Key Takeaways

- Expansion in the direct booking channel and enhanced product offerings through multiple travel services aim to improve marketing efficiency and customer retention.

- Investment in AI and data analytics, alongside a focus on alternative accommodations, is intended to increase operational efficiency and market share.

- High cancellable bookings, regulatory fines, dependency on travel demand, intense competition, and AI integration challenges could impact revenue, margins, and net income.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Expansion of the direct booking channel and the associated increase in direct mix are expected to contribute to marketing efficiency and support margin expansion, positively impacting net margins and profitability.

- Scaling up of flight offerings and the integration of multiple travel services (alternative accommodations, ground transportation) could enhance the overall product offering, attracting new customers and improving customer retention, ultimately leading to revenue growth.

- Enhancement of the Genius loyalty program to include all travel verticals aims to increase customer loyalty and frequency of bookings, potentially boosting revenue through repeat business.

- Investment in AI technology and data analytics to improve operational efficiency and customer experience is anticipated to lead to cost savings and higher customer satisfaction, positively influencing net margins and earnings.

- Continued focus on alternative accommodations, especially in the U.S. market, by increasing supply and improving product offerings, is expected to capture additional market share and drive revenue growth.

Assumptions

How have these above catalysts been quantified?

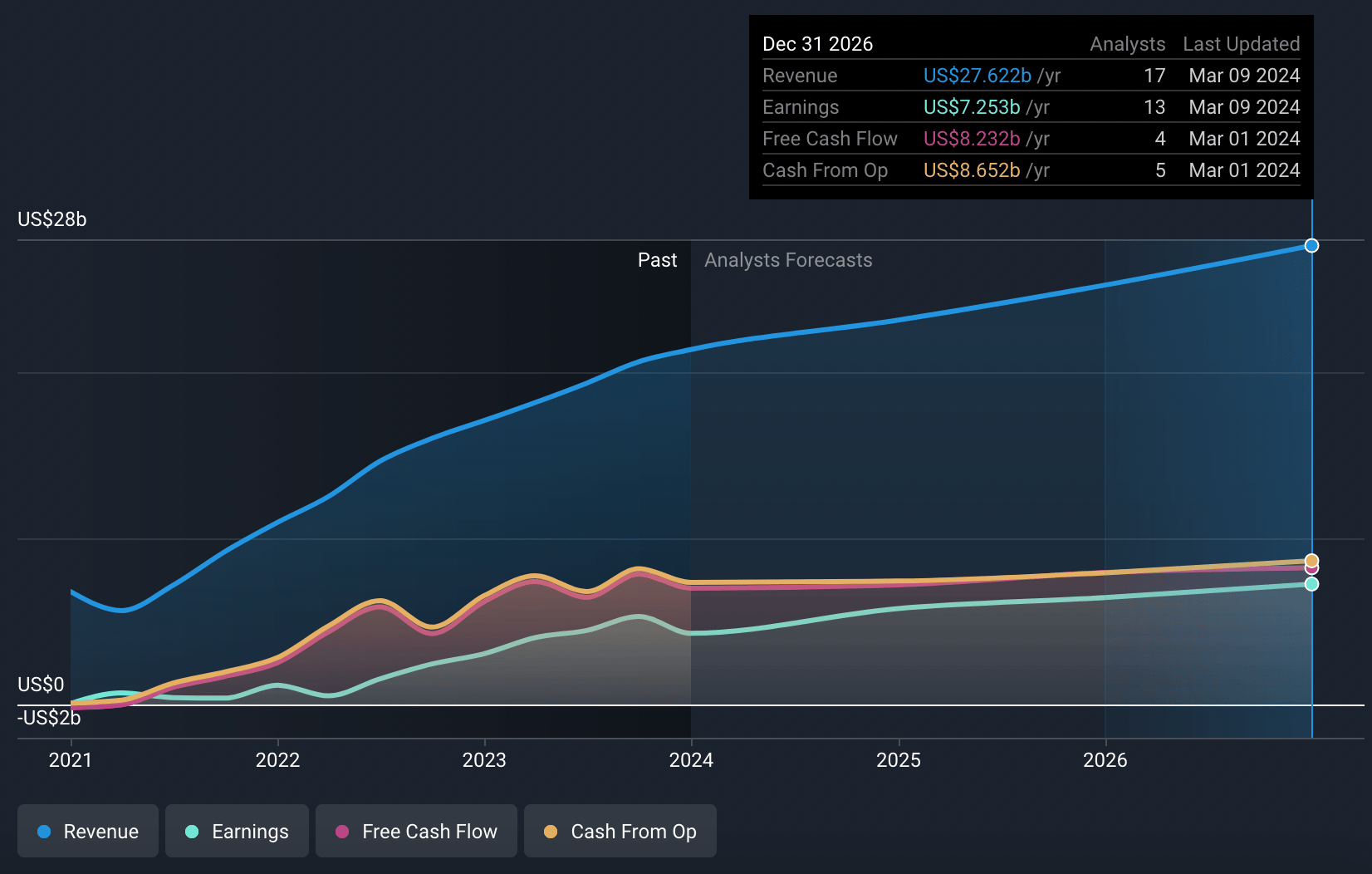

- Analysts are assuming Booking Holdings's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 26.3% in 3 years time.

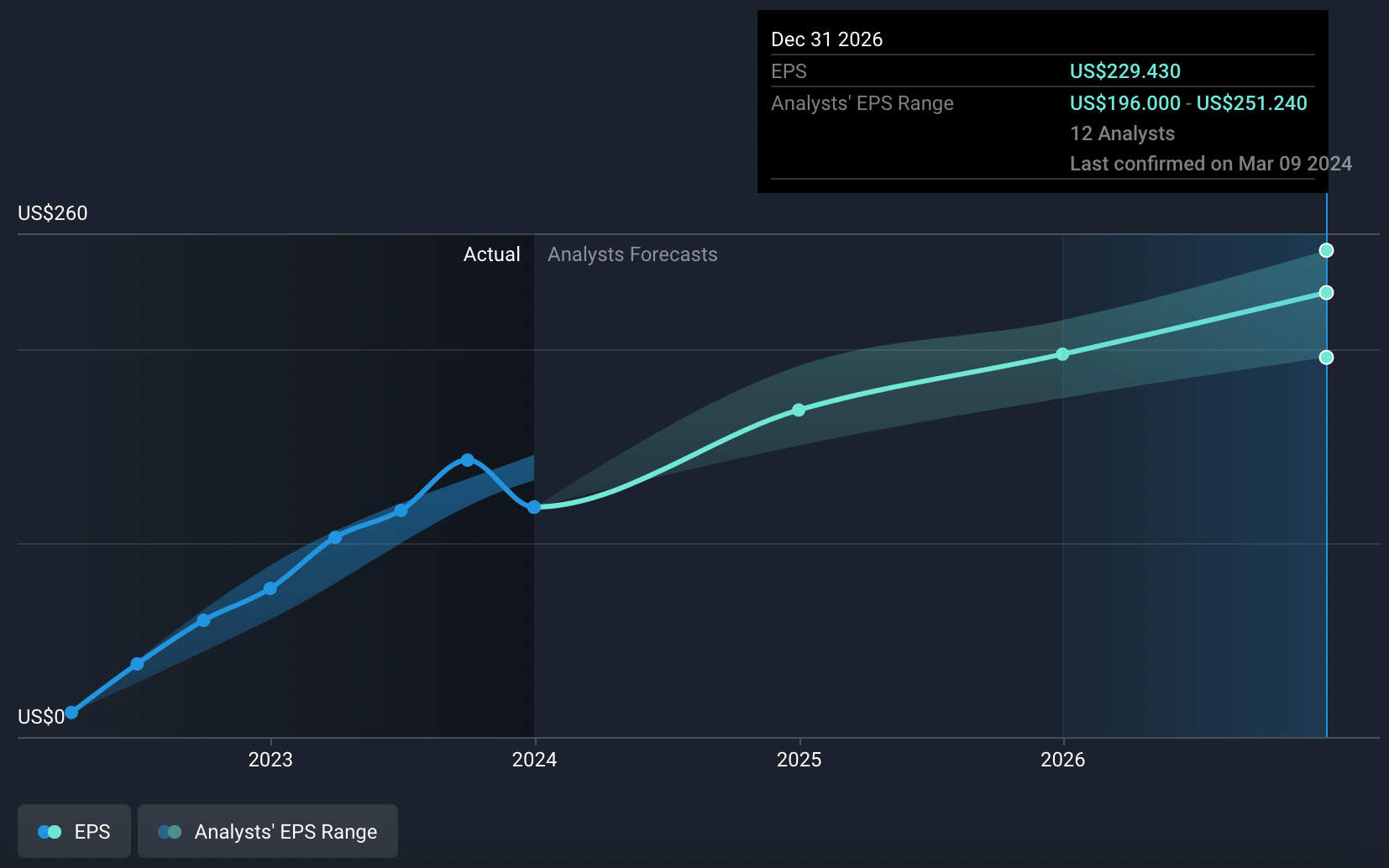

- Analysts expect earnings to reach $7.3 billion (and earnings per share of $229.43) by about March 2027, up from $4.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.9x on those 2027 earnings, down from 28.0x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- High percentage of cancellable bookings might lead to revenue volatility if a significant number of bookings are canceled. This could negatively impact revenue and net margins.

- Operational and financial impacts stemming from regulatory challenges such as the proposed $530 million fine by the Spanish competition authority. If this becomes final and is upheld upon appeal, it could significantly reduce net margins and affect net income.

- Dependency on global leisure travel demand and its associated risks, including geopolitical tensions, pandemics, or economic downturns, could impact room nights and gross bookings.

- Intense competition in the travel booking industry could pressure the company to increase marketing and promotional spending, potentially reducing profit margins and impacting earnings per share.

- Potential challenges in integrating AI and new technologies efficiently across its services. Failure to do so could increase operational costs without corresponding revenue growth, impacting net margins and earnings.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $3943.96 for Booking Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $27.6 billion, earnings will come to $7.3 billion, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $3511.56, the analyst's price target of $3943.96 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.