Key Takeaways

- Continued customer preference for smaller projects and deflation in commodities like lumber could pressure sales, affecting revenue and margins.

- High interest rates may dampen consumer spending on home improvement, impacting revenue and earnings growth.

- Emphasis on Pro customer segment and digital initiatives, alongside innovative products and technology use, aims to grow revenue and improve customer satisfaction.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The Pro customer segment outperforming the DIY segment and the investment in initiatives for Pro customers indicate potential revenue growth from a significant addressable market for professional services and products.

- Continued investment in the digital platform and improvements in the online shopping experience can drive ecommerce sales, impacting revenue positively.

- Strategic initiatives like enhancing the interconnected shopping experience and focusing on reducing pain points across the shopping journey may enhance customer satisfaction and loyalty, likely boosting revenue.

- The introduction of innovative products and exclusive deals, like the launch of WAGO products, could strengthen Home Depot's market position and drive sales in key categories, positively impacting revenue.

- The company's efforts to maintain in-stock levels and improve on-shelf availability through technology like computer vision and machine learning could enhance shopping experience, potentially leading to an increase in sales and improving net margins.

Assumptions

How have these above catalysts been quantified?

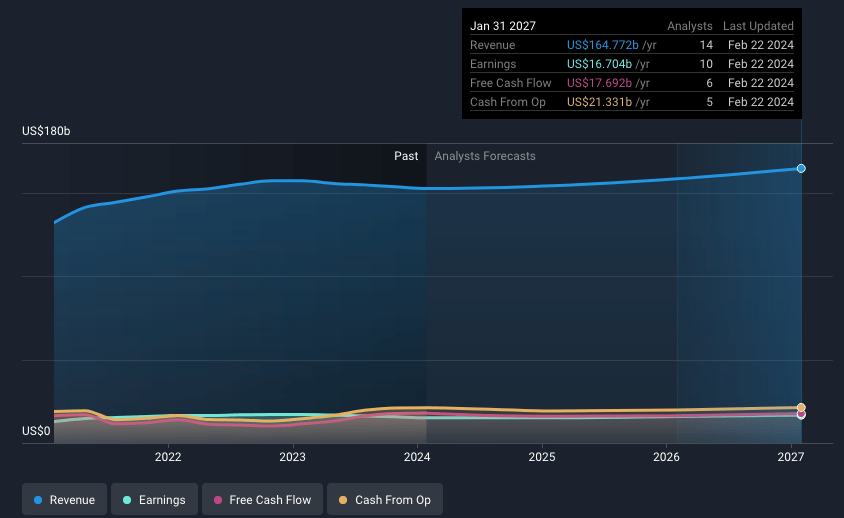

- Analysts are assuming Home Depot's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 10.3% in 3 years time.

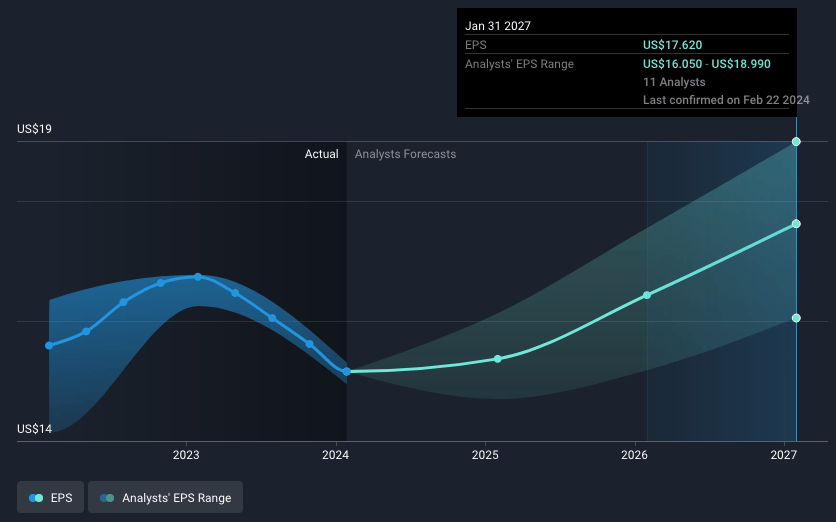

- Analysts expect EPS to reach $18.0 ($17.0 billion in earnings) by about February 2027, up from $15.78 today.

Risks

What could happen that would invalidate this narrative?

- Continued customer preference for smaller projects over big-ticket discretionary categories could lead to a prolonged period of lower sales growth, impacting revenue.

- Persistent deflation in key commodities like lumber and copper, along with reduced storm-related sales, could pressure sales and margin performance, affecting earnings.

- The narrowing of the guidance range for fiscal 2023 suggests cautious outlook, potentially reflecting concerns about future growth and margins.

- Investments in strategic initiatives, while necessary for long-term growth, may weigh on short-term profitability and operational efficiency, impacting net margins.

- A potentially higher-for-longer interest rate environment as suggested by the Federal Reserve's stance might dampen consumer spending on home improvement projects, affecting revenue and earnings growth.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.