Last Update 10 Nov 25

Fair value Increased 7.12%8604: Revenue Outlook Should Support Dividend Growth Despite Modest Margin Pressure

Narrative Update on Nomura Holdings

Analysts have raised their price target for Nomura Holdings from ¥1,082.86 to ¥1,160.00, citing a significant increase in expected revenue growth as the primary rationale for the upward revision.

What's in the News

- Nomura Holdings announces an increased dividend of JPY 27 per share for shareholders as of September 30, 2025. This is up from JPY 23 per share the previous year. The payment date is December 1, 2025 (Key Developments).

Valuation Changes

- Fair Value: Increased from ¥1,082.86 to ¥1,160.00, reflecting a higher assessment of Nomura Holdings' intrinsic worth.

- Discount Rate: Decreased slightly from 8.12% to 8.08%, indicating marginally lower perceived risk or cost of capital.

- Revenue Growth: Projected revenue growth rose substantially from 4.89% to 32.97%.

- Net Profit Margin: Edged down from 17.01% to 16.57%.

- Future P/E: Increased mildly from 12.06x to 12.60x, suggesting a higher valuation relative to projected earnings.

Key Takeaways

- Faith in Asia-Pacific wealth growth may overlook Japan's aging population, risking weaker domestic fee income and asset inflows for Nomura's wealth management business.

- Digital disruption, regulatory complexity, and unsustainable deal-driven gains could pressure Nomura's margins, while underperforming overseas divisions threaten long-term group returns.

- Strong wealth and asset management growth, digital innovation, global expansion, resilient advisory demand, and cost discipline position Nomura for long-term stable and diversified earnings.

Catalysts

About Nomura Holdings- Provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide.

- Investors may be overly optimistic about Nomura's ability to benefit from Asia-Pacific wealth growth and demographic shifts, overlooking Japan's significantly aging and shrinking population, which could dampen domestic fee income, slow recurring asset inflows, and pressure long-term wealth management revenue.

- The current high valuation could reflect excessive faith in Nomura's capacity to offset global fintech-driven disintermediation: new digital competitors and ongoing fee compression are likely to erode traditional margins faster than Nomura can implement digital transformation or cost controls, affecting long-term net margins and earnings growth.

- Geopolitical tensions and regulatory fragmentation (such as ongoing trade disputes and compliance complexity across markets) are likely to raise operational and compliance costs for Nomura, especially given its cross-border expansion strategy, potentially reducing future group net margins.

- Recent outperformance in deal-driven revenues (M&A advisory, primary bond sales, and tender offers) may not be sustainable; if investor enthusiasm is anchored in these nonrecurring factors, future periods could show softer revenue and EPS results, especially as policy holding disposals and ECM activities normalize.

- Persistent underperformance in certain overseas divisions and international investment banking-where risk assets and expenses have grown without proportionate profitability-suggests that Nomura's global expansion may continue to weigh on group-wide returns and could limit medium

- to long-term earnings growth.

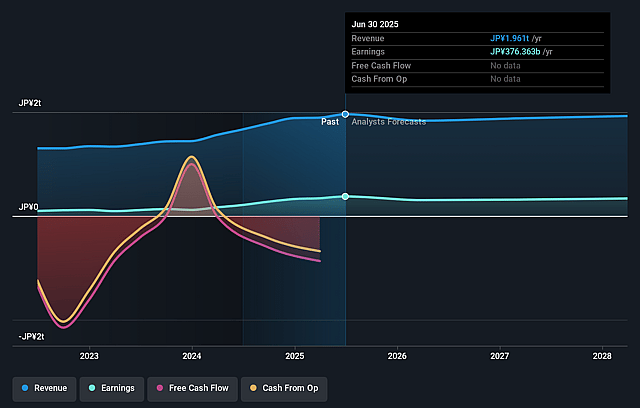

Nomura Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nomura Holdings's revenue will decrease by 0.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.2% today to 17.0% in 3 years time.

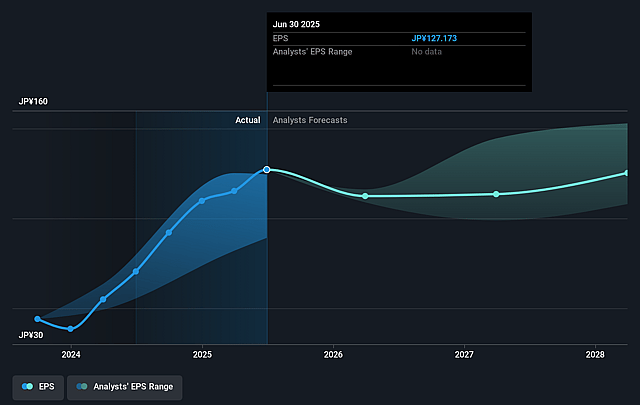

- Analysts expect earnings to reach ¥334.2 billion (and earnings per share of ¥124.88) by about September 2028, down from ¥376.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥412.2 billion in earnings, and the most bearish expecting ¥290.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the US Capital Markets industry at 16.2x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Nomura Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained inflows into wealth and asset management (13 consecutive quarters of net inflow, record-high assets under management at ¥94.3 trillion, and recurring revenue assets rebounding after market shocks) signal growing fee-based and stable revenue streams, supported by demographic and wealth growth in Asia-Pacific and global trends toward investment diversification-potentially driving upward pressure on long-term revenues and earnings.

- Ongoing digital transformation (upgrades to Nomura Trust and Banking's core banking system, planned introduction of sweep accounts, new biometric authentication for security) demonstrates commitment to fintech innovation and operational efficiency, likely reducing costs over time and supporting expansion of net margins.

- Expansion through targeted acquisitions and international diversification (e.g., acquisition of Macquarie's U.S. Asset Management business, strong performance in overseas markets, especially Americas and EMEA) increases Nomura's global presence, product breadth, and client flows, pointing to enhanced revenue diversification and reduced reliance on domestic market cycles.

- Resilient demand for advisory and capital markets services, particularly in Japan (high corporate activity, robust M&A pipeline, firms focusing on capital efficiency and governance reform) positions Nomura to benefit from long-term secular trends in corporate growth, capital allocation, and ongoing globalization-supporting robust deal flow and stable advisory fee income.

- Demonstrated cost control discipline (recurring revenue cost coverage at 69%, personnel and IT costs managed, prompt responses to operational risks like phishing) and capacity to swiftly recover from market volatility (improved recurring revenues after shocks) may underpin expanding margins and protect earnings, especially amid industry-wide fee compression and regulatory burdens.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1087.143 for Nomura Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1300.0, and the most bearish reporting a price target of just ¥990.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1964.2 billion, earnings will come to ¥334.2 billion, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of ¥1033.5, the analyst price target of ¥1087.14 is 4.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.