Key Takeaways

- Oracle's strategic shift to a cloud-centric model and focus on Oracle Cloud Infrastructure for growth indicate a robust future revenue stream and market positioning.

- Expansion in cloud capacity and disciplined financial strategies, including acquisitions and stock repurchases, are set to support and potentially boost earnings per share growth.

- Expanding cloud infrastructure and transitioning offerings to SaaS poses execution risks, may strain financial resources, and challenges in innovation could affect Oracle's market position.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Oracle's shift to a cloud-centric model, with cloud services and license support making up 74% of revenue and growing, signifies a strong, future revenue stream, likely enhancing the company-s revenue profile.

- The strategic focus on Oracle Cloud Infrastructure (OCI) as a prime driver of growth, especially its recognition in the 2023 Gartner Magic Quadrant for Strategic Cloud Platform Services, highlights OCI's potential to significantly impact Oracle-s revenue growth.

- The company's unique positioning for AI workloads due to its differentiated and price-performance efficient cloud offerings suggests a competitive edge that could lead to increased market share and higher margins in the booming AI sector, positively affecting net margins.

- Expansion plans, including building out cloud capacity and launching new cloud regions, suggest a strategy to capture the overwhelming demand for cloud infrastructure, which is expected to fuel considerable revenue growth.

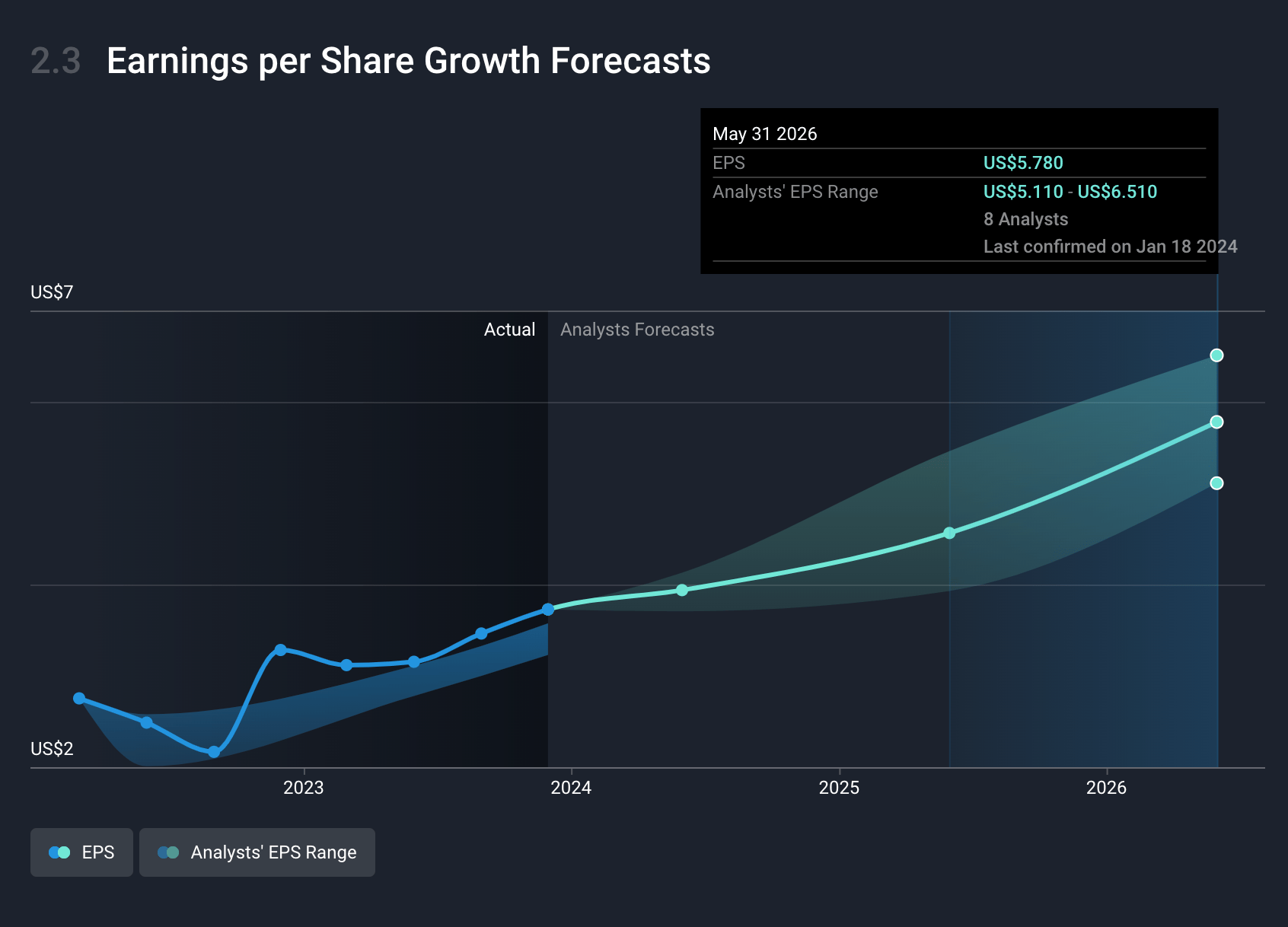

- Oracle's commitment to financial discipline through strategic acquisitions, stock repurchases, and prudent use of debt, alongside a consistent dividend payout, underscores a confidence in sustaining and potentially increasing earnings per share (EPS) growth.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Oracle's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.6% today to 23.3% in 3 years time.

- Analysts expect EPS to reach $5.71 ($15.5 billion in earnings) by about February 2027, up from $3.69 today.

Risks

What could happen that would invalidate this narrative?

- The ambitious plans to build 100 new cloud data centers could strain operational capacities and lead to execution risks, impacting future earnings due to potential delays or increased costs.

- Concentrated demand from big clients, such as the order of 20 data centers from Microsoft, might expose Oracle to client concentration risks, affecting revenue stability if these key clients reduce purchases or delays occur.

- Continuous need for high CapEx to expand cloud infrastructure may limit free cash flow availability for other growth opportunities or shareholder returns, impacting net income and potentially Oracle-s stock valuation.

- The transition of Cerner's offerings to fully SaaS-based solutions and the integration into OCI imposes risks related to product execution and market acceptance, which could affect revenue growth and margins if not managed successfully.

- Rapid technological advancements in cloud and AI domains present a challenge in keeping up with innovation and customer expectations, potentially affecting Oracle-s competitive position and its ability to maintain or increase cloud revenues.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.