Last Update 06 Nov 25

Fair value Increased 36%3711: Global Expansion And Facility Acquisition Will Support Balanced Performance Ahead

Analysts have raised their price target for ASE Technology Holding from $176.29 to $239.69. They cite improved outlooks for revenue growth and profit margins as key drivers behind this more optimistic valuation.

What's in the News

- ASE Technology Holding and Analog Devices Inc. have signed a binding Memorandum of Understanding for a strategic partnership in Penang, Malaysia. (Key Developments)

- ASE intends to acquire 100 percent of Analog Devices Sdn. Bhd., including its manufacturing facility with over 680,000 square feet in Bayan Lepas. (Key Developments)

- The agreement includes a planned long-term supply partnership, with ASE providing manufacturing services for Analog Devices Inc. (Key Developments)

- Both companies plan to co-invest in upskilling the Penang facility and expanding ASE's global IC packaging and testing operations. (Key Developments)

- The transaction is expected to close in the first half of 2026, pending regulatory approvals and satisfaction of closing conditions. (Key Developments)

Valuation Changes

- Fair Value: The updated analyst consensus fair value has increased significantly from NT$176.29 to NT$239.69.

- Discount Rate: This has increased slightly from 10.11% to 10.55%.

- Revenue Growth: Projected revenue growth has improved, moving from 10.40% to 13.53%.

- Net Profit Margin: The forecasted net profit margin has expanded from 8.91% to 10.88%.

- Future P/E: The expected future price-to-earnings ratio has risen modestly from 13.85x to 14.05x.

Key Takeaways

- Diversified growth in advanced packaging, automation, and new technologies is driving higher-margin potential and positioning ASE as a key industry player for next-generation demands.

- Margin pressures from costs and foreign exchange are expected to ease as automation ramps and value-added services enable more stable, resilient, and diversified earnings.

- Persistent currency volatility, capacity constraints, rising leverage, market cyclicality, and geopolitical risks collectively threaten ASE's margins, scaling ability, earnings stability, and global competitiveness.

Catalysts

About ASE Technology Holding- Provides semiconductor manufacturing services in assembly and testing in the United States, Taiwan, Europe, Asia, and internationally.

- ASE is experiencing strong, multi-year demand driven by the expansion of global data centers, proliferation of AI applications, and increasing semiconductor content per device across end-markets. This should support sustained revenue growth into 2026 and beyond as advanced packaging and testing needs accelerate.

- Investments in leading-edge technologies (3D IC, chiplet, system-in-package, silicon photonics) and aggressive capacity expansion-especially in advanced packaging/test and fully automated lines-position ASE as a key player to meet next-generation requirements, enabling higher-margin mix and long-term operating margin expansion.

- The increasing pace of digital transformation in automotive, industrial, and networking segments is boosting high-margin demand for ASE's services outside traditional consumer electronics, supporting more stable and resilient earnings and diversifying revenue streams.

- Margins are temporarily pressured by foreign exchange headwinds and early ramp-up costs, but management anticipates a return to structural margin levels by 2026 as utilization improves, cost efficiencies from automation ramp, and pricing recalibrates to reflect value-added capabilities, benefiting future net margins and earnings.

- Tight capacity environment and high CapEx investments today are largely customer-driven, with long-term orders and ecosystem partnerships in place. As these capacity additions come online and resource optimization initiatives take effect, ASE can better leverage scale, capture incremental volume, and realize improved returns on capital, positively impacting future operating and net margins.

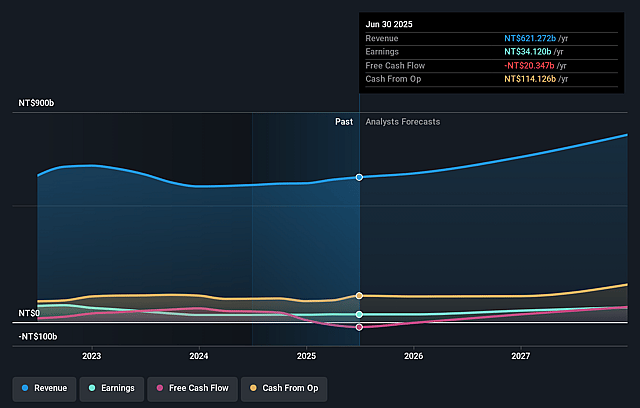

ASE Technology Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ASE Technology Holding's revenue will grow by 10.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 8.7% in 3 years time.

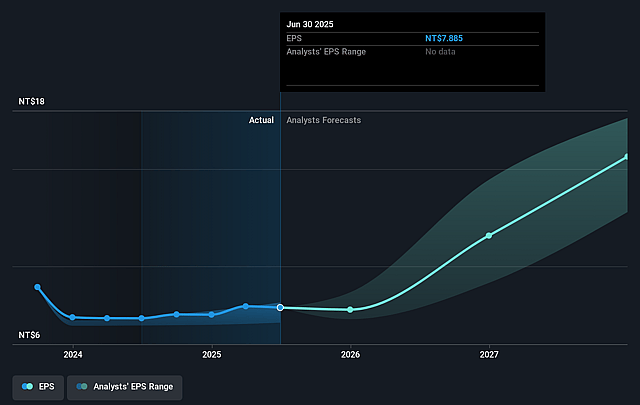

- Analysts expect earnings to reach NT$72.4 billion (and earnings per share of NT$15.63) by about September 2028, up from NT$34.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 20.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.41%, as per the Simply Wall St company report.

ASE Technology Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent foreign exchange volatility, particularly NT dollar appreciation against the US dollar, is having a significant and direct negative impact on ASE's gross and operating margins; this currency risk remains a structural threat that could continue to erode profitability and reported earnings if left unmitigated.

- The company is facing substantial resource constraints-including execution risk, human talent shortages, land, facility, and machine delivery issues-that are limiting its ability to rapidly scale capacity to meet surging demand, potentially resulting in missed revenue opportunities and higher operational pressure.

- Ongoing, heavy capital expenditures funded through rising debt are increasing financial leverage and net debt-to-equity ratios; if anticipated returns or market growth do not materialize as planned, this creates long-term pressure on net margins and could limit financial flexibility.

- There are signs of market disparity and potential cyclicality, with non-AI segments (such as PC, smartphone, and general EMS) described as slow or inconsistent; over-reliance on the AI and advanced packaging/testing wave exposes ASE to earnings volatility if there is a pause or slowdown in that domain.

- Geopolitical risks and regulatory controls-including evolving tariffs, BIS restrictions, and worldwide deglobalization trends-may require costly overseas investments, resource diversion, or loss of market access, all of which threaten revenue growth and global competitiveness in the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$172.765 for ASE Technology Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$190.0, and the most bearish reporting a price target of just NT$150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$832.9 billion, earnings will come to NT$72.4 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 10.4%.

- Given the current share price of NT$157.0, the analyst price target of NT$172.76 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.