Last Update 09 Dec 25

EXLS: AI Data Suite And Fraud Platform Will Drive 2025 Momentum

Analysts have modestly raised their price target on ExlService Holdings to 52.29 dollars from 52.29 dollars. This reflects slightly lower discount rate assumptions and a largely unchanged outlook for revenue growth, profit margins, and future valuation multiples.

What's in the News

- ExlService and Shift Technology will co build a national data analytics platform to combat insurance fraud in Australia, enabling secure sharing of fraud patterns and real time alerts for motor claims investigators (Strategic Alliances)

- The company completed a major buyback tranche, repurchasing 9,801,936 shares, or about 6.01% of outstanding shares, for a total of 385.39 million dollars under its February 2024 authorization (Buyback Tranche Update)

- Management raised full year 2025 revenue guidance to 2.07 billion to 2.08 billion dollars, implying roughly 13% growth versus 2024 on both reported and constant currency bases (Corporate Guidance, Raised)

- EXL launched EXLdata.ai, an agentic AI data suite built with Databricks to make enterprise data AI ready, unifying modernization, governance, and unstructured data management across the data lifecycle (Product Related Announcements)

- New and renewed client partnerships, including Schneider National, Whitbread, and InsureMO, highlight growing demand for EXL's AI driven workflow optimization and insurance modernization capabilities (Client Announcements)

Valuation Changes

- Fair Value Estimate is unchanged at 52.29 dollars per share, indicating a stable intrinsic valuation outlook.

- The Discount Rate has fallen slightly from about 7.28 percent to about 7.25 percent, reflecting a modestly lower perceived risk profile.

- Revenue Growth is effectively unchanged at about 11.15 percent, signaling a steady medium term top line growth expectation.

- The Net Profit Margin is stable at about 11.95 percent, implying no material revision to long term profitability assumptions.

- The Future P/E has edged down slightly from about 28.72 times to about 28.70 times, suggesting minimal change in expected market valuation multiples.

Key Takeaways

- Accelerated AI adoption and expansion into new sectors are diversifying revenue streams and supporting stable, long-term growth for ExlService.

- Deep domain expertise and focus on proprietary data platforms strengthen competitive advantages, boosting higher-margin service offerings and protecting net margins.

- Rapid advances in AI, increasing regulation, rising talent costs, sector concentration, and intense competition threaten ExlService's margins, growth, and long-term revenue stability.

Catalysts

About ExlService Holdings- Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

- The accelerated global adoption of AI and digital transformation in regulated industries is expanding the addressable market for ExlService, driving strong double-digit pipeline and growing annuity-like revenues; this trend supports sustained revenue growth and improved earnings visibility.

- Increasing reliance by clients on advanced data and AI-driven solutions for operational efficiency positions ExlService to generate higher-margin services, benefiting both revenue mix and long-term margin expansion as traditional usage-based contracts transition to outcome-based commercial models.

- ExlService's deep domain expertise and proprietary data platforms enable rapid development of differentiated AI solutions, creating high barriers to entry and competitive advantages that should support revenue growth and protect net margins as competition in the sector intensifies.

- Expansion into new high-growth verticals, including healthcare and international markets, is diversifying revenue streams, reducing cyclicality, and supporting long-term earnings stability and growth.

- Strategic investments in AI and ongoing shift of revenue mix toward data and analytics are driving revenue per employee growth, offering scalability and operating leverage that can further enhance net margin over time.

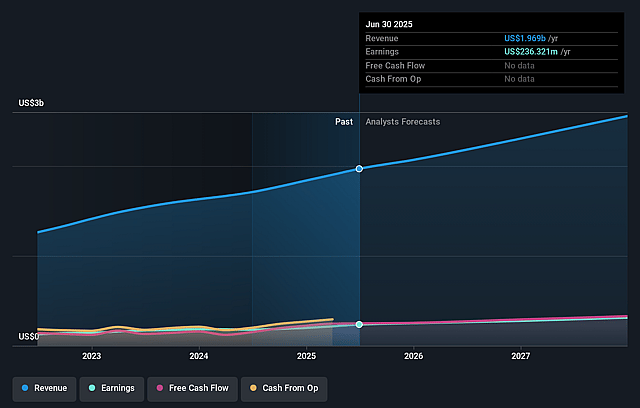

ExlService Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ExlService Holdings's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.0% today to 12.2% in 3 years time.

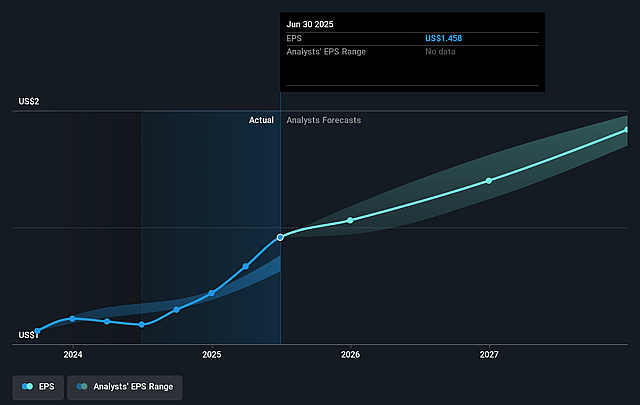

- Analysts expect earnings to reach $326.3 million (and earnings per share of $1.92) by about September 2028, up from $236.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.2x on those 2028 earnings, up from 30.2x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

ExlService Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating advances in artificial intelligence and automation could reduce the demand for outsourced business process services over the long term, even as ExlService pivots to higher-value AI offerings; this secular trend presents ongoing revenue risk if clients increasingly adopt in-house or cloud-based automation solutions instead of third-party providers.

- Heightened global data privacy and security regulations (such as GDPR, CCPA, and new initiatives) are increasing compliance complexity and costs, particularly as ExlService expands internationally and handles sensitive data in regulated sectors like healthcare and insurance; over time, this can pressure net margins and limit the company's ability to scale cross-border operations profitably.

- Rising wage inflation and talent shortages in traditional outsourcing hubs (such as India and the Philippines) are driving up employee costs significantly (as reflected in 16%-17% cost increases vs. 9% headcount growth); this long-term industry trend threatens to compress operating margins and earnings as ExlService continues to expand AI and data-driven services that require highly skilled, expensive talent.

- Intense competition from both large global IT services firms and new AI-centric entrants is increasing the risk of pricing pressure and fast-following technology replication, potentially diminishing ExlService's moat built on proprietary data and platforms; this risk could lead to net margin compression and increased client turnover as barriers to entry are lowered in the AI-enabled BPO space.

- Continued heavy reliance on a concentrated set of verticals-especially insurance and healthcare-subjects ExlService to sector-specific regulatory shifts, reimbursement changes (such as healthcare program cuts), and cyclical downturns, all of which amplify long-term revenue and earnings volatility despite attempts at diversification.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.143 for ExlService Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $326.3 million, and it would be trading on a PE ratio of 33.2x, assuming you use a discount rate of 7.1%.

- Given the current share price of $44.12, the analyst price target of $54.14 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ExlService Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.