Key Takeaways

- Expansion in private wealth and insurance channels suggests potential for stable, growing fee-related earnings, impacting revenue and margins positively.

- Strategic focus on digital infrastructure, software, and energy transition aimed at future growth areas could enhance investment returns and earnings.

- Economic uncertainty, shifts in monetary policy, reliance on specific asset classes, performance goals, and a focus on realizations are key risks to Blackstone's earnings.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Significant momentum in private wealth and insurance channels, which could provide a stable and growing source of fee-related earnings. This is likely to impact revenue growth and margin expansion.

- Near-term deployment plans with nearly $200 billion of dry powder, which suggests aggressive investment in undervalued assets and sectors that could lead to enhanced performance revenues and earnings growth as market conditions improve.

- Exceptional outperformance in flagship strategies compared to public indices across asset classes, indicating robust internal investment and risk management capabilities that could continue to attract institutional and retail investors, driving AUM growth.

- Strategic positioning in sectors such as digital infrastructure, enterprise software, and energy transition, reflecting a focus on future growth areas that could lead to superior investment returns and further boost earnings.

- Enhanced data analytics capabilities across a broad portfolio that offers unique insights and competitive advantages in investment decisions, potentially leading to superior asset selection, risk management, and operational efficiencies that can impact long-term earnings and margin improvement.

Assumptions

How have these above catalysts been quantified?

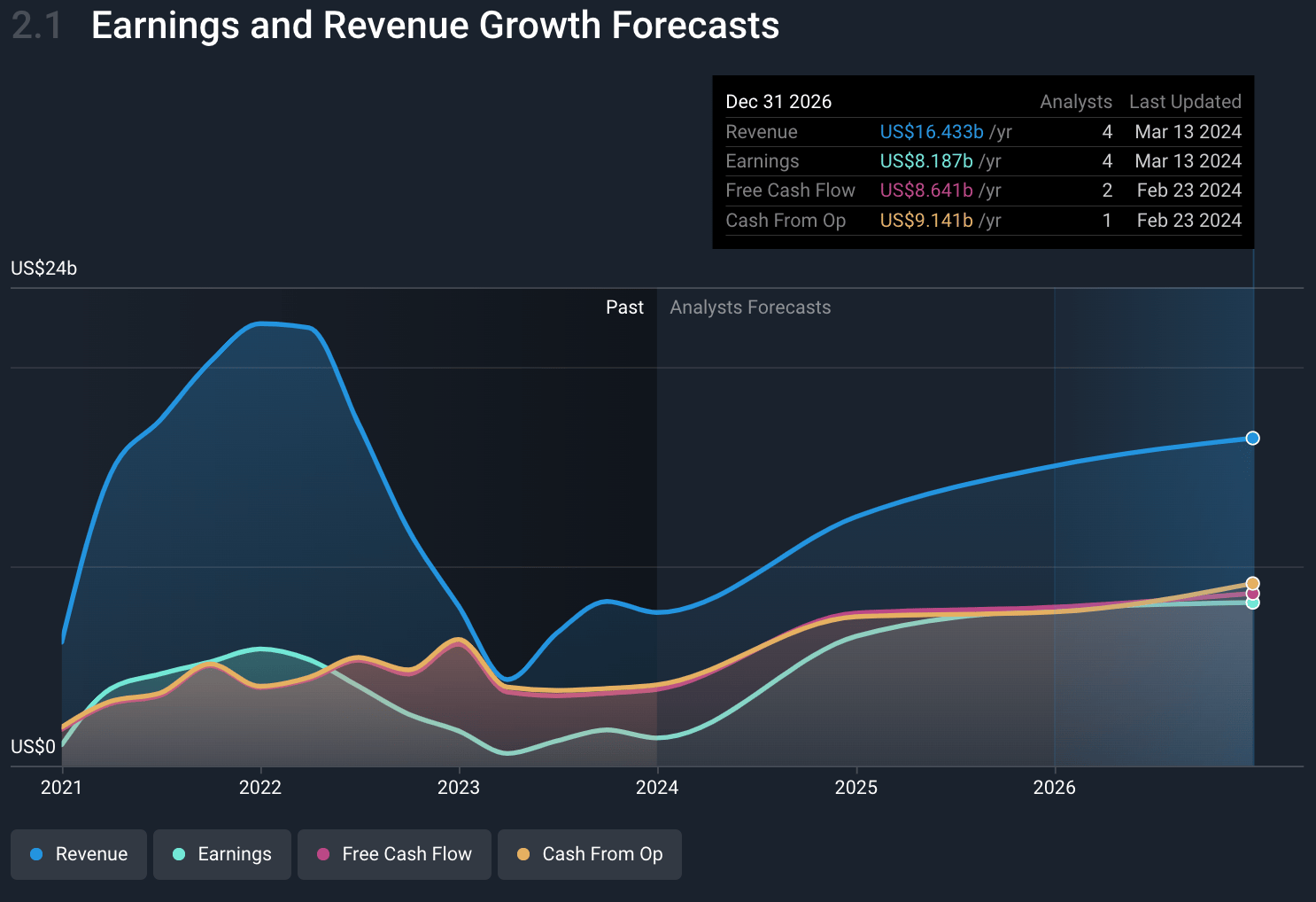

- Analysts are assuming Blackstone's revenue will grow by 28.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.1% today to 49.8% in 3 years time.

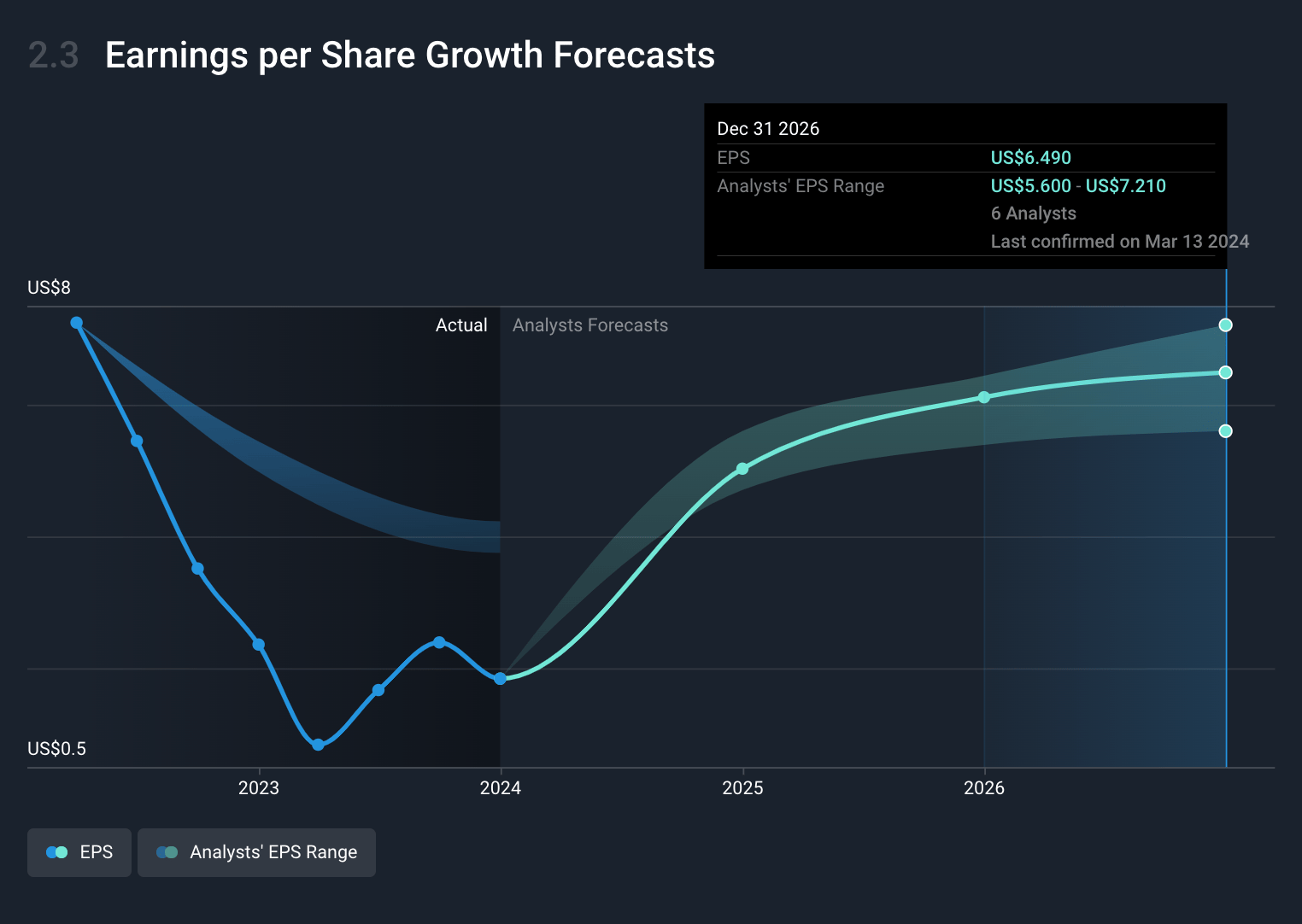

- Analysts expect earnings to reach $8.2 billion (and earnings per share of $6.49) by about March 2027, up from $1.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2027 earnings, down from 64.1x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Economic uncertainty and geopolitical instability could result in market volatility affecting the valuation of investments and potentially impacting revenue.

- The potential moderation of investor confidence due to shifts from a restrictive monetary policy could affect the ability to raise and deploy capital, impacting earnings.

- The reliance on the performance of asset classes such as real estate, which experienced a difficult environment, may risk revenue if market conditions do not improve as expected.

- A significant amount of the company’s future success is predicated on outperforming market indices, which poses a risk to earnings if these performance goals are not met, particularly in challenging market conditions.

- The firm's heavy reliance on realizations for driving distributable earnings suggests that any delay or reduction in realizations, possibly due to unfavorable market conditions, could negatively impact net margins and earnings.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $127.7 for Blackstone based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $16.4 billion, earnings will come to $8.2 billion, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of $124.8, the analyst's price target of $127.7 is 2.3% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.