Last Update 07 Nov 25

Fair value Decreased 0.15%6301: Earnings Outlook To Balance Weaker Yen With Dividend Increase And Buybacks

Analysts have revised their price target for Komatsu slightly downward from ¥5,150 to ¥5,142.5, citing updated assumptions for the company's discount rate, revenue growth, and profit margins.

What's in the News

- Komatsu raised its consolidated earnings guidance for the fiscal year ending March 31, 2026. The company attributed the increase to a weaker yen, U.S. tariffs, and the latest market outlook (Key Developments).

- The company announced a dividend increase to JPY 95 per share, up from JPY 83 per share the previous year. The record date is set for September 30, 2025, and the effective date is December 1, 2025 (Key Developments).

- From July 1 to September 30, 2025, Komatsu repurchased 7,968,200 shares, completing its buyback program at 14,962,300 shares under the initiative announced in April 2025 (Key Developments).

- Komatsu signed an MOU with Cummins and included Wabtec to jointly develop hybrid powertrains for mining equipment. The goal is to advance decarbonization and improve productivity across the industry (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: decreased slightly from ¥5,150 to ¥5,142.5.

- Discount Rate: increased modestly from 6.88% to 7.08%.

- Revenue Growth: increased from 1.83% to 2.25%.

- Net Profit Margin: rose from 10.24% to 10.28%.

- Future P/E: declined from 12.84x to 12.32x.

Key Takeaways

- Expansion into major mining projects and innovative low-emission equipment supports long-term revenue growth and strengthens position amid rising global and environmental demands.

- Stable aftermarket sales and pricing power in key markets enhance revenue resilience, recurring income, and operating margin stability despite regional and market volatility.

- Sustained demand weakness, regional headwinds, tariff risks, and high inventories threaten Komatsu's earnings growth and margins without a clear catalyst for market recovery.

Catalysts

About Komatsu- Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, Rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

- Komatsu's contract for the large-scale Reko Diq copper/gold mining project in Pakistan, with equipment deliveries beginning FY2026, provides a multi-year revenue stream tied to growing global demand for battery metals and infrastructure materials, supporting future revenue growth and order backlog.

- Komatsu's introduction of a modular, power-agnostic mining truck that can seamlessly switch to battery or hydrogen power positions it well as stricter environmental regulations accelerate customer preference for low

- and zero-emission equipment, potentially driving higher-margin sales and increasing net margins.

- Demand for mining and construction equipment outside of weak regions (Indonesia and Japan) remains solid, and an expected acceleration in global infrastructure investment and mineral demand (especially copper) is likely to drive equipment replacement cycles and support top-line growth over the next several years.

- Aftermarket sales (parts and services) are forecast to increase, excluding FX impacts, and already represent more than half of segment revenue, underpinning recurring, higher-margin income streams and reducing earnings cyclicality.

- Komatsu's ongoing ability to implement regular price increases without materially impacting sales volumes in North America and Europe demonstrates pricing power amid industry consolidation, which can help to offset cost inflation and sustain stable or improving operating margins.

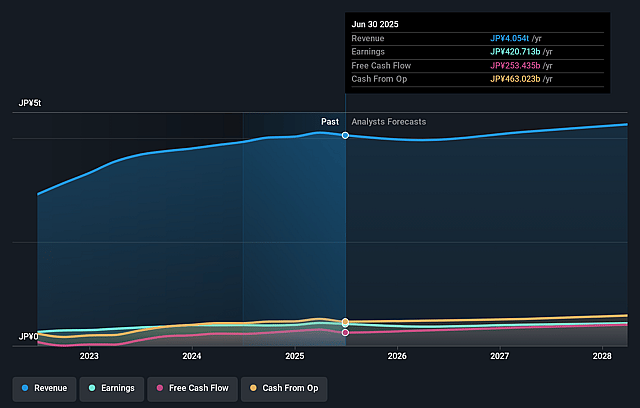

Komatsu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Komatsu's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.4% today to 10.3% in 3 years time.

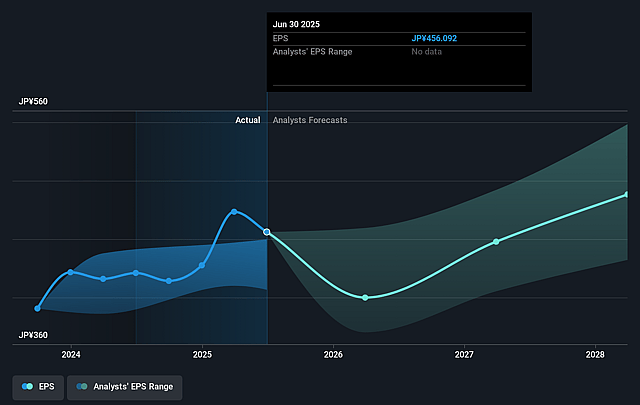

- Analysts expect earnings to reach ¥444.3 billion (and earnings per share of ¥502.62) by about September 2028, up from ¥420.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥497.5 billion in earnings, and the most bearish expecting ¥390.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 10.8x today. This future PE is lower than the current PE for the JP Machinery industry at 13.3x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

Komatsu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The combination of declining sales and profits in Komatsu's core Construction, Mining & Utility Equipment segment, as well as overall net income dropping by 16.9% year-on-year, signals underlying demand weakness and cost pressures, which, if sustained, could impair revenue and margin recovery over the long term.

- Market-specific headwinds are emerging: Japan and Indonesia show material demand weakness due to factors like sluggish rental equipment utilization, labor shortages, and falling coal prices; if these trends persist, key regional revenue streams may come under sustained pressure, weighing on overall earnings.

- Ongoing tariff volatility, especially related to steel and aluminum between the U.S., Japan, and China, risks raising compliance costs and impacting operational flexibility-long-term elevation in tariffs could compress margins and disrupt global supply chains, affecting net profitability.

- High inventory levels, particularly an increase in inventory assets and declining equipment sales in certain segments, pose a risk of inventory write-downs or reduced pricing power if demand fails to stabilize, directly threatening near

- and mid-term earnings and working capital efficiency.

- The company's guidance and management tone express heightened caution and a lack of visible tailwinds in key developed and emerging markets, suggesting that without a meaningful pick-up in global capital investment or a successful pivot to new markets, structurally slower growth could persist, limiting revenue expansion and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥5000.0 for Komatsu based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5910.0, and the most bearish reporting a price target of just ¥4200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥4297.5 billion, earnings will come to ¥444.3 billion, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of ¥4993.0, the analyst price target of ¥5000.0 is 0.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.