Key Takeaways

- Increasing customer traffic across divisions and expansion in merchandise, especially in the beauty sector, show strong brand appeal and revenue potential.

- Focused improvement on merchandise margins and a disciplined approach to e-commerce for profitability demonstrate potential for higher net margins through cost management.

- Challenges in e-commerce, increased store wage costs, reliance on foot traffic, higher freight costs, and supply chain investments may impact margins and profitability.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Increment in customer traffic across all divisions serves as a significant catalyst for future growth, indicating a strong brand appeal and potential for sustained revenue increases.

- Expansion of merchandise assortment, especially noted in the beauty category, highlights the company's ability to diversify its product offerings and tap into new market segments, potentially boosting revenue.

- Continued focus on improving merchandise margins, facilitated by strategic buying and enhanced vendor relationships, suggests potential for higher net margins through cost management and pricing optimization.

- The scaling down of HomeGoods' e-commerce operation to focus on profitability highlights a disciplined approach to capital allocation, which could improve net margins and earnings by reducing unprofitable ventures.

- Aggressive store expansion strategy, particularly for HomeGoods and internationally, reflects TJX's confidence in physical retail's growth potential, positioning the company for increased market share and revenue growth in underpenetrated markets.

Assumptions

How have these above catalysts been quantified?

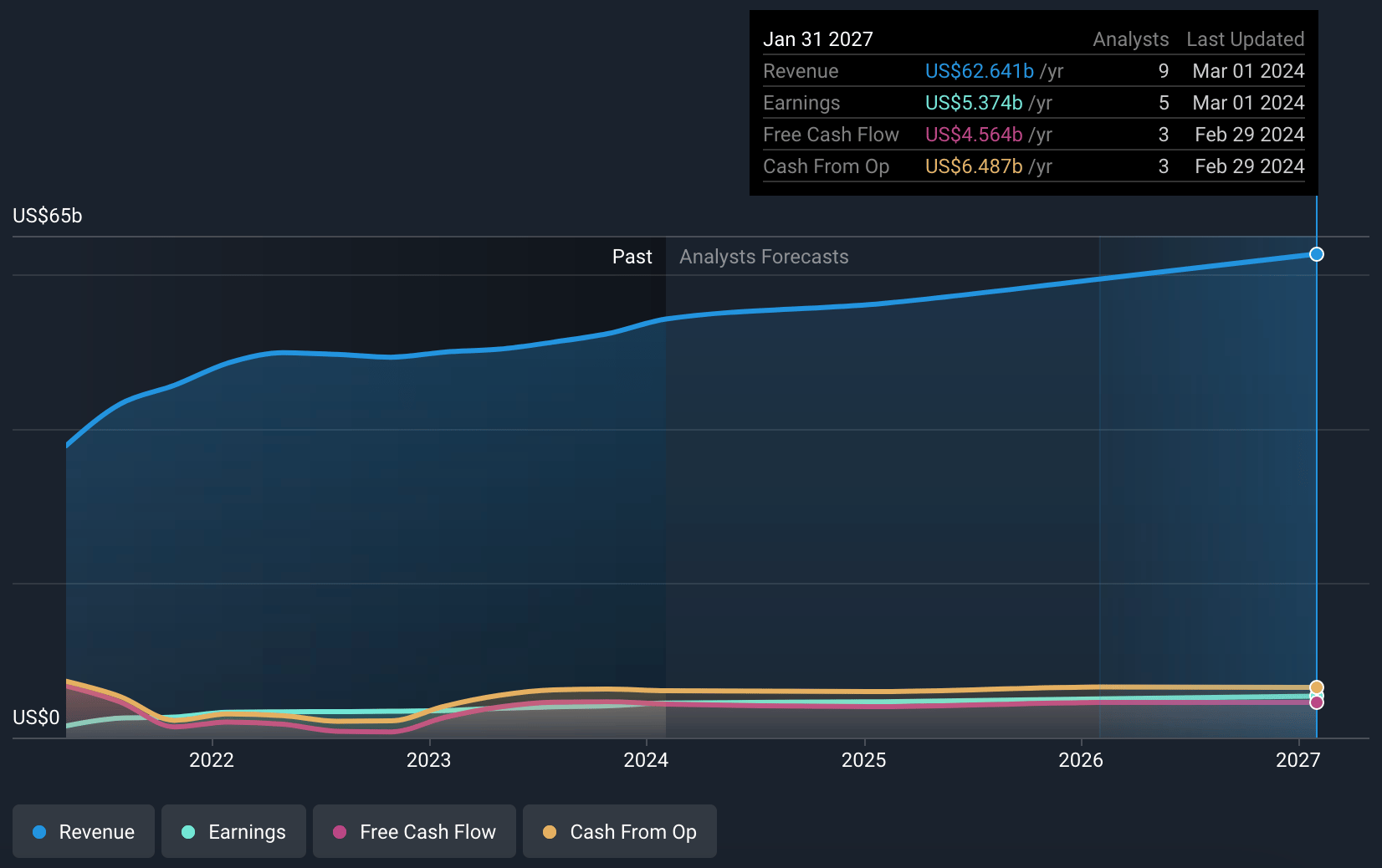

- Analysts are assuming TJX Companies's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.9% today to 8.5% in 3 years time.

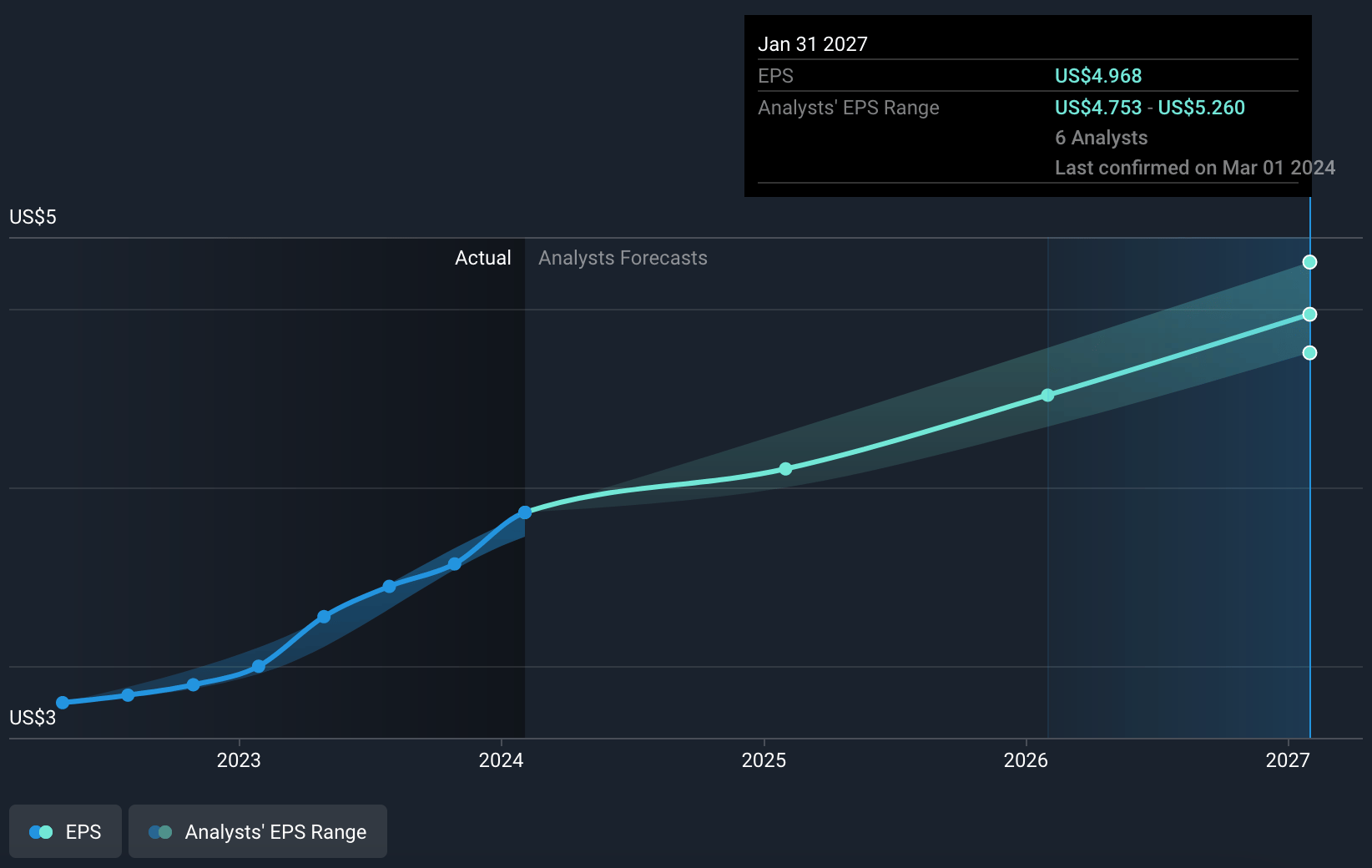

- Analysts expect EPS to reach $4.97 ($5.37 billion in earnings) by about February 2027, up from $3.61 today.

Risks

What could happen that would invalidate this narrative?

- The closing of the HomeGoods online business could signal challenges in navigating the e-commerce landscape, potentially affecting future revenue streams from online sales.

- Higher incremental store wage and payroll costs could squeeze operating margins if sales growth does not offset these increased expenses.

- Reliance on customer traffic for comp store sales growth may be risky if consumer spending habits shift or macroeconomic factors reduce foot traffic, impacting revenue.

- The expectation that freight costs may not return to pre-pandemic levels could continue to pressure gross margins, affecting overall profitability.

- Investments in supply chain enhancements, while necessary for long-term efficiency, could result in short-term margin compression if cost savings are not realized as planned, impacting net margins.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.