Key Takeaways

- Strategic sale and focus on cost savings aim to strengthen the balance sheet by reducing debt and positively impacting net leverage.

- Investment in new U.S. and Europe tower sites and operational efficiency measures are designed to improve profitability and maintain sustained growth.

- Sale of Indian business, cautious dividend strategy, and emphasis on cost-cutting may affect revenue, shareholder returns, and service quality, risking long-term growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The sale of the India business and the strategic focus on reducing overall capital intensity and executing on cost savings across the business are geared towards strengthening the balance sheet, aiming for a reduction in gross debt balance, which in turn is expected to impact net leverage positively.

- A significant portion of 2024's development capital is allocated towards the U.S. and Europe, focusing on expanding within the CoreSite footprint, given the demand trends that drive expected stabilized returns in the mid-teens for ongoing development projects, potentially enhancing revenue and profit margins in these developed markets.

- Plans to invest in the construction of around 3,000 new tower sites, primarily in international markets, albeit at a reduced volume compared to previous years to manage risks including FX volatility, indicate a strategic approach to capital allocation that could impact long-term growth.

- Operational strategies to drive cost discipline, margin expansion, and increased returns on invested capital, alongside initiatives to lower direct cost per site and implement AI and other technologies for efficient operations, are set to contribute significantly towards improving profitability.

- A strong focus on operating the highest quality portfolio, ensuring business is secured with market leaders and maximizing organic growth across existing assets, complemented by incremental revenue through select development opportunities, underscores efforts aimed at achieving sustained top-line growth and enhanced profitability.

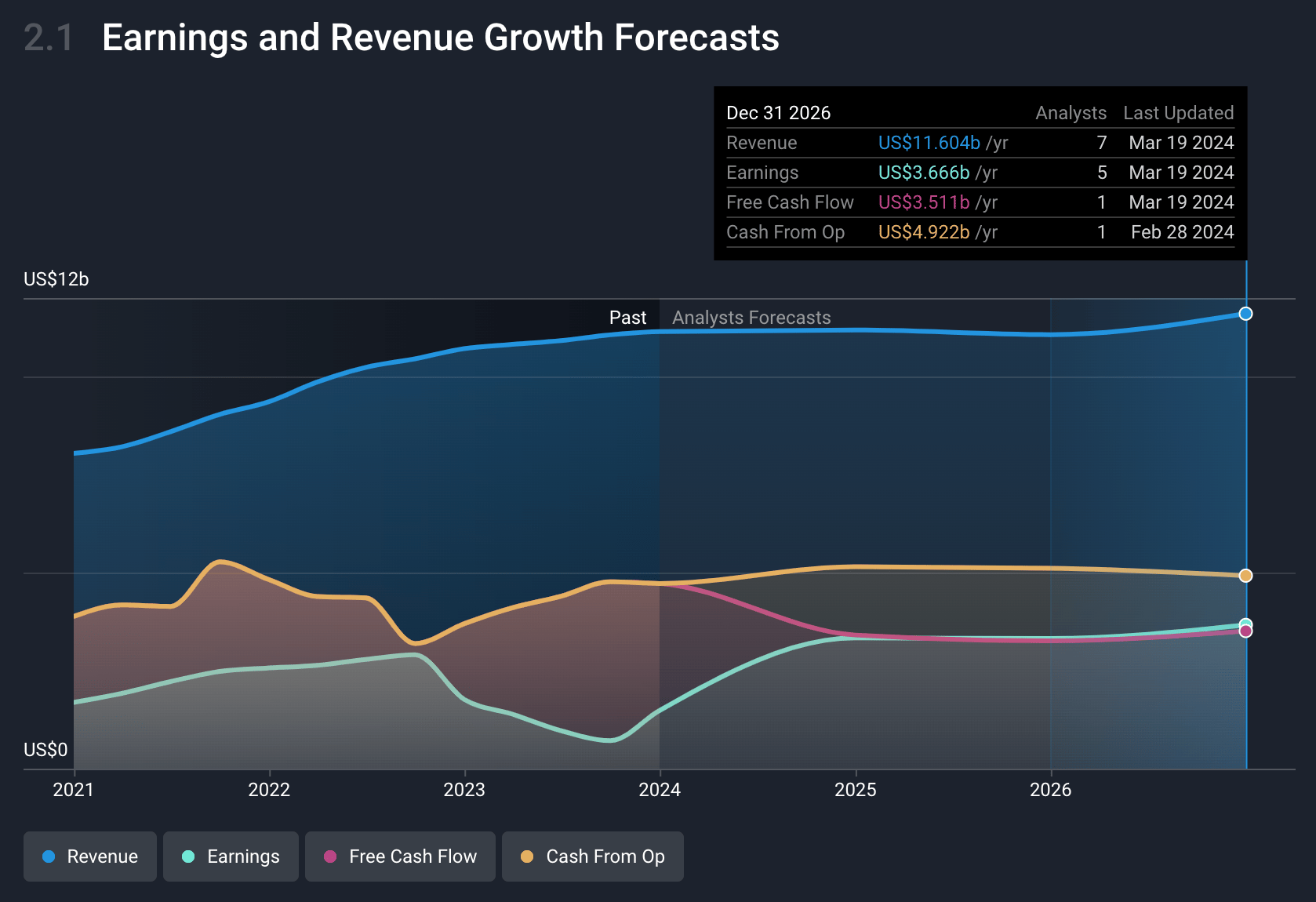

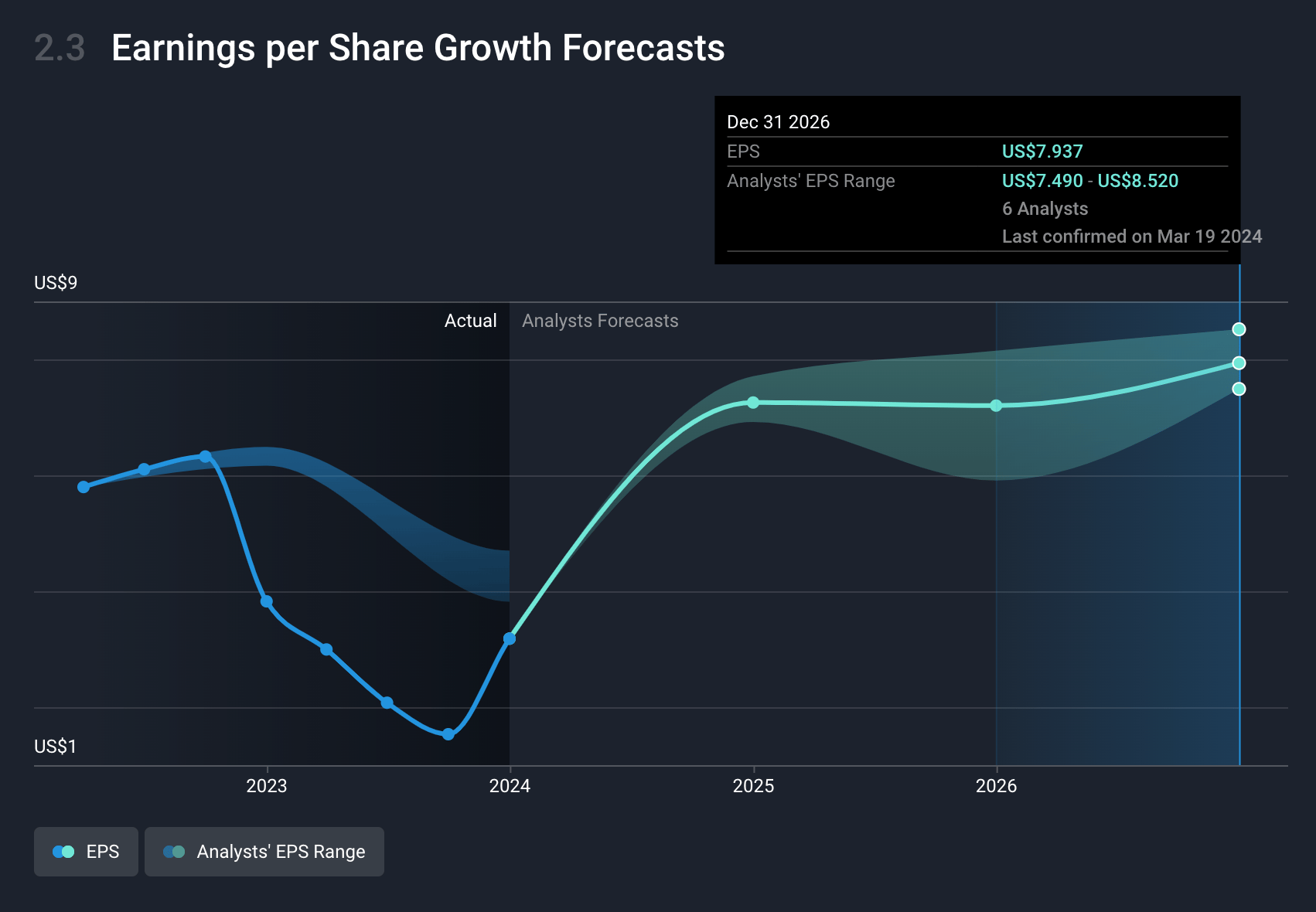

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming American Tower's revenue will grow by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.3% today to 31.3% in 3 years time.

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $7.82) by about March 2027, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.1x on those 2027 earnings, down from 61.6x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- The sale of the American Tower's India business to Brookfield might introduce risk related to the realization of expected proceeds and the impact on revenue, given India's contribution of over $1.16 billion in property revenue, which if removed, could affect overall revenue growth.

- Expected capital allocation towards developed markets and data centers might risk overlooking or underinvesting in emerging markets, which could impact long-term growth prospects, especially if emerging markets outperform expectations.

- The decision to hold the dividend relatively flat in 2024 may signal a more cautious approach to capital return to shareholders, potentially affecting shareholder return expectations and possibly the attractiveness of the stock to income-focused investors.

- Emphasis on cost-cutting and operational efficiency initiatives, including AI applications, to drive down direct cost per site may introduce risks around execution and potentially impact service quality, affecting client satisfaction and retention.

- Strategic review and potential portfolio adjustments based on market assessments may lead to divestitures or exits from less performing markets, impacting short to medium-term revenue and possibly leading to write-downs or losses associated with such adjustments.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $228.76 for American Tower based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $11.5 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of $195.91, the analyst's price target of $228.76 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.