Last Update 18 Jan 26

Fair value Decreased 5.86%CLAS B: Insjon Distribution Centre Upgrade Will Support Future Upside Potential

Analysts have trimmed their fair value estimate for Clas Ohlson from SEK 370 to about SEK 348, citing slightly higher discount rate assumptions and a lower future P/E multiple, partly offset by updated views on revenue growth and profit margins.

What's in the News

- Clas Ohlson's board has approved an investment of about SEK 400 to 450 million in its distribution centre in Insjon to support long term growth with a more efficient logistics hub in the company's founder town (Key Developments).

- The upgrade of the Insjon distribution centre will add increased automation and capacity to handle larger volumes for both stores and e commerce, with total goods handling capacity expected to be about 15 to 20% higher (Key Developments).

- The project is planned to start in March 2026 and is expected to be completed in the second half of 2027, with procurement of construction and automation partners already underway (Key Developments).

- The company expects no negative impact on earnings during the rebuild, with the investment mainly charged to the 2026/27 financial year and financed through existing cash (Key Developments).

- Management expects the pay back time for the automation investment to be about four years after full implementation, supported by higher capacity and lower handling costs (Key Developments).

Valuation Changes

- The fair value estimate has been trimmed from SEK 370 to about SEK 348, indicating a small downward adjustment in the assessed equity value.

- The discount rate has risen slightly from 6.32% to about 6.60%, implying a somewhat higher required return in the updated model.

- Revenue growth has increased modestly from about 5.12% to about 5.97%, reflecting a somewhat higher expected top line expansion.

- The net profit margin has eased from about 9.31% to about 8.97%, pointing to slightly lower expected profitability on each krona of sales.

- The future P/E has been reduced from about 21.93x to about 20.71x, so the shares are now being valued on a lower earnings multiple in the updated assumptions.

Key Takeaways

- Transitioning to a multi-niche retailer differentiates Clas Ohlson in various market segments, driving sales growth and improving margins.

- Emphasis on profitable online sales and store expansions supports sustained growth, with strategic partnerships enhancing revenue through a diversified product range.

- Currency fluctuations, rising sea freight costs, and higher operating expenses pose risks to gross margins and revenue growth for Clas Ohlson.

Catalysts

About Clas Ohlson- A retail company, sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

- Clas Ohlson's shift from a generalist retailer to a multi-niche player allows them to differentiate within multiple market segments, which should drive continued sales growth and improve operating margins.

- The focus on a profitable online business, with online sales growth at 22%, aims to continually increase the share of online sales, positively impacting revenue and potentially improving net margins.

- The store expansion strategy, with a goal of adding approximately 10 new stores annually, combined with improvements in existing stores, is expected to sustain organic growth and enhance revenue.

- Efforts to establish a cost-competitive operating model, notably through optimized sourcing and inventory management, are likely to contribute to higher net margins and overall earnings.

- Strategic partnerships and product range expansions, such as the introduction of well-known brands like Husqvarna, should attract more customers and increase revenue through a diversified assortment.

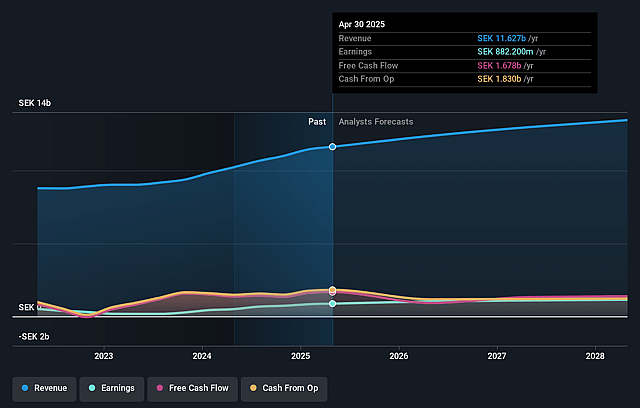

Clas Ohlson Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clas Ohlson's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 8.5% in 3 years time.

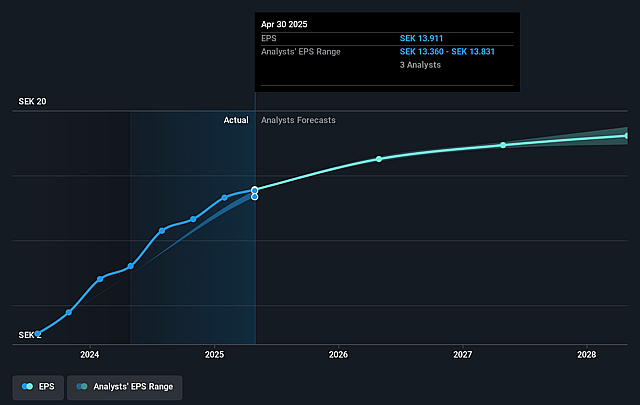

- Analysts expect earnings to reach SEK 1.1 billion (and earnings per share of SEK 18.07) by about September 2028, up from SEK 882.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, down from 23.4x today. This future PE is lower than the current PE for the GB Specialty Retail industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.32%, as per the Simply Wall St company report.

Clas Ohlson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The effects of currency fluctuations, specifically a weak Norwegian kroner and a volatile U.S. dollar, present significant risks that can negatively impact gross margins and net profit due to unforeseen fluctuations in costs related to purchasing and logistics.

- The rising sea freight costs, despite recent improvements, have created headwinds that may impact future gross margins by increasing the cost of goods sold.

- The potential slowdown in sales growth, as indicated by a slight decline in February sales growth, may suggest softer consumer demand or external macroeconomic pressures that could affect revenue growth targets.

- Higher salary agreements in Finland could increase operating expenses, which may pressure operational margins if they are not offset by corresponding increases in revenue or operational efficiencies.

- A heavy dependence on maintaining a high store opening pace for growth could increase capital expenditures and operating expenses, which may dilute earnings if the new stores do not meet revenue expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK345.0 for Clas Ohlson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK380.0, and the most bearish reporting a price target of just SEK310.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK13.5 billion, earnings will come to SEK1.1 billion, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK325.0, the analyst price target of SEK345.0 is 5.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Clas Ohlson?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.