Key Takeaways

- Increasing focus on AI and innovative technologies like GenAI may raise R&D costs, impacting net margins and earnings.

- Aggressive market penetration efforts with new technologies may increase sales and marketing expenses without assured short to medium-term revenue growth.

- Intuit's strategy centered on AI and diversification, including GenAI and expanding international markets, aims to boost customer engagement, retention, and revenue growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The expansion of Intuit's AI-driven expert platform strategy, particularly through Intuit Assist powered by GenAI, indicates potential for increased customer engagement and monetization, positively impacting revenue and margins.

- Strong growth in Small Business and Self-Employed Group revenue, driven by innovative offerings such as AI-driven audience segmentation and marketing automation in Mailchimp, points towards growing market capture and customer value, enhancing revenue and profit margins.

- The diversification of Intuit's product offerings, including advances in digital expert systems in QuickBooks for business insights, may increase customer retention and acquisition, thereby contributing to revenue growth.

- Investment in the development and integration of GenAI across Intuit's platform, including products like TurboTax and Credit Karma, suggests an improved product offering that could attract new customers and retain existing ones, benefiting overall earnings.

- Focused efforts on expanding into international markets and deepening penetration in mid-market segments, with products like QuickBooks Advanced, indicate potential for broader market reach and higher average revenue per customer, positively influencing Intuit's revenue and margins.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Intuit's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.5% today to 21.0% in 3 years time.

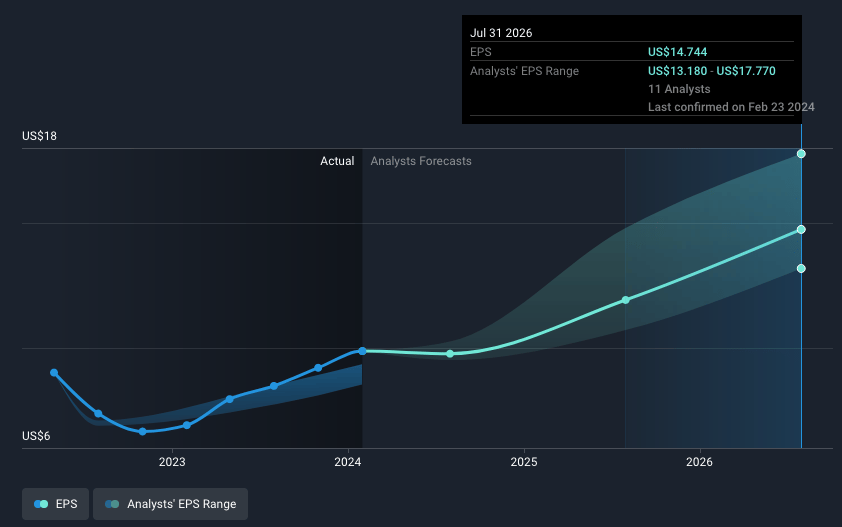

- Analysts expect EPS to reach $15.68 ($4.4 billion in earnings) by about February 2027, up from $9.23 today.

Risks

What could happen that would invalidate this narrative?

- The strong focus on AI-driven offerings and increasing reliance on innovative technologies such as GenAI may lead to higher research and development costs, potentially impacting net margins and earnings.

- Credit Karma's revenue decline of 5% in the current macroeconomic environment could signal vulnerability in segments of Intuit's business model, potentially affecting overall revenue growth projections.

- The substantial investments in data and AI, while potentially beneficial long-term, might not yield immediate financial results, possibly affecting short-term revenue and earnings growth expectations.

- The pivot towards an AI-driven expert platform strategy underscores a significant transformation in the company's operational focus which may involve execution risks and initial profitability pressures, likely impacting net margins.

- The aggressive pursuit of penetrating a $300 billion total addressable market (TAM) with new technologies might result in increased sales and marketing expenses without guaranteed proportional revenue growth in the short to medium term.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.