Key Takeaways

- Focus on AI and new pricing models like UE+ aims to boost customer data effectiveness and make products more attractive, enhancing user adoption and revenue.

- Investments in sales force training and strategic M&A activity are designed to improve sales effectiveness and drive inorganic growth, respectively, without harming shareholder value.

- Salesforce faces potential slower growth and margin pressures due to cautious investment behavior, organizational changes, reliance on professional services, increased competition, and AI transformation risks.

Catalysts

About Salesforce

Provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide.

What are the underlying business or industry changes driving this perspective?

- Salesforce's focus on Artificial Intelligence (AI) and its integration into its offerings is expected to drive future growth by enhancing customer data usage and improving the effectiveness of its CRM solutions, impacting revenue growth positively.

- The introduction of new pricing models such as UE+, which combines per-user pricing with consumption-based pricing, is expected to make Salesforce's products more attractive to a wider range of customers, potentially increasing user adoption and revenue.

- Salesforce's commitment to maintaining high pipeline multiples (e.g., aiming for 3x pipelines) to manage in the current economic environment indicates strategic sales management that could secure better conversion rates and revenue stability.

- Investments in training and enablement for Salesforce's massive sales force on AI capabilities and new product offerings can improve sales effectiveness and potentially drive higher ACV (Annual Contract Value) bookings, positively affecting revenue growth.

- Strategic M&A activity adhering to Salesforce's disciplined framework (focused on time to value accretion, balance sheet consideration, and targeting best-in-class assets) suggests a focused approach to inorganic growth that could bolster the company's product portfolio and open new revenue streams without diluting shareholder value.

Assumptions

How have these above catalysts been quantified?

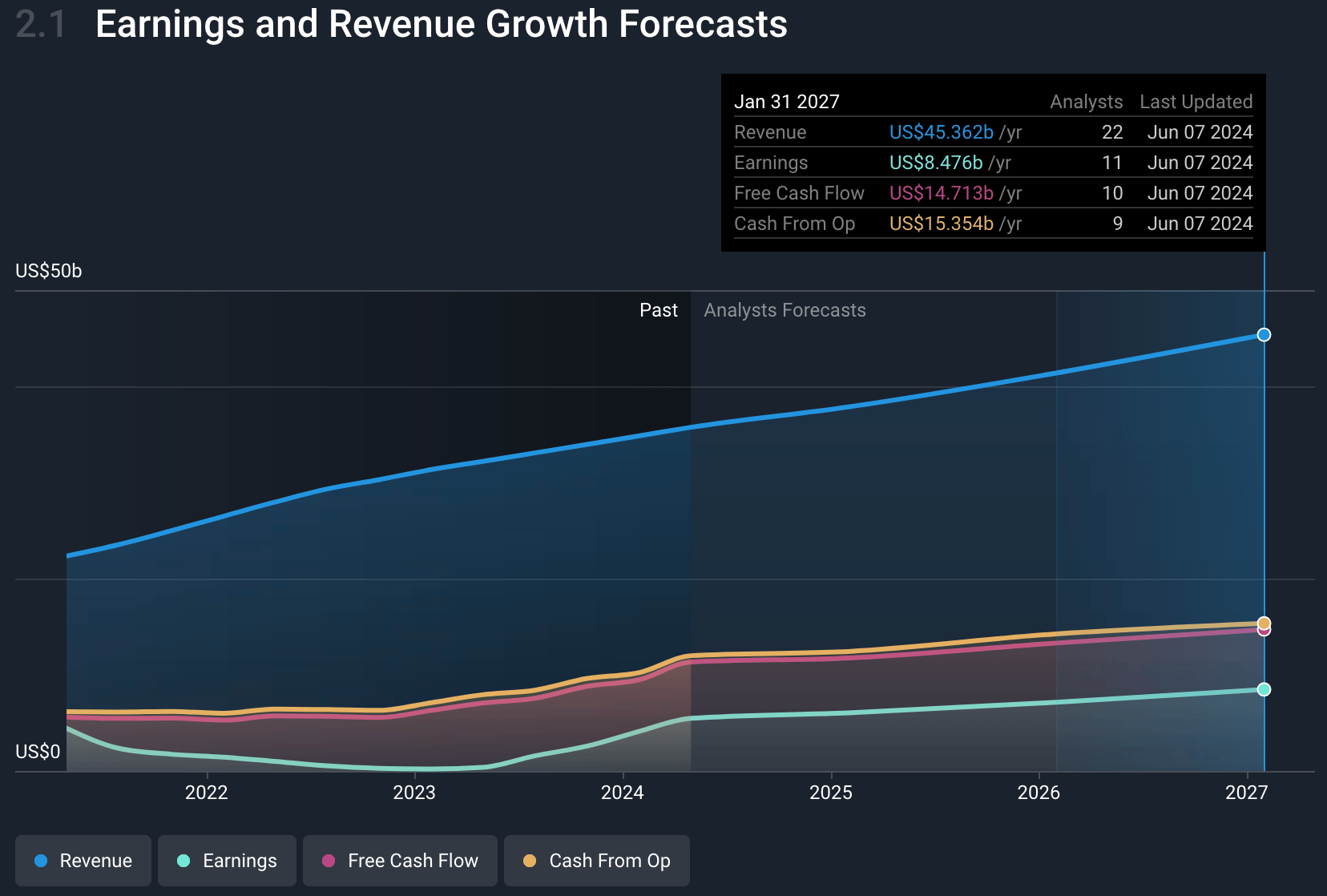

- Analysts are assuming Salesforce's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.3% today to 18.9% in 3 years time.

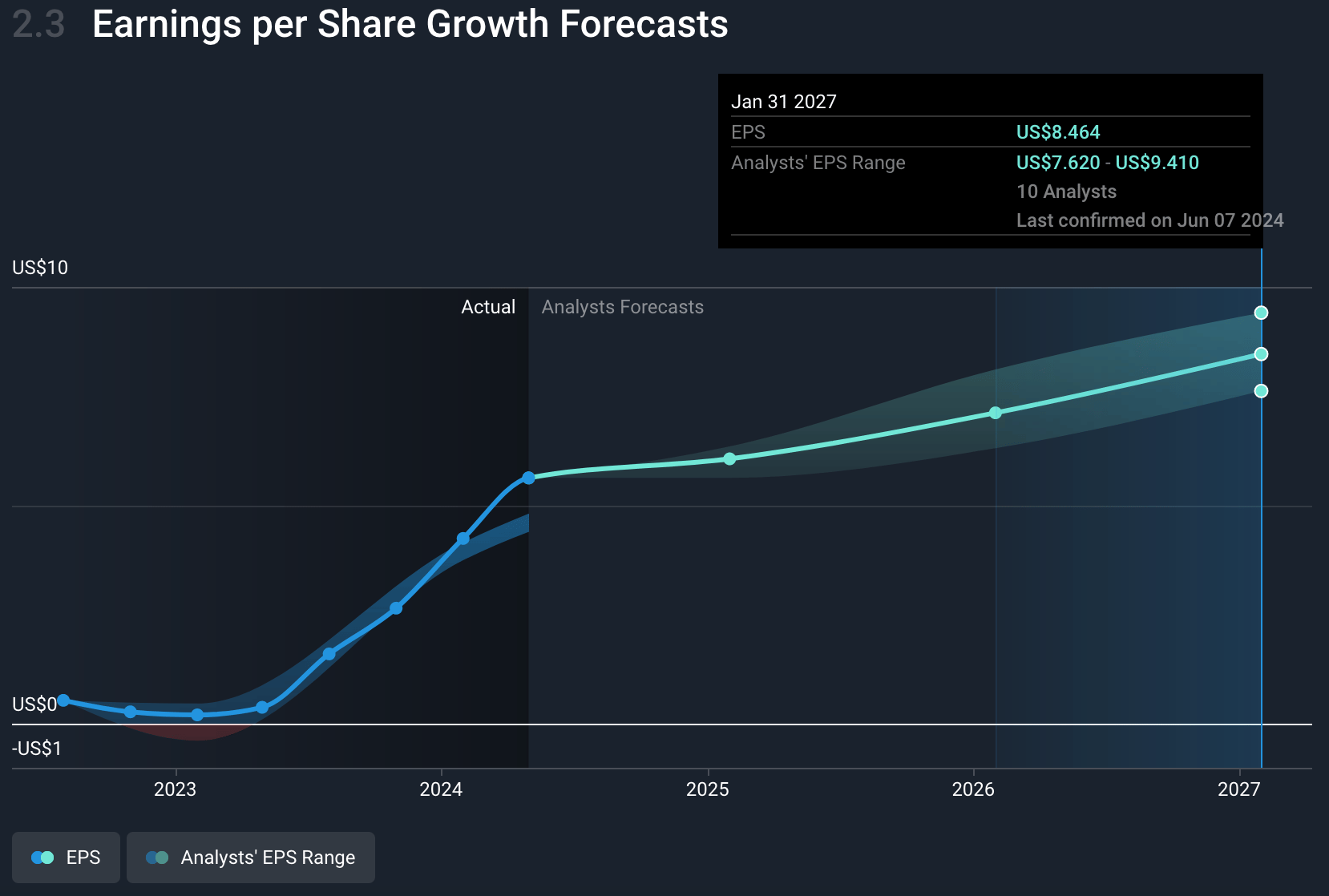

- Analysts expect earnings to reach $8.9 billion (and earnings per share of $8.66) by about June 2027, up from $5.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $9.2 billion in earnings, and the most bearish expecting $7.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.0x on those 2027 earnings, down from 41.5x today. This future PE is lower than the current PE for the US Software industry at 41.9x.

- Analysts expect the number of shares outstanding to grow by 1.79% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The measured buying behavior and deal compression observed suggest caution among businesses in their investment decisions, which could lead to slower revenue growth for Salesforce.

- Changes in Salesforce's go-to-market organization aimed at long-term productivity might initially disrupt bookings and sales execution, potentially affecting short-term revenue and margins.

- Continued reliance on professional services as a revenue source faces headwinds, as customers are opting for shorter project durations, possibly impacting future revenue growth.

- Increased market competition in AI and CRM spaces could challenge Salesforce's ability to maintain its market share and pressure on pricing, affecting profit margins.

- The transformation to AI and reliance on data as a new growth lever introduces execution risks. Failure to effectively leverage and monetize Data Cloud and AI innovations could impact anticipated revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $302.04 for Salesforce based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $390.0, and the most bearish reporting a price target of just $230.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $47.0 billion, earnings will come to $8.9 billion, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $234.44, the analyst's price target of $302.04 is 22.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.