Key Takeaways

- BD's 2025 strategy focuses on innovation in high-growth areas like connected care and chronic disease management, aiming for durable revenue growth and improved product mix.

- Strategic initiatives, including the PureWick and BD MiniDraw systems and the reintroduction of the Alaris system, position BD for market expansion and strong revenue growth.

- Reliance on specific markets and new product ramp-ups, operational and competitive challenges, along with regulatory hurdles, could negatively impact revenues and margins.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Continued execution of BD's 2025 strategy, including advancing the innovation pipeline in high-growth areas like connected care, new care settings, and chronic disease management, is expected to support durable revenue growth beyond the 5.5% target. This can positively impact revenue and net margins by expanding the market and improving the product mix.

- Progress in the R&D milestones, particularly in the PureWick portfolio and the BD MiniDraw capillary blood collection system, positions BD as a key player in shifting care settings and expanding market reach. This is likely to drive revenue growth as these innovations cater to growing markets with double-digit growth expectations.

- The reintroduction of the Alaris system following 510(k) clearance and the anticipated $200 million revenue as the floor for fiscal '24 from this product alone suggests a positive impact on revenue and earnings. This also indicates strong customer engagement and demand for BD's infusion solutions.

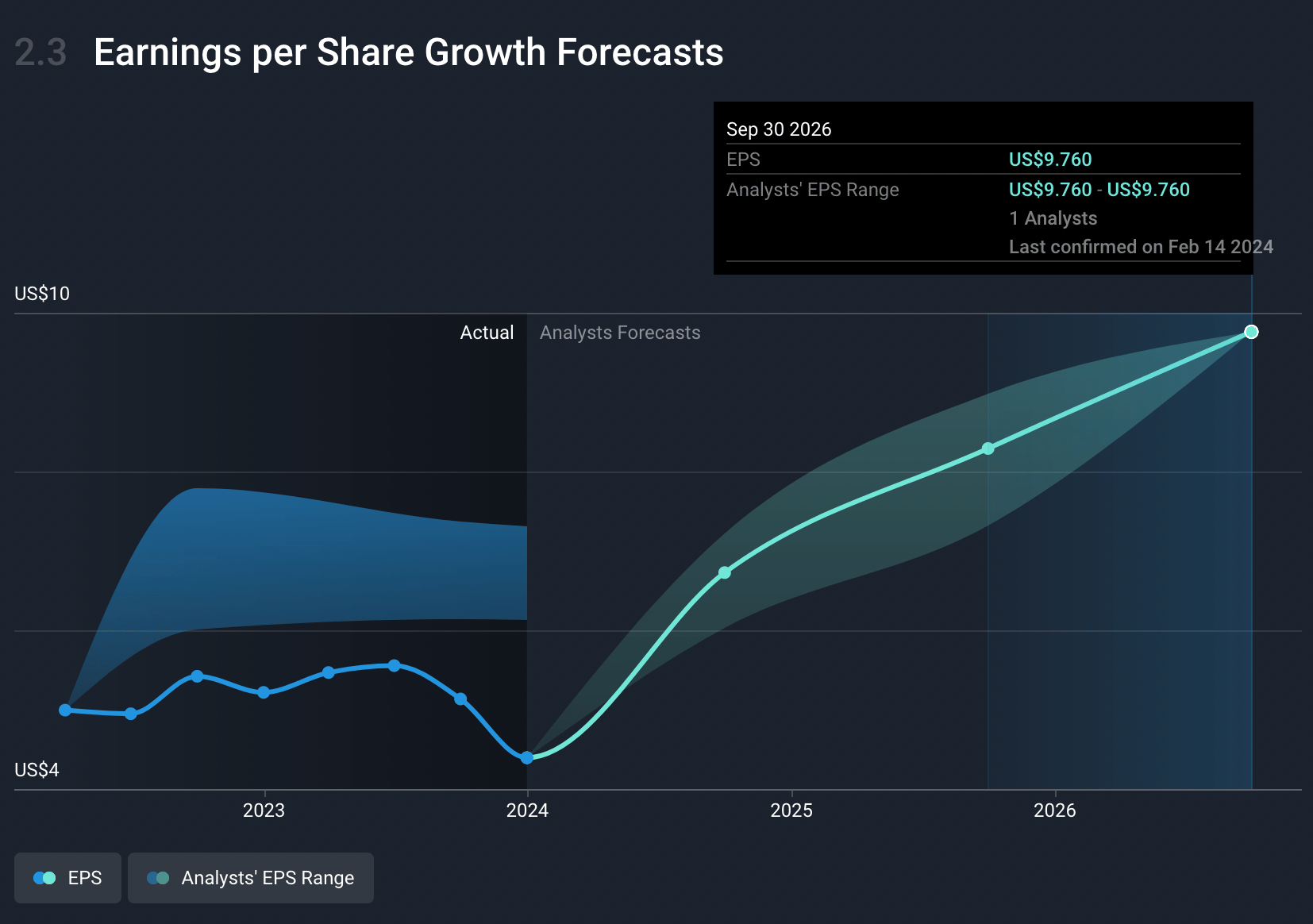

- The execution of Project Recode and the BD Excellence operating system, aimed at driving operating efficiencies and margin expansion, support the expectation of a double-digit base EPS CAGR through FY '25. These operational efficiencies are expected to positively impact net margins by reducing costs and improving productivity.

- Strong execution on cash flow generation, with over $850 million in operating cash flows in Q1, positions BD well for double-digit growth in free cash flows in FY '24. This financial health allows for strategic M&A activities in higher growth categories and might provide additional upside to revenue and earnings growth.

Assumptions

How have these above catalysts been quantified?

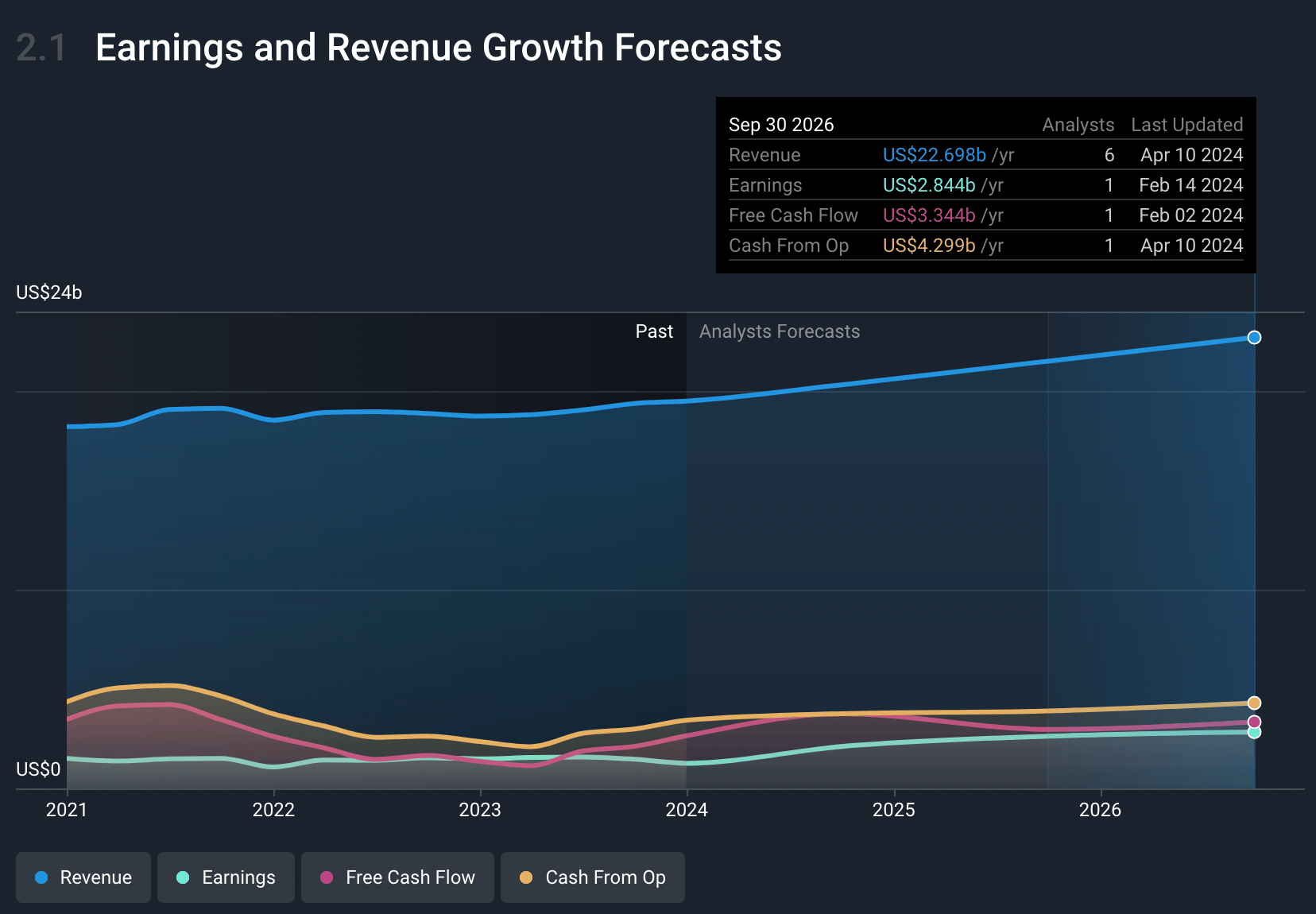

- Analysts are assuming Becton Dickinson's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 12.8% in 3 years time.

- Analysts expect earnings to reach $2.9 billion (and earnings per share of $10.0) by about April 2027, up from $1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.3x on those 2027 earnings, down from 55.2x today. This future PE is lower than the current PE for the US Medical Equipment industry at 40.2x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The reliance on specific markets like China and potential adverse impacts from policies like value-based procurement could negatively affect revenues.

- Execution risk in ramping up new products like the BD Nexis infusion system and converting lines for Biologics could impact the expected revenue growth.

- Operational challenges and the effectiveness of cash flow management strategies might not yield the anticipated improvements in free cash flows, possibly affecting the company's ability to invest in growth opportunities or return capital to shareholders.

- Competition and rapid innovation in high-growth areas, such as molecular diagnostics and pharmacy automation, could impact BD's market share and margins.

- Regulatory hurdles and delays in receiving approvals for new products or expansions, such as the 510(k) clearance challenges for the Alaris system, could slow down revenue growth and margin improvement.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $281.86 for Becton Dickinson based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $22.8 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 32.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $241.72, the analyst's price target of $281.86 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.