Key Takeaways

- CVS Health's integration of services like Aetna and CVS Pharmacy aims to improve health outcomes and lower care costs, enhancing enterprise value.

- Strategies like CVS CostVantage and expanding biosimilar adoption are designed to increase transparency, affordability, and consumer engagement, contributing to revenue growth.

- Elevated medical costs, regulatory pressures, execution risks from acquisitions, and competition in the Medicare Advantage market could impact CVS Health's margins and profitability.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The Medicare Advantage market, despite recent challenges, is still seen as a long-term opportunity for growth, especially as CVS Health aims to achieve targeted margins in Medicare Advantage by 2025, which should positively influence net margins and earnings.

- The innovative CVS CostVantage and CVS Caremark TrueCost models are expected to create more transparency and choice for consumers and clients, potentially leading to increased customer engagement and loyalty, thus contributing to revenue growth.

- CVS Health's ability to lower the total cost of care, improve health outcomes, and deepen patient engagement through the integration of its services (Aetna, CVS Pharmacy, CVS Healthspire, and Caremark) may drive enterprise value and positively impact net margins and earnings.

- The company's strategy to expand engagement with customers across CVS Health through multipayer capability and vast consumer reach could enhance customer base and revenue growth.

- The planned increase in adoption of biosimilars, including the strategic removal of HUMIRA from a major commercial template formulary and offering a co-branded HUMIRA product through Cordavis, aims at increasing the affordability of critical specialty drugs, which can contribute to revenue growth and potentially improve net margins by reducing drug costs.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

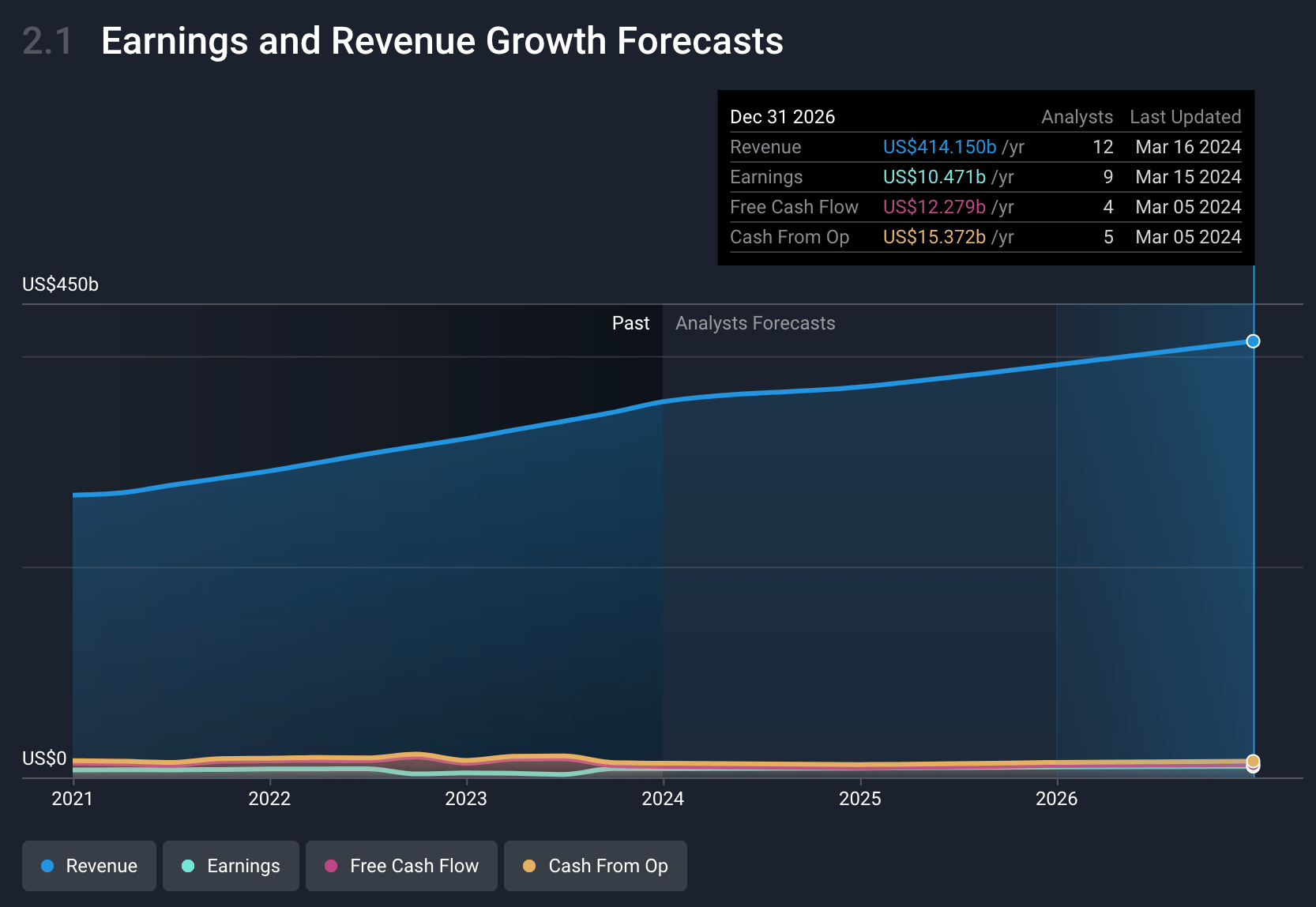

- Analysts are assuming CVS Health's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 2.5% in 3 years time.

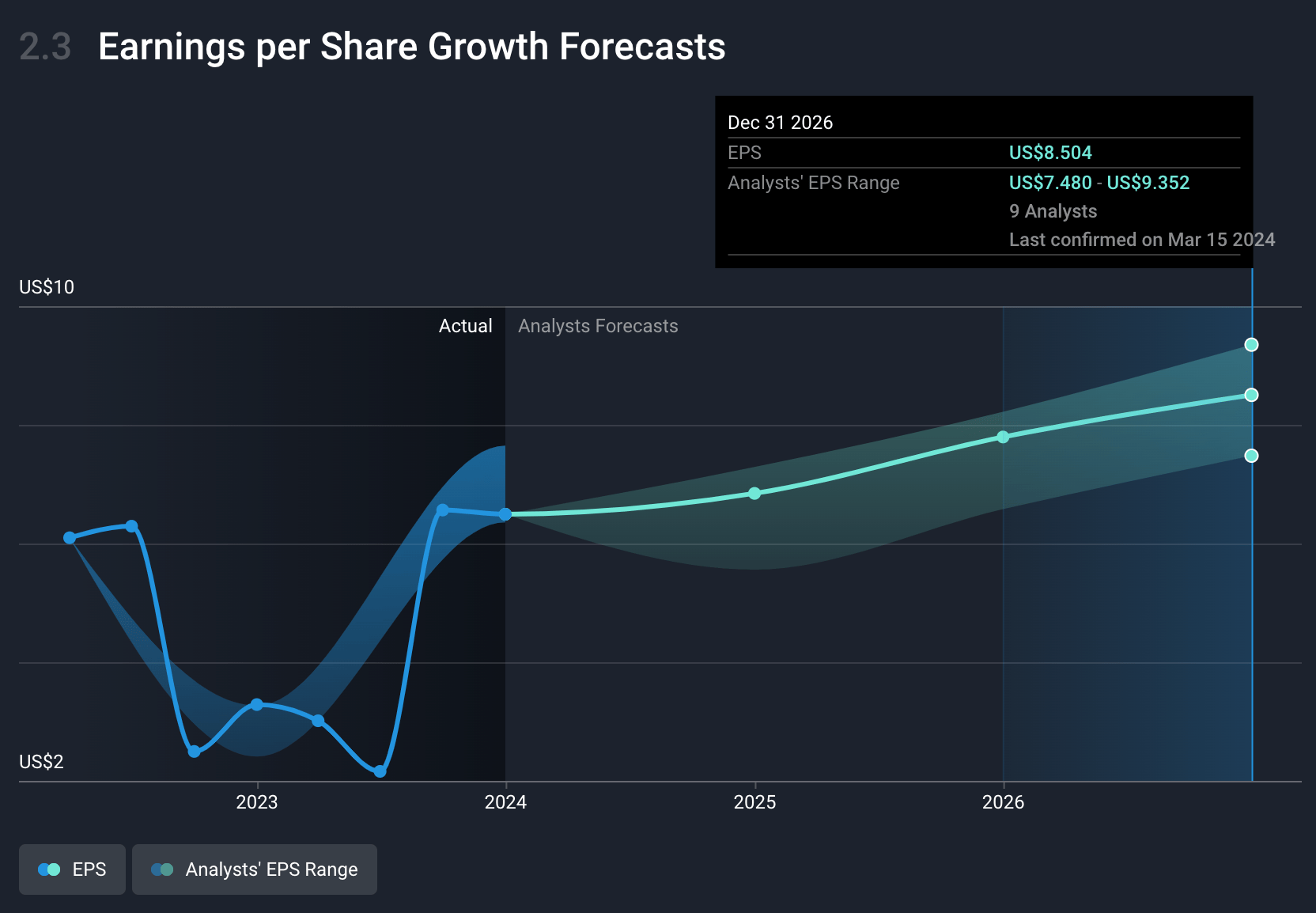

- Analysts expect earnings to reach $10.4 billion (and earnings per share of $8.49) by about March 2027, up from $8.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2027 earnings, up from 11.5x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- Elevated medical cost trends in the Medicare Advantage business are expected to continue into 2024, which could pressure full-year medical benefit ratio and impact net margins in the health care benefits segment.

- Concerns around the sustainability of pharmacy reimbursement pressure and the impact of new reimbursement models such as CVS CostVantage could affect future revenue and net margins in the Pharmacy & Consumer Wellness segment.

- Legislative and regulatory pressures on pharmacy benefit managers (PBMs) related to transparency and pricing could introduce additional risks to the business model and potentially impact earnings.

- Execution risks associated with integrating and realizing the expected benefits from acquisitions such as Oak Street and Signify Health may impact revenue and the ability to improve health outcomes, deepen patient engagement, and increase loyalty as planned.

- The potential for increased competition in the Medicare Advantage market and the necessity to cut benefits to improve margins could impact the ability to grow membership while aiming to achieve targeted margins, ultimately affecting revenue growth and profitability.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $89.57 for CVS Health based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $414.5 billion, earnings will come to $10.4 billion, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $76.42, the analyst's price target of $89.57 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.