Key Takeaways

- Citigroup's organizational restructuring and focus on core businesses are set to reduce expenses and enhance earnings efficiency through streamlined operations.

- Investments in digital banking, talent acquisition, and strategic alignment across services aim to drive future revenue growth and achieve medium-term targets.

- Restructuring, investment cutbacks, interest rate assumptions, regulatory changes, and external risks like geopolitical tensions could significantly impact revenue and innovation.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The simplification of Citigroup’s organizational structure, resulting in over $1 billion of run rate savings from the net elimination of approximately 5,000 roles, mainly in management, will contribute to reducing expenses in 2024, positively impacting net margins.

- Citigroup's strategy to focus on 5 core interconnected businesses and the divestiture of non-core international consumer franchises will streamline operations and provide greater transparency into business performance, likely enhancing earnings efficiency.

- Investments in key products, such as commercial banking and digital payment capabilities, and the hiring of key talent aim to capture market share and improve service offerings, driving future revenue growth.

- The restructuring toward core interconnected businesses, including a significant record year for services and wealth management growth, is expected to realize synergies between divisions. This strategic alignment is anticipated to contribute to reaching medium-term revenue targets through enhanced client connectivity and product offerings.

- Citigroup’s ongoing transformation, including risk management and control environment improvements as well as investments in data architecture, are designed to address regulatory expectations and modernize the firm’s operations. These efforts are expected to drive efficiency gains, reduce long-term costs, and ultimately support earnings growth.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

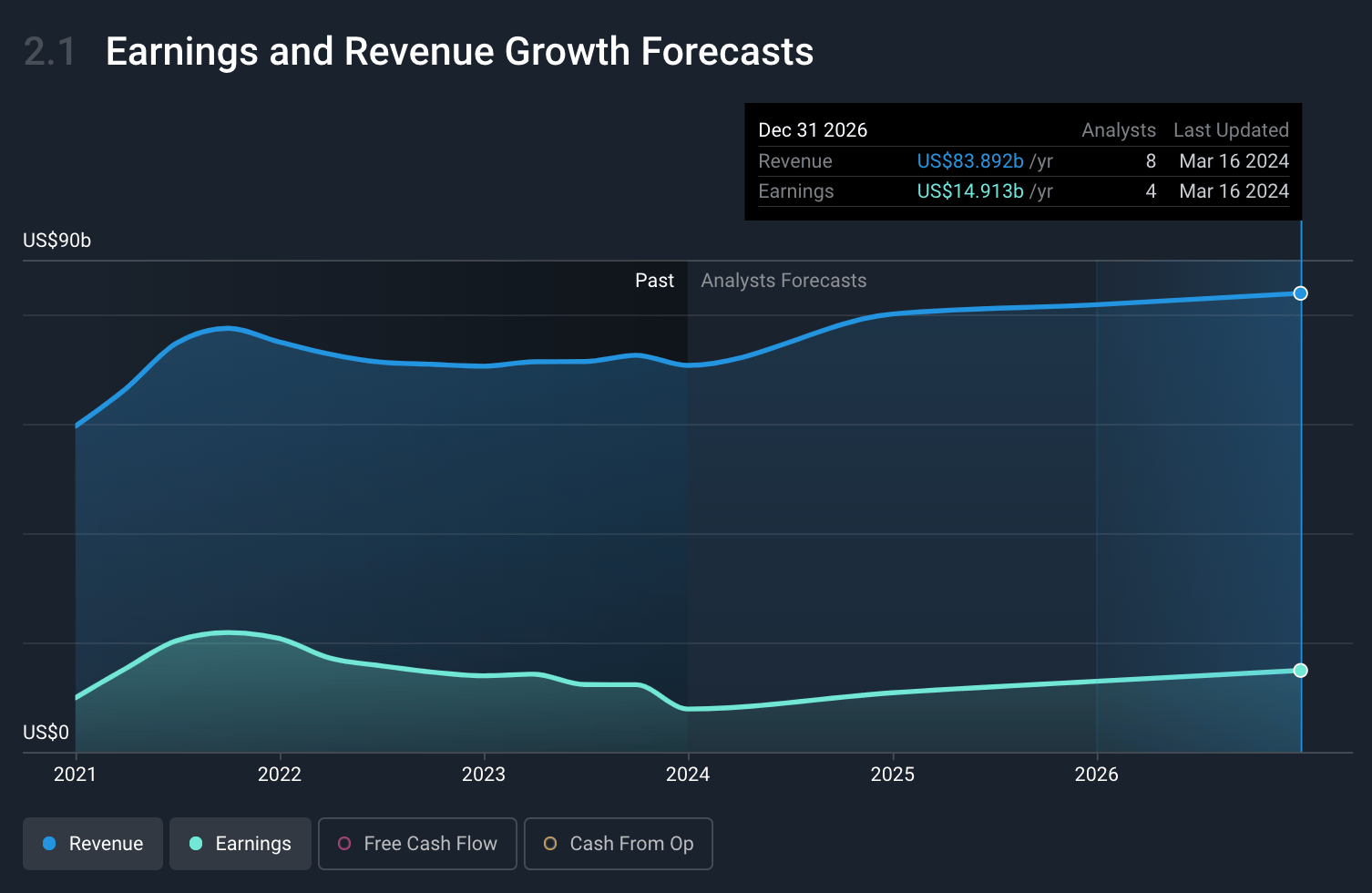

- Analysts are assuming Citigroup's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.1% today to 17.8% in 3 years time.

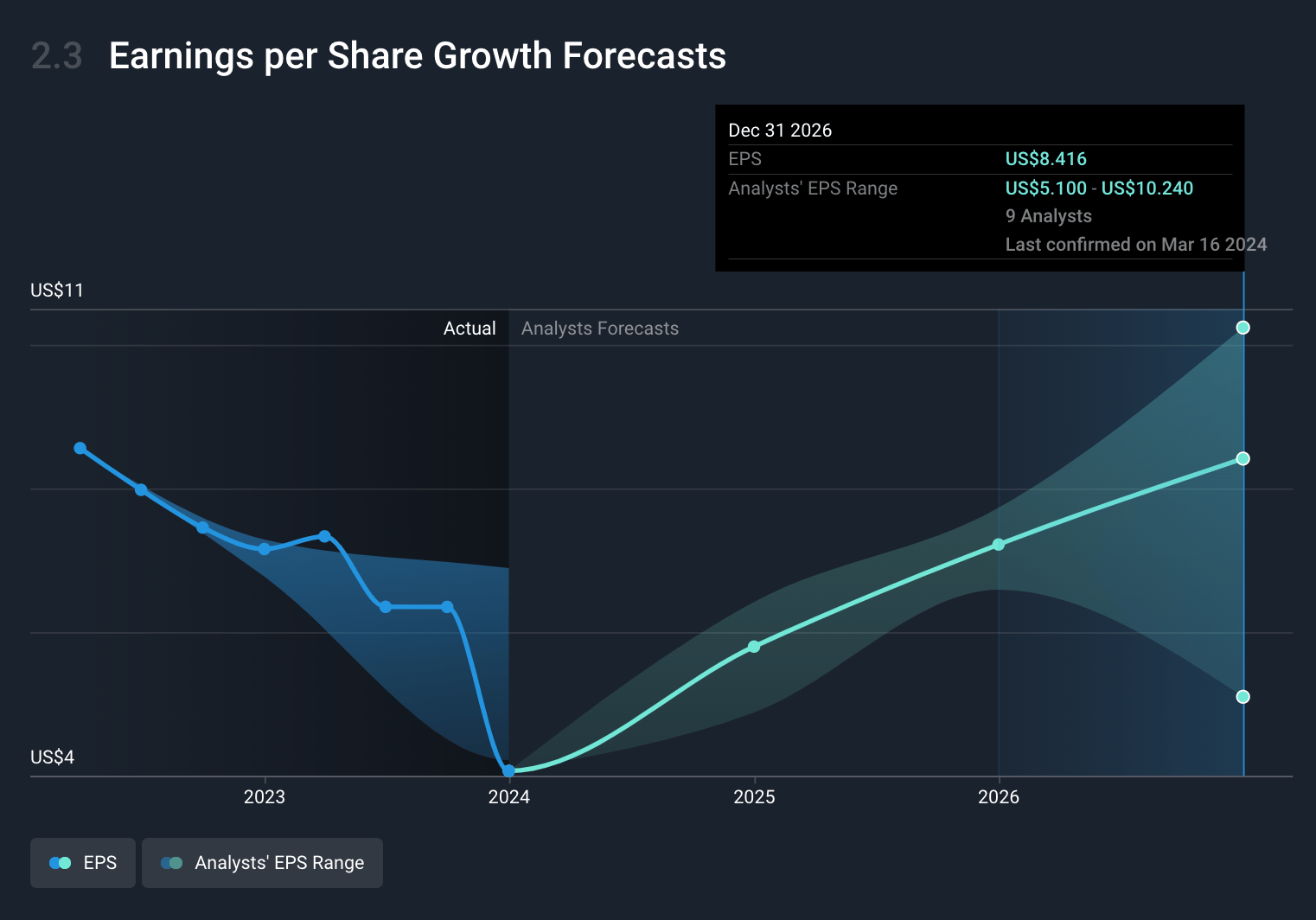

- Analysts expect earnings to reach $14.9 billion (and earnings per share of $8.19) by about March 2027, up from $7.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.7x on those 2027 earnings, down from 13.9x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- The ongoing organizational simplification and restructuring efforts could lead to disruptions in operations and uncertainty among employees, potentially impacting productivity and revenue growth.

- Cutbacks in investment notwithstanding the ongoing transformation might slow down innovation and competitiveness, ultimately affecting future revenue streams.

- Revenue guidance incorporates assumptions of interest rate cuts, whose actual occurrence could vary, thus posing risks to net interest income projections and overall revenue forecasts.

- Anticipated regulatory changes, such as adjustments to credit card late fees, could reduce fee income, thereby impacting net revenue negatively.

- External risks, including geopolitical tensions and economic instability in regions like Russia and Argentina, have already led to significant financial impacts. Continuation or escalation of such issues could further affect the company's financial performance, particularly in terms of provisions for credit losses and currency devaluation impacts on investments and revenues.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $61.97 for Citigroup based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $83.7 billion, earnings will come to $14.9 billion, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $57.09, the analyst's price target of $61.97 is 7.9% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.