Key Takeaways

- Evernorth's innovations and the sale of Medicare businesses highlight a strategic focus on growth areas and efficiency, likely enhancing earnings.

- Investments in affordability and medical cost management, alongside expansion in specialty services, suggest potential for improved net margins and continued earnings growth.

- Expected earnings growth headwinds from normalizing Stop Loss margins, customer losses in individual exchange, Medicare Advantage market share challenges, and higher projected medical costs.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Evernorth's continued strong performance and profitability, including the success of the largest contract in the pharmacy benefits industry and pharmacy network innovations like ClearCareRx and ClearNetwork, point towards sustained growth in revenue and bottom line results.

- The definitive agreement to sell Medicare businesses to HCSC, while still serving HCSC with Evernorth services, is expected to sharpen focus on core growth areas and optimize capital allocation, potentially enhancing earnings.

- Significant investments and focus on affordability measures and medical cost management in Cigna Healthcare, yielding better-than-expected medical care ratios, indicate potential for improvement in net margins.

- Expansion and innovation in Evernorth’s specialty pharmacy and care services businesses, including Accredo Specialty Pharmacy and MDLIVE, suggest continued growth in high-margin services, which could positively impact earnings.

- Anticipated strong customer and revenue base growth across both Evernorth and Cigna Healthcare in 2024, with projections of at least 20% consolidated adjusted revenue growth and at least $11 billion operating cash flow, indicate robust future earnings growth potential.

Assumptions

How have these above catalysts been quantified?

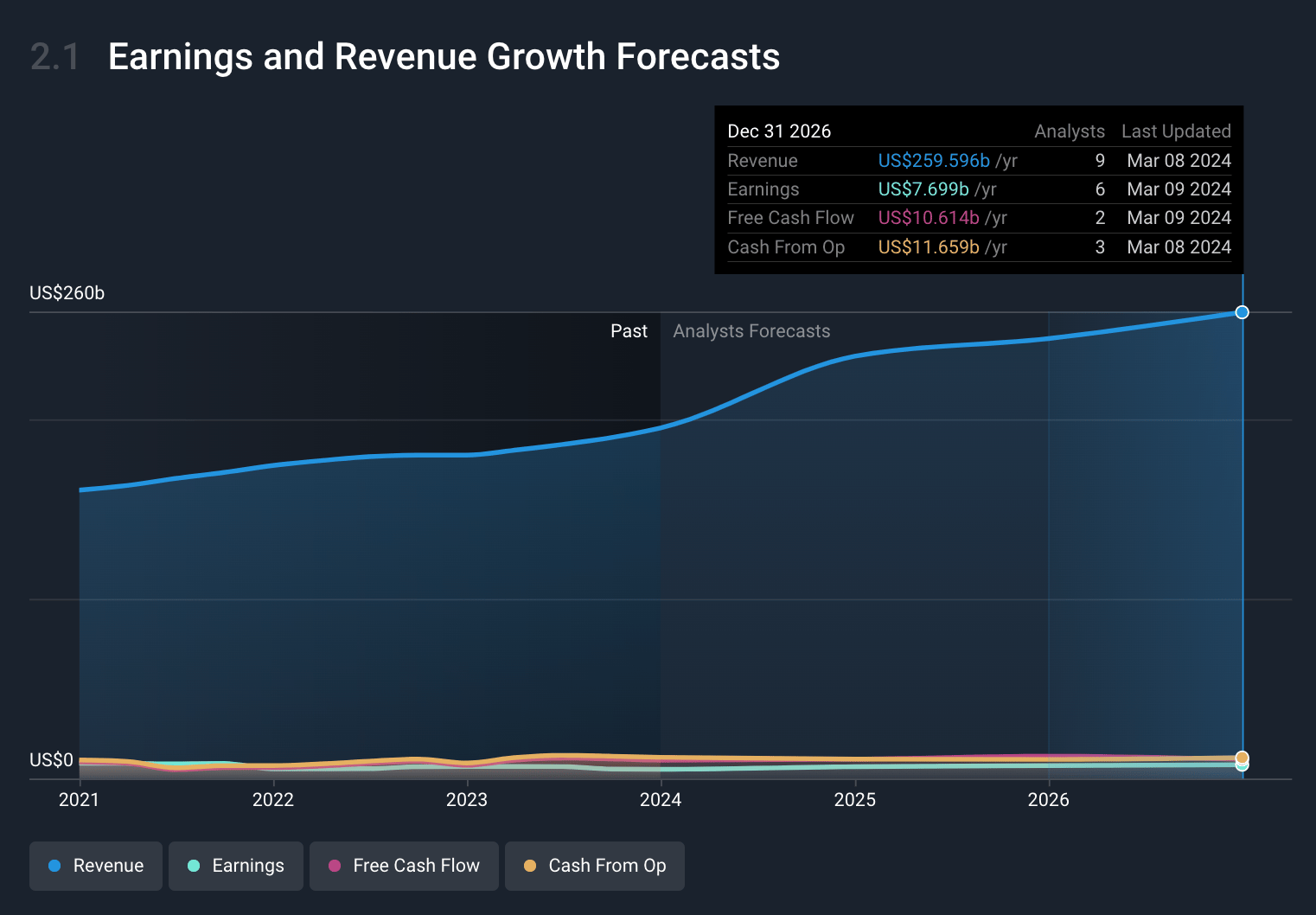

- Analysts are assuming Cigna Group's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 3.0% in 3 years time.

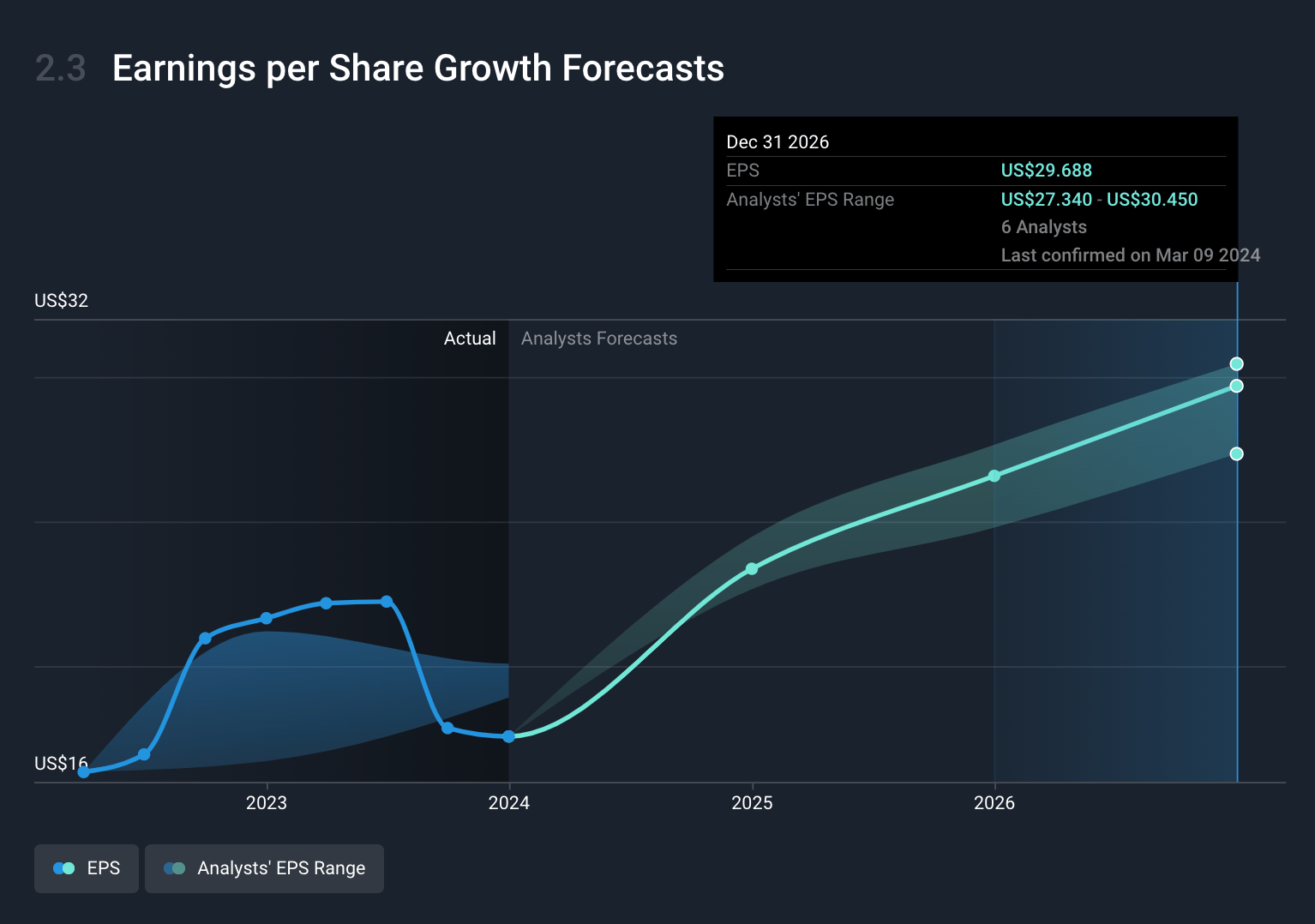

- Analysts expect earnings to reach $7.7 billion (and earnings per share of $29.69) by about March 2027, up from $5.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2027 earnings, down from 19.8x today.

- To value all of this in today’s dollars, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Stop Loss products are anticipated to normalize back to traditional levels of profitability in 2024 after contributing significantly to the favorability in the medical care ratio (MCR) in 2023, indicating a potential headwind to earnings growth due to higher medical costs.

- The projection of net customer declines in the individual exchange business for 2024 due to pricing actions, which could result in lower premium revenues and potentially impact net margins.

- The inclusion of Medicare Advantage customer volumes indicating slight declines for year-end 2024 compared to year-end 2023, suggesting challenges in maintaining or increasing market share in Medicare Advantage, which could affect revenue growth from this segment.

- The expectation of a higher medical care ratio (MCR) for 2024 (81.7% to 82.7%) compared to 2023, driven by normalization of Stop Loss product margins and product mix shifts within Cigna Healthcare, points to to potential pressure on overall net margins due to higher projected medical costs.

- The implementation and onboarding costs associated with the Centene relationship, despite expectations of it normalizing, indicate that managing large client relationships and maximizing their profitability may pose challenges, potentially impacting earnings growth in the short to mid-term.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $376.91 for Cigna Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $259.6 billion, earnings will come to $7.7 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of $349.51, the analyst's price target of $376.91 is 7.3% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.