Key Takeaways

- Expanding into new segments and regions supports revenue growth, reduces concentration risk, and leverages global demand for sustainable synthetic materials.

- Operational improvements and ongoing R&D investments strengthen innovation, restore margin potential, and position the company well for future regulatory and consumer shifts.

- Exposure to cyclical markets, cost pressures, and ongoing geopolitical and currency risks threaten profitability, revenue stability, and undermine long-term investor confidence.

Catalysts

About Ultrafabrics HoldingsLtd- Manufactures and sells polyurethane leather products in Japan, North America, Europe, and internationally.

- Operational disruptions from volatile tariffs and delayed customer purchasing-especially within the automotive segment-have temporarily depressed sales, but a normalization of trade policy or customer destocking could catalyze a rebound in volumes and revenue.

- The expansion into fast-growing segments like residential outdoor furniture and increased success in commercial aviation are beginning to gain traction, positioning Ultrafabrics to benefit from rising demand for high-performance synthetic materials amidst global shifts toward animal-free and sustainable alternatives-positively impacting revenue growth and margin mix.

- Strategic efforts to diversify the customer base geographically (specifically into Europe and German automotive OEMs) and by end-market are likely to reduce concentration risk and increase addressable market size, providing visibility and stability to future earnings.

- Investments in advanced production processes, new facility integration, and defect reduction initiatives are expected to drive operating leverage and gradually restore gross margins as volumes recover, boosting future net margins and earnings.

- Ongoing R&D investments and repositioning resources for greater synergy between production and product development reinforce Ultrafabrics' potential for innovation and alignment with stricter regulatory and consumer preferences for sustainable, durable materials, supporting long-term pricing power and revenue resilience.

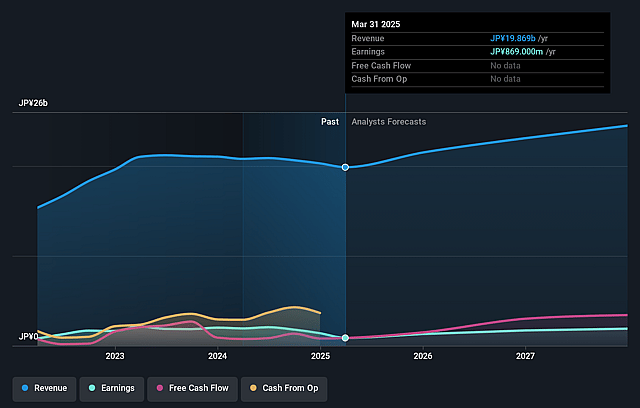

Ultrafabrics HoldingsLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ultrafabrics HoldingsLtd's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 9.5% in 3 years time.

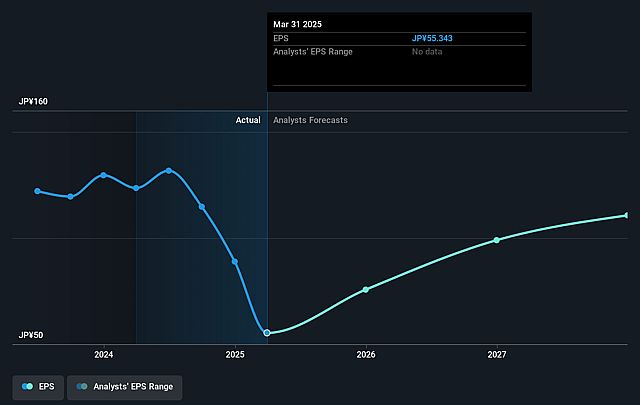

- Analysts expect earnings to reach ¥2.4 billion (and earnings per share of ¥110.67) by about September 2028, up from ¥582.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 18.9x today. This future PE is lower than the current PE for the JP Chemicals industry at 12.5x.

- Analysts expect the number of shares outstanding to grow by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Ultrafabrics HoldingsLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent geopolitical and tariff uncertainties-especially between the US, Japan, and China-have resulted in customer hesitation, deferred investment decisions, and supply chain disruptions, reducing short-term sales and introducing sustained volatility that may continue to negatively impact revenue reliability and top-line growth.

- Heavy exposure to cyclical end-markets such as automotive (notably electric vehicles), RV, and marine-segments currently facing structural headwinds from adverse policy shifts (e.g., reduced EV incentives), high interest rates, and weak demand-exposes Ultrafabrics to ongoing volume and revenue declines, heightening earnings unpredictability.

- Rising production costs due to outsourcing and inefficiencies have already caused gross profit margin reductions of over 10% and a more than 80% decline in net income year-over-year, indicating that without significant sales growth or successful operational restructuring, sustained margin compression may pressure long-term earnings and profitability.

- Currency volatility has caused reported sales in yen to decline even when dollar sales are stable, and ongoing appreciation of the yen versus the dollar impairs both export competitiveness and the translation of overseas earnings, further constraining revenue and net profit.

- The company's reliance on expanding sales to offset rising costs and weak profitability, without clear evidence of resurgent end-market demand or successful regional diversification, poses a substantial risk that ongoing financial underperformance will persist, reducing investor confidence and diminishing share price prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1300.0 for Ultrafabrics HoldingsLtd based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥25.7 billion, earnings will come to ¥2.4 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of ¥694.0, the analyst price target of ¥1300.0 is 46.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.