Key Takeaways

- Strong credit card segment growth and efficiency initiatives suggest potential for higher revenue, profitability, and improved net margins.

- Investments in Corporate Investment Bank and technology aim to enhance customer experience, drive growth, and increase market share.

- Broad economic concerns, shifts in consumer banking, real estate demand, and rising costs could pressure profitability and net interest margins.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Strong growth in the credit card segment, driven by new product launches, indicates potential for higher revenue and profitability as the portfolio matures, impacting revenue and net margins.

- Execution of efficiency initiatives leading to lower operating costs, suggesting an improvement in net margins through reduced expenses.

- Investment in the Corporate Investment Bank (CIB) has resulted in revenue growth and increased market share, potentially impacting future growth in revenue.

- Strategic focus on a more efficient home lending strategy is expected to result in higher returns and earnings, potentially improving net margins.

- Ongoing investments in technology and mobile banking, aiming to enhance the customer experience and drive growth, potentially increasing customer engagement and revenue.

Assumptions

How have these above catalysts been quantified?

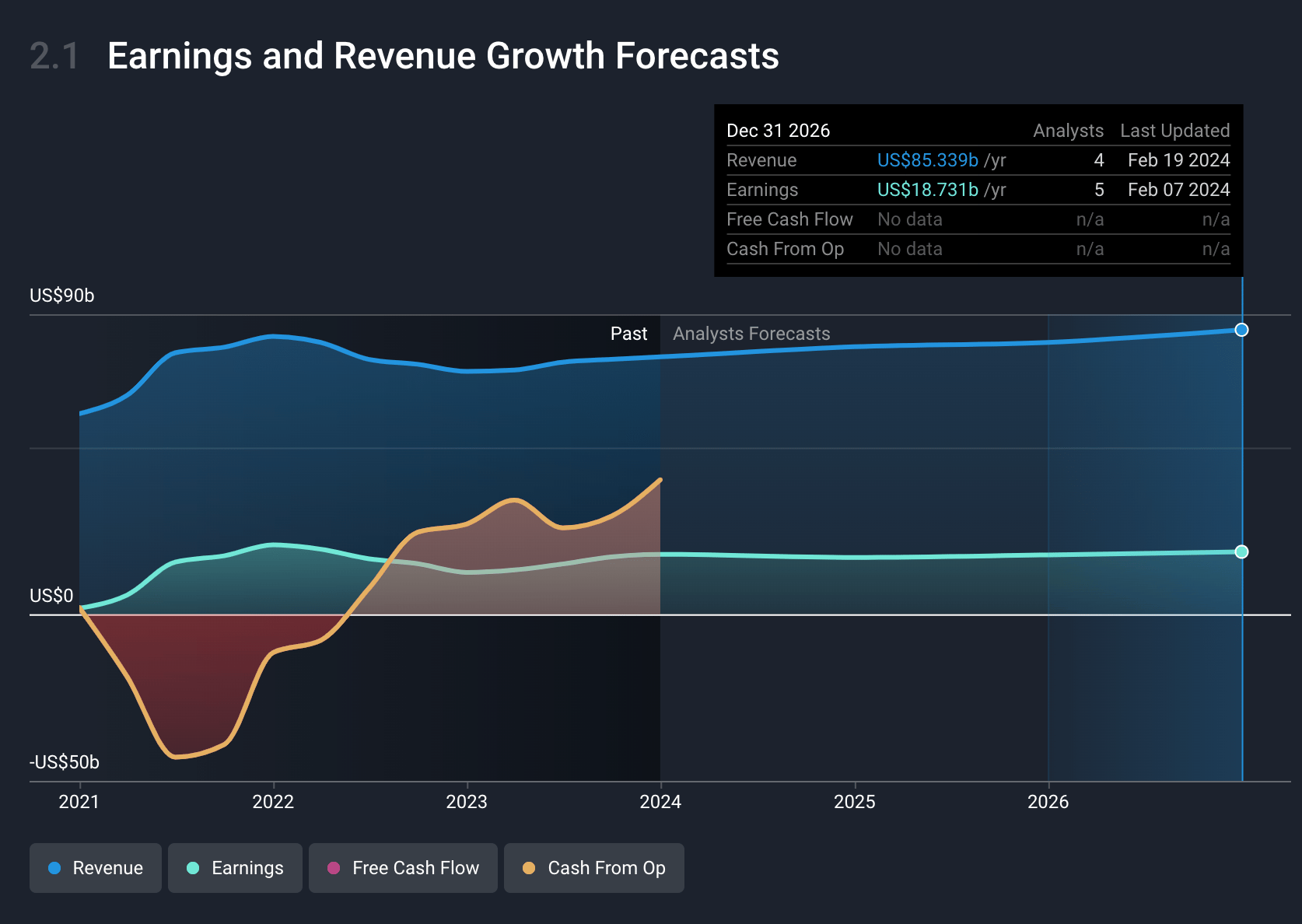

- Analysts are assuming Wells Fargo's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.3% today to 21.9% in 3 years time.

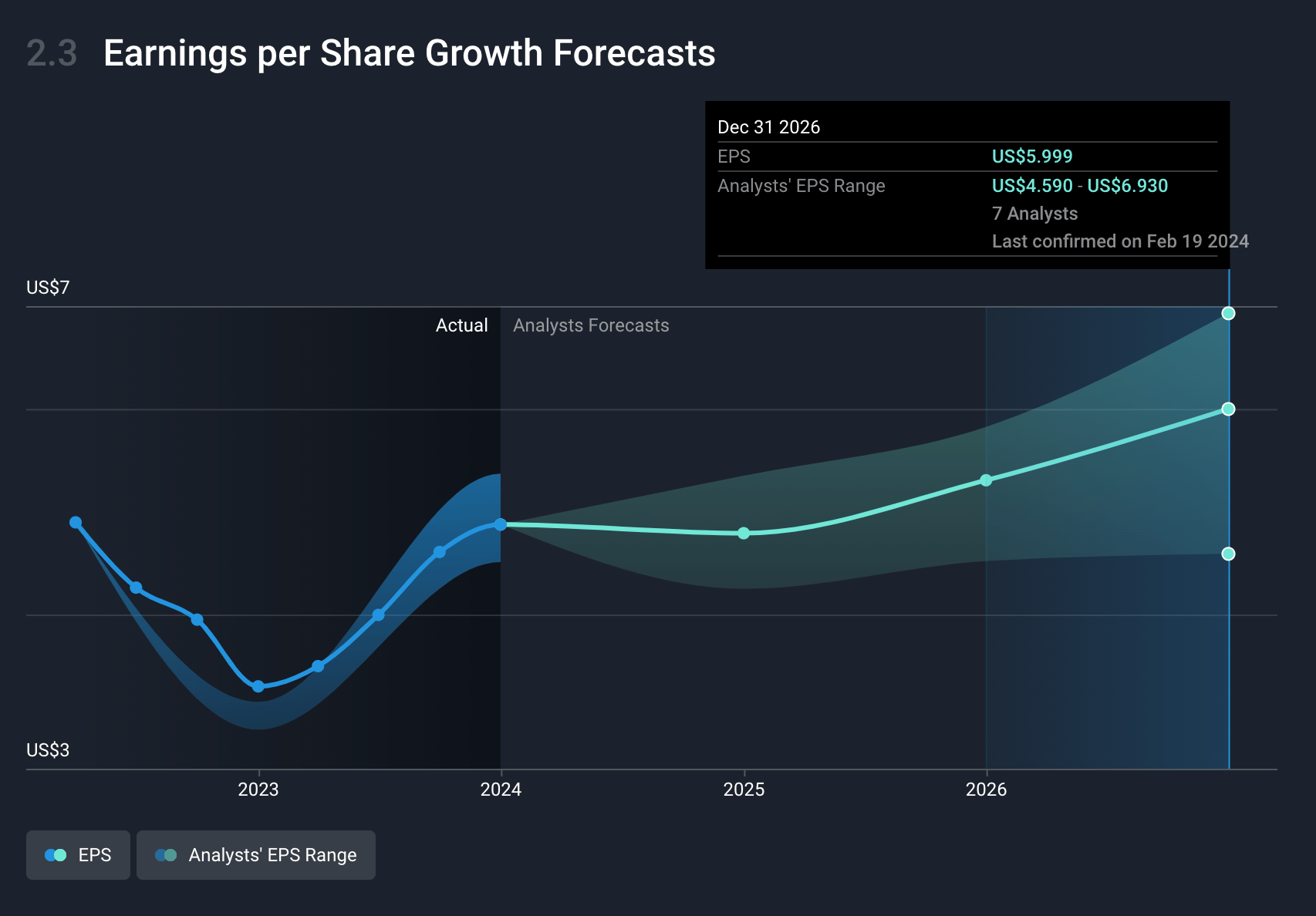

- Analysts expect EPS to reach $5.84 ($18.7 billion in earnings) by about February 2027, up from $5.0 today.

Risks

What could happen that would invalidate this narrative?

- Concerns about the broader economic environment and its impact on consumer and commercial banking could affect revenue growth and profitability.

- The normalization of credit card losses as the portfolio matures could lead to higher net charge-offs, impacting net margins.

- The ongoing structural shifts in demand for commercial real estate, particularly office spaces, pose a risk of continued credit losses, which could affect earnings.

- The sharp shift from noninterest-bearing to interest-bearing deposits, increasing the cost of funds, could pressure net interest margins and reduce net interest income.

- Ongoing investments in risk and control infrastructure, while necessary, could lead to elevated operating expenses, impacting overall earnings.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.