Last Update 17 Dec 25

Fair value Increased 1.87%SOBI: Rare Disease Pipeline Progress Will Drive Future Share Price Upside

Analysts have raised their price target on Swedish Orphan Biovitrum from SEK 360 to SEK 367, reflecting slightly improved fair value assumptions and confidence in the company’s future earnings backed by recent positive research commentary.

Analyst Commentary

Recent upgrades reflect a growing conviction that Swedish Orphan Biovitrum can deliver attractive risk adjusted returns at current levels, with the new SEK 370 price target signaling modest upside from the revised fair value range.

Bullish Takeaways

- Bullish analysts see the SEK 370 price target as supported by clearer earnings visibility from the existing portfolio, which they view as reducing perceived execution risk in the medium term.

- They highlight improving operational leverage, arguing that disciplined cost control and scale benefits can drive margin expansion and support a premium valuation multiple.

- Positive sentiment is tied to a more constructive view on the company’s growth trajectory in rare diseases, with expectations that continued product uptake can sustain mid to high single digit revenue growth.

- Bullish analysts also point to what they see as a healthier balance between pipeline investment and profitability, which they believe strengthens the long term equity story and narrows downside risk to the share price.

Bearish Takeaways

- Bearish analysts remain cautious that the upside to SEK 370 may be limited if competitive pressures or pricing headwinds in key markets slow top line growth more than currently modeled.

- Concerns persist that any delays in pipeline milestones or regulatory decisions could undermine the improved growth narrative and justify a lower valuation multiple.

- Some see execution risk around scaling newer indications and geographies, warning that missteps in launch strategy could weigh on operating margins and free cash flow.

- Bearish analysts also flag that the stock already prices in a portion of the anticipated margin gains, leaving the shares vulnerable to disappointment if cost efficiencies materialize more slowly than expected.

What's in the News

- CHMP issued a positive opinion recommending EU marketing authorisation for Aspaveli (pegcetacoplan) in C3 glomerulopathy and primary IC MPGN, with a final European Commission decision expected in the first quarter of 2026. The opinion is backed by Phase 3 VALIANT data showing meaningful kidney and proteinuria benefits (company announcement).

- Sobi and Apellis continue global co development of systemic pegcetacoplan. Sobi holds exclusive ex U.S. commercialisation rights, while Apellis retains U.S. rights and global ophthalmology rights, reinforcing a long term partnership in complement mediated diseases (company announcement).

- Sobi North America reported 15 scientific abstracts, including six oral presentations, across its immunology portfolio at ACR Convergence 2025 in Chicago. The presentations highlighted new data for NASP (formerly SEL 212), Vonjo and Gamifant in rare inflammatory and uncontrolled gout indications (conference disclosure).

- The U.S. FDA accepted the BLA for NASP for uncontrolled gout and set a PDUFA target action date of June 27, 2026, following Phase 3 DISSOLVE trials that showed reduced disease burden with no new safety signals (regulatory filing).

- Tryngolza (olezarsen) was approved in the EU as an adjunct to diet for adults with genetically confirmed familial chylomicronemia syndrome, after Phase 3 Balance data showed sustained triglyceride reductions and fewer acute pancreatitis events. Sobi holds exclusive rights outside the U.S., Canada and China (company announcement).

Valuation Changes

- Fair Value: Raised slightly from SEK 360.36 to SEK 367.09, indicating a modest upward revision in long term intrinsic value estimates.

- Discount Rate: Increased marginally from 5.32 percent to 5.34 percent, reflecting a slightly higher assumed cost of capital in the updated model.

- Revenue Growth: Trimmed slightly from 10.53 percent to 10.46 percent, pointing to a modestly more conservative view on long term top line expansion.

- Net Profit Margin: Reduced marginally from 20.16 percent to 20.07 percent, suggesting only a small downgrade to expected long term profitability.

- Future P/E: Edged higher from 19.32x to 19.82x, implying a modestly higher valuation multiple on forward earnings despite the small adjustments to growth and margins.

Key Takeaways

- Successful Altuvoct launch in Europe and expanding regulatory approvals for Aspaveli and Gamifant could significantly boost revenue through market share growth and new entries.

- Strategic operational efficiency, cost management, and increased Beyfortus royalties are expected to enhance margins and stabilize earnings.

- Reliance on international expansion and competition challenges may limit revenue growth, while geopolitical and regulatory factors could further impact margins and earnings stability.

Catalysts

About Swedish Orphan Biovitrum- A biopharma company, provides medicines in the areas of haematology, immunology, and specialty care in Europe, North America, the Middle East, Asia, and Australia.

- The successful launch and rapid adoption of Altuvoct in markets like Germany, where it achieved a 57% market share within 9 months, present a significant opportunity for market share growth in Europe, potentially boosting future revenues.

- The expected regulatory approvals and market entries for Aspaveli in nephrology indications and Gamifant in secondary HLH show potential for new revenue streams, as these products address unmet medical needs in growing markets.

- Expansion of Gamifant into new indications, such as interferon-gamma-driven sepsis and the subsequent international filings, could drive significant long-term revenue growth, solidifying its position in an untapped market segment.

- The ongoing development and subsequent potential label expansion of Vonjo through the PACIFICA Phase III study and international launches may unlock new growth areas, positively impacting revenue and earnings.

- The strategic focus on enhancing operational efficiency and cost management, alongside anticipated increased royalty rates from Beyfortus, should support margin improvement and earnings stabilization in the coming years.

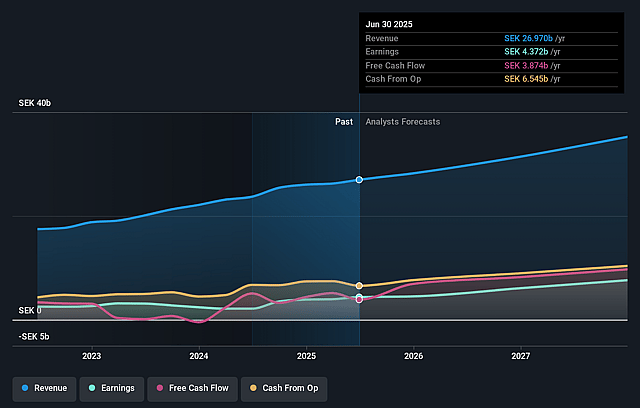

Swedish Orphan Biovitrum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Swedish Orphan Biovitrum's revenue will grow by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.2% today to 20.8% in 3 years time.

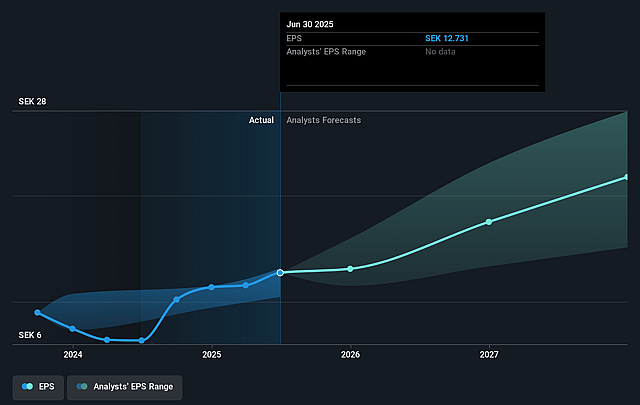

- Analysts expect earnings to reach SEK 7.5 billion (and earnings per share of SEK 21.93) by about September 2028, up from SEK 4.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK9.3 billion in earnings, and the most bearish expecting SEK5.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, down from 22.2x today. This future PE is lower than the current PE for the GB Biotechs industry at 32.5x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.98%, as per the Simply Wall St company report.

Swedish Orphan Biovitrum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growth rate, while positive, is relatively modest at 3% due to discontinuation of certain manufacturing revenues and seasonal impacts, potentially signaling limited expansion capacity which could affect future revenue expectations.

- The reliance on international expansion for products like Altuvoct is subject to reimbursement and regional regulatory challenges, particularly in markets like Spain and France, which could impact revenue growth if expected launches face delays.

- The intensified competition in some therapeutic areas, such as the competition Aspaveli faces from new oral medicines, may exert downward pressure on pricing or slow market penetration, affecting net margins and revenue.

- Stocking issues and adjustments related to Medicare Part D reform have negatively impacted Vonjo's quarterly performance, highlighting risks that might disrupt earnings consistency if not managed effectively.

- Fluctuating exchange rates and potential tariffs due to geopolitical factors could affect both revenue and EBITDA margins, as a significant portion of operations and sales occur in multiple currencies outside of the Swedish krona.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK341.182 for Swedish Orphan Biovitrum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK380.0, and the most bearish reporting a price target of just SEK275.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK36.3 billion, earnings will come to SEK7.5 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 5.0%.

- Given the current share price of SEK280.2, the analyst price target of SEK341.18 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Swedish Orphan Biovitrum?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.