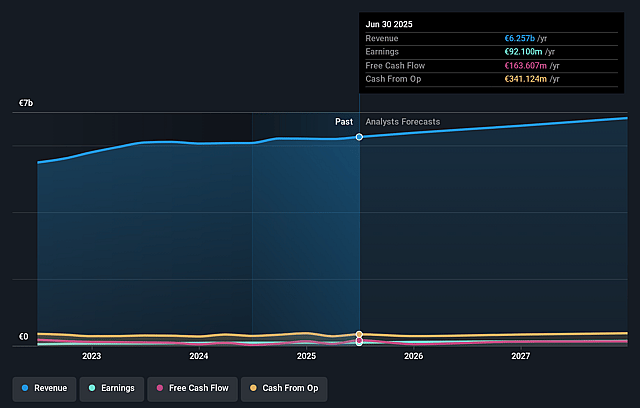

How have these above catalysts been quantified?- Analysts are assuming PORR's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 2.3% in 3 years time.

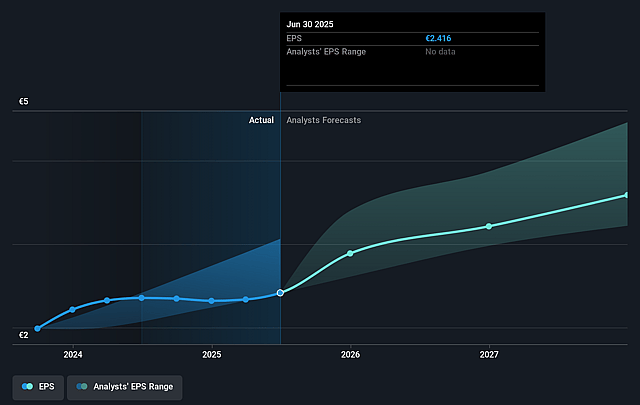

- Analysts expect earnings to reach €155.4 million (and earnings per share of €3.6) by about September 2028, up from €92.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €175.3 million in earnings, and the most bearish expecting €126.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 12.2x today. This future PE is lower than the current PE for the GB Construction industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 2.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

PORR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent low EBIT margins (currently around 1.6%) despite record order backlog and revenue growth indicate continued profitability challenges; if PORR cannot improve margins sustainably, future earnings and returns to shareholders may remain limited.

- Heavy dependence on large-scale, government-funded infrastructure projects in Germany, Austria, Poland, and Romania exposes PORR to political cycles, slow bureaucracy, budget delays, and potential cutbacks, creating risks to revenue visibility and earnings stability.

- Delays in infrastructure project starts-especially in Germany, where major investments won't materialize until 2026/2027, and in CEE countries due to permitting and design phases-could lead to underutilized capacity and lower revenue realization over the medium term.

- Rising personnel and material costs, partly driven by inflation and tight labor markets, are pressuring margins, while competitive pricing on tenders and high reliance on in-house work could further constrain net profits if not offset by efficiency gains or cost controls.

- Weakness in residential and commercial construction markets in key geographies, alongside constrained real estate lending and a shrinking developer base in Austria and Germany, could structurally reduce PORR's revenue mix and make it more vulnerable to sector downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €35.383 for PORR based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €6.9 billion, earnings will come to €155.4 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of €28.7, the analyst price target of €35.38 is 18.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PORR?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.