Last Update 10 Nov 25

Fair value Decreased 0.043%SAN: Forward Momentum Will Rely On Pipeline Success And Operational Execution

Sanofi's analyst price target saw a slight decrease to $106.85 from $106.90. Analysts cite moderating revenue growth expectations and a slightly higher discount rate impacting the updated valuation.

Analyst Commentary

Analysts reviewing Sanofi’s outlook continue to provide measured commentary and updates following the recent, modest adjustment to the price target. Their perspectives reflect careful assessment of the company’s fundamentals, valuation, and forward growth prospects.

Bullish Takeaways- Bullish analysts appreciate Sanofi's diverse and resilient product portfolio, which continues to provide stable revenue streams despite moderating growth expectations.

- Recent updates factor in potential for pipeline innovation to support long-term growth, especially within specialty care and emerging markets.

- Execution on recent cost initiatives and operational efficiencies are viewed positively. This is helping to maintain healthy margins even as revenue growth decelerates.

- Several analysts believe the current valuation adequately reflects near-term risks. This allows for attractive upside if the company exceeds earnings expectations or delivers positive trial results.

- Bearish analysts remain cautious due to the anticipated moderation in top-line growth, citing tougher year-over-year comparisons and fewer major product launches in the near term.

- Concerns persist regarding R&D productivity, with any setbacks or delays in the pipeline likely to weigh on future valuation updates.

- Market sensitivity to discount rates is creating some pressure on the valuation, particularly amid broader macroeconomic uncertainty and higher interest rate environments.

- Execution risks related to cost-saving programs and maintaining competitive advantage also contribute to a more tempered outlook by some analysts.

What's in the News

- Sanofi announced positive phase 3 results from the LIBERTY-AFRS-AIMS study, showing Dupixent significantly improves signs and symptoms of allergic fungal rhinosinusitis (AFRS) for patients aged 6 years and older. The FDA is reviewing the supplemental biologics license application (sBLA) for this indication, and approval would mark Dupixent’s ninth FDA-approved use. (Key Developments)

- Quebec added Rezurock (belumosudil) to the list of publicly reimbursed medications for adults and children aged 12 and up with chronic graft-versus-host disease (GVHD), following Health Canada approval and further support from Canadian and Quebec drug agencies. (Key Developments)

- Sanofi completed its share buyback program, repurchasing nearly 3.94% of shares for €4.3 billion as part of the plan announced earlier in the year. (Key Developments)

- The company affirmed its 2025 earnings guidance, expecting high single-digit percentage sales growth and low double-digit percentage business EPS growth at constant exchange rates. (Key Developments)

- Sanofi expanded its partnership with Medidata Solutions to enhance innovation, unify clinical trial processes, and increase the use of AI-driven, decentralized clinical trials in global research. (Key Developments)

Valuation Changes

- The consensus analyst price target edged down marginally to $106.85 from $106.90.

- The discount rate has risen slightly to 6.18% from 5.98%.

- Revenue growth projections have decreased to 4.09% from 4.27%.

- The net profit margin remains nearly stable, dipping slightly to 19.74% from 19.77%.

- The future P/E ratio has increased modestly to 14.0x from 13.83x.

Key Takeaways

- Continued investment in innovative products, strategic acquisitions, and portfolio streamlining is positioning Sanofi for long-term growth in high-value therapeutic areas.

- Leadership in biologics and vaccines, alongside regulatory opportunities, supports revenue stability and operating efficiency amid evolving market dynamics.

- Prolonged pricing pressures, R&D setbacks, and rising costs from acquisitions and regulations threaten Sanofi's margins and future growth amid increasing post-patent competition.

Catalysts

About Sanofi- A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, and internationally.

- Sanofi's ongoing focus on innovative product launches and its strong R&D pipeline-highlighted by accelerating investments, multiple Phase III readouts through 2026, and continued expansion of biologics (e.g., Dupixent, amlitelimab)-position the company to capture higher demand for chronic disease treatments in a world with an aging population, supporting robust long-term sales growth and EPS upside. (Revenue, EPS)

- Strategic expansion into rare disease and immunology through targeted acquisitions (e.g., Blueprint Medicines with Ayvakit, Vigil Neuroscience, Vicebio) will expand Sanofi's presence in high-growth, premium-priced therapeutic areas, broadening its addressable patient base as global healthcare access increases, and driving net margin and revenue improvement over time. (Revenue, Net Margins)

- Dupixent's continued growth across multiple indications-including recent launches in COPD, CSU, and bullous pemphigoid-along with significant potential for geographic and indication expansion (notably in underpenetrated markets such as China), underpins a credible pathway to €22 billion in 2030 sales, supporting sustained top-line growth and improved operating leverage. (Revenue, Net Margins)

- Portfolio streamlining-such as the sale of Opella and Consumer Healthcare separation-combined with redeployment of capital into higher growth pharmaceuticals and vaccines, is driving greater operating efficiency, improved product mix, and tighter SG&A/G&A control, all likely to further support net margin and BOI (business operating income) expansion. (Net Margins, BOI)

- Sanofi's leadership in vaccines, development of combination and next-generation products (e.g., Beyfortus, flu/RSV combinations), and active pursuit of regulatory incentives (orphan/fast-track designations) position the company to capitalize on secular trends of rising non-communicable disease prevalence and industry shifts toward biologics, supporting baseline revenue resilience despite periodic pricing pressures in established markets. (Revenue)

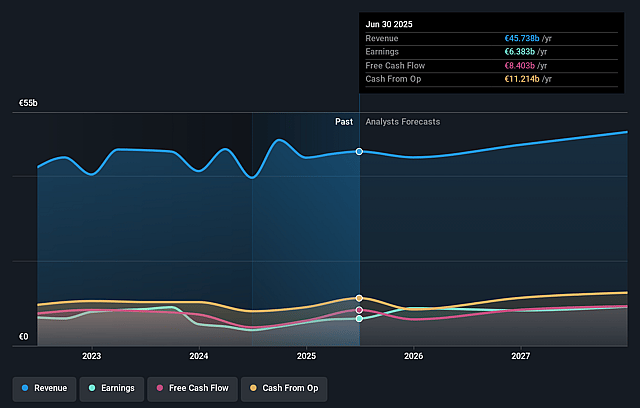

Sanofi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sanofi's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 18.5% in 3 years time.

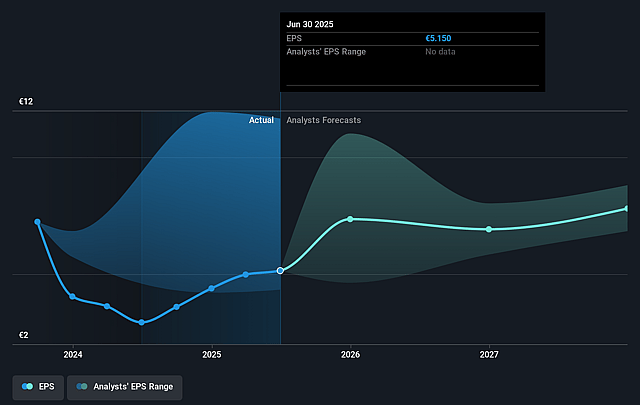

- Analysts expect earnings to reach €9.6 billion (and earnings per share of €8.23) by about September 2028, up from €6.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €8.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, down from 16.5x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Sanofi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened pressure from competitive pricing, particularly in flu vaccines (expected mid-teens decline in 2025 sales from price competition in the U.S. and Germany), poses a structural risk to Sanofi's long-term vaccine franchise and could compress net margins as pricing headwinds persist beyond this year.

- Pipeline execution remains a key uncertainty: management and investors directly acknowledged that Sanofi's R&D transformation will take several years to play out, and that some high-profile late-stage assets have produced "mixed" results or outright Phase III failures (e.g., itepekimab in COPD), increasing the risk of slower revenue and earnings growth if pipeline assets don't materialize as expected.

- Sanofi's heavy investment in new launches and recent acquisitions (e.g., Blueprint, Vigil Neuroscience, Vicebio), while offering promising long-term growth avenues, has resulted in higher SG&A and R&D expenses; failure to generate expected returns from these investments or delayed integration could limit operating leverage and compress net margins in the coming years.

- The expiration of patent protection for key blockbuster drugs like Dupixent (U.S. 2031, EU 2033) and increasing biosimilar/generic competition industry-wide mean Sanofi faces the risk of accelerating revenue erosion post-exclusivity, particularly as payers, governments, and insurers globally push harder for drug price reductions and transparency.

- Intensified regulatory and geopolitical uncertainty-such as potential U.S. tariffs on EU pharmaceuticals, drug pricing reforms in both the U.S. and Europe, and lengthening approval timelines amid higher regulatory scrutiny-could drive higher operating costs, strain international sales, and directly impair net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €109.218 for Sanofi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €124.8, and the most bearish reporting a price target of just €92.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €51.8 billion, earnings will come to €9.6 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.0%.

- Given the current share price of €86.12, the analyst price target of €109.22 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.