Key Takeaways

- Structural improvements and proactive inventory management, alongside advances in precision agriculture, are poised to significantly enhance Deere's profits and growth potential.

- A shift towards reducing production costs through strategic partnerships and a focus on innovation in product and system leadership are expected to improve net margins and market share.

- Adjusting production in response to shifting market conditions and betting on new technologies might impact Deere's profitability and net margins.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Structural improvements and proactive inventory management are anticipated to enhance Deere's profitability and efficiency across business cycles, positively impacting net margins and earnings.

- Advances in precision agriculture and technology integration, including the partnership with SpaceX for satellite connectivity, are expected to unlock incremental value for customers and drive future growth in revenue.

- A focus on reducing production costs through strategic partnerships and supplier agreements, coupled with designing cost reductions into products, is likely to contribute to favorable year-over-year production cost comparisons, enhancing net margins.

- Investments in research and development aimed at innovative product launches and technology upgrades are set to bolster Deere's product and system leadership, potentially leading to revenue growth and improved market share.

- Solutions as a Service model and precision upgrade offerings, geared towards technology utilization and improving operational efficiencies for customers, may create new revenue streams and contribute to sustained long-term growth.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

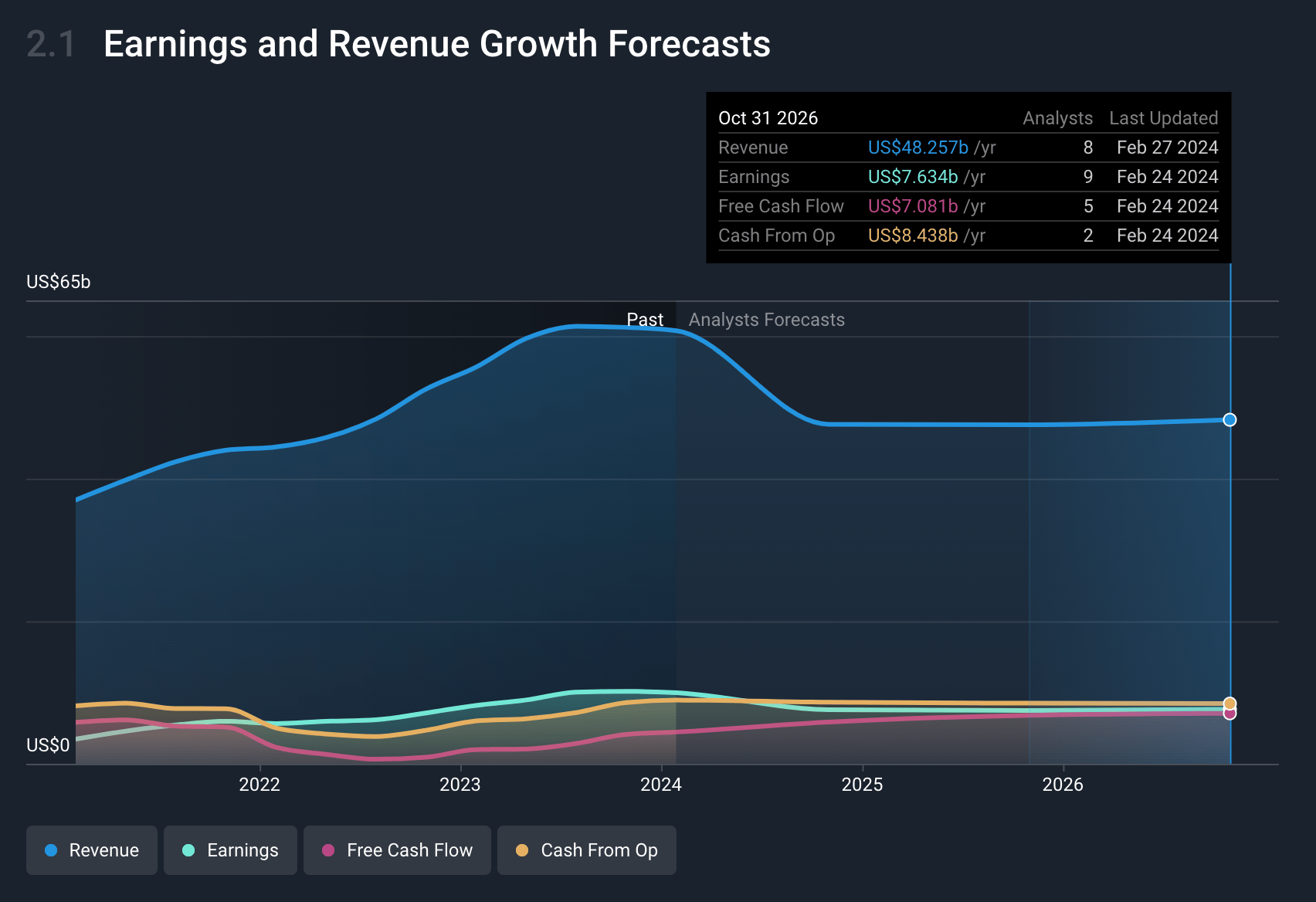

- Analysts are assuming Deere's revenue will decrease by -11.4% annually over the next 2 years.

- Analysts assume that profit margins will shrink from 16.4% today to 15.8% in 2 years time.

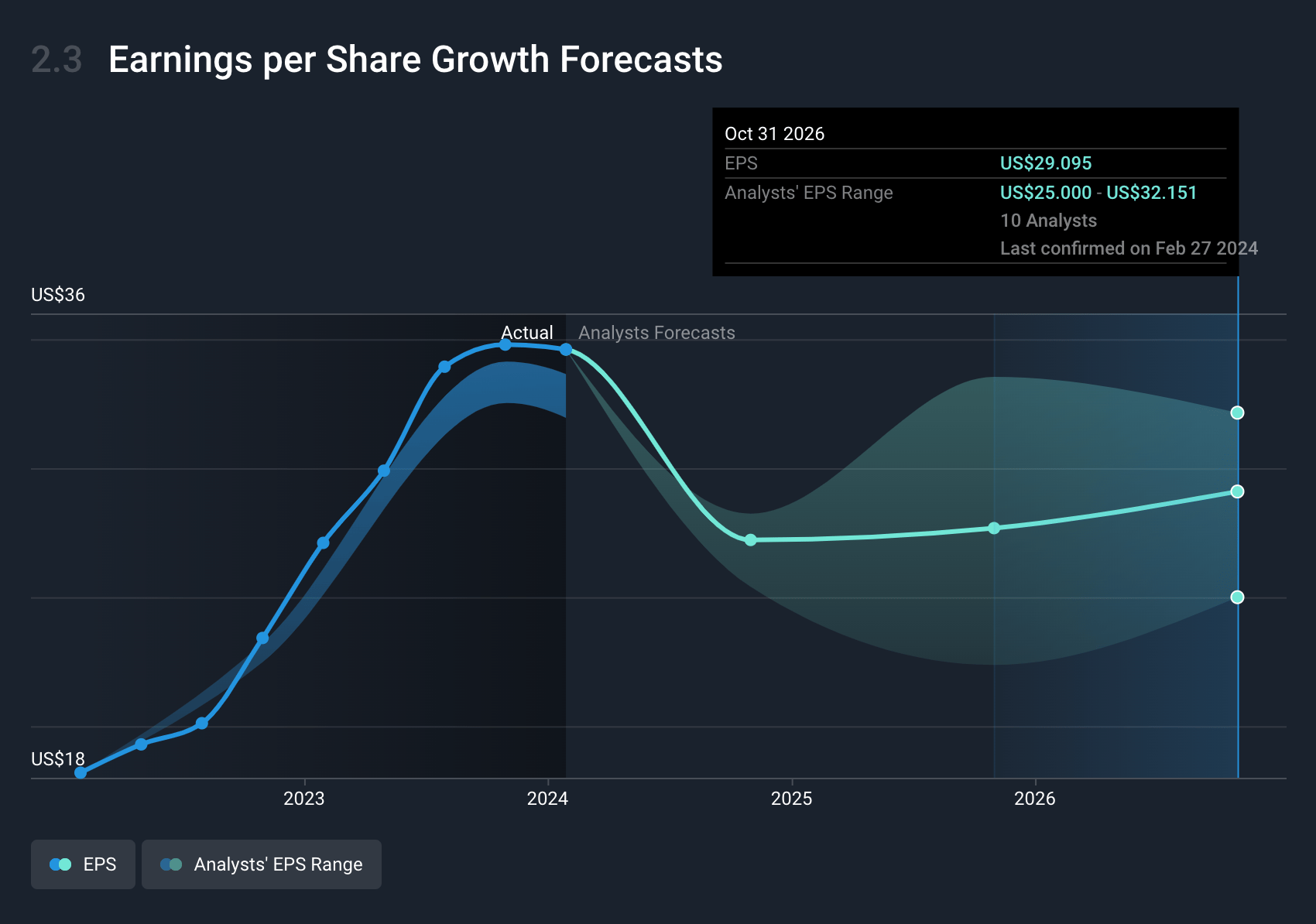

- Analysts expect EPS to reach $28.02 ($7.5 billion in earnings) by about March 2026, down from $35.77 today.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- The shift towards underproduction in Europe and Brazil, as part of adapting to softening market conditions, might lead to increased decremental margins, impacting profitability. This underproduction can reduce operating margins in the production and precision ag segment by about 1 point.

- The reliance on early order programs for crop care machines such as planters and sprayers might not fully capture demand shifts, especially if commodity prices are less supportive than in previous years. This could potentially impact revenue and margins in the production and precision ag segment if anticipated demand does not materialize.

- The adjustments in production levels, particularly the moderation in North America large tractor order velocity, might lead to higher decremental margins than originally anticipated. This would impact earnings directly as the company has to balance production with demand to avoid excess inventory.

- The strategy to produce to retail demand in North America while pulling back in other regions like Europe and Brazil reflects a careful inventory management approach. However, it also presents risks if demand forecasts do not align with real market conditions, potentially leading to either stock shortages or overproduction, each affecting revenues and net margins differently.

- The ongoing investments in new technologies and partnerships, like the collaboration with SpaceX for connectivity solutions, while foundational for future growth, could pressure short-term margins due to upfront costs and the time lag in realizing returns through subscription models or increased market share, potentially affecting net income.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $415.06 for Deere based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2026, revenues will be $47.7 billion, earnings will come to $7.5 billion, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $366.63, the analyst's price target of $415.06 is 11.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.