Key Takeaways

- Expansion of 4G and financial services in Africa is key to increasing Vodacom's revenue and diversifying its revenue streams.

- Investments in 5G and climate initiatives enhance market opportunities and could attract ESG-focused investors, improving sustainability.

- Currency devaluations, competition issues, and high taxes are constraining Vodacom's profitability and growth across multiple markets.

Catalysts

About Vodacom Group- Operates as a connectivity, digital, and financial services company in South Africa, Egypt, and internationally.

- Vodacom is focused on expanding digital and financial inclusion in Africa, particularly by increasing 4G access in low-income areas and launching new rural sites. This should boost future revenue through increased customer base and data usage.

- Significant growth in Vodacom's financial services through mobile platforms is anticipated, which should aid in diversifying revenue streams and potentially increasing net margins due to the low capital intensity of financial services.

- Vodacom's strategic focus on digital skills development and initiatives like Code like a Girl could stimulate future earnings by addressing skill shortages and fostering economic growth in their markets.

- Investments in 5G technology, particularly in Egypt, are expected to enhance network optimization and expand revenue opportunities through fixed wireless services, potentially leading to significant increases in revenue and market share.

- The emphasis on climate initiatives and renewable energy solutions might attract ESG-focused investors and partners, which could improve net margins and long-term sustainability of earnings.

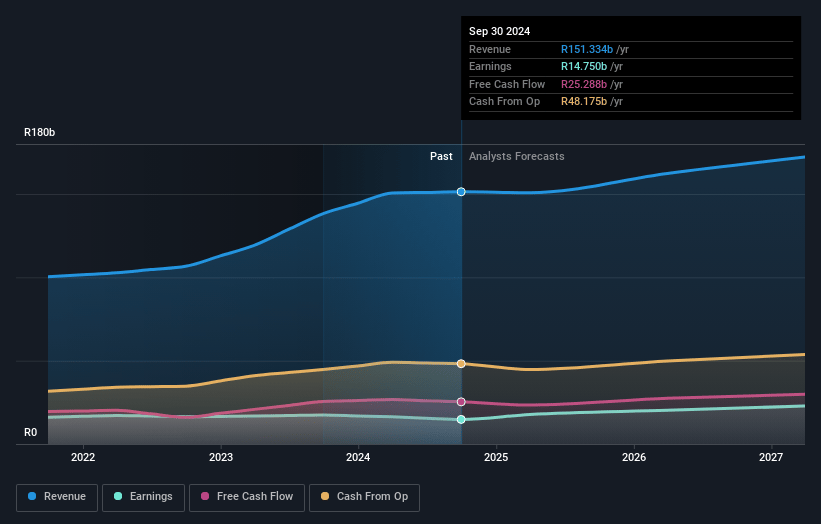

Vodacom Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vodacom Group's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.7% today to 14.7% in 3 years time.

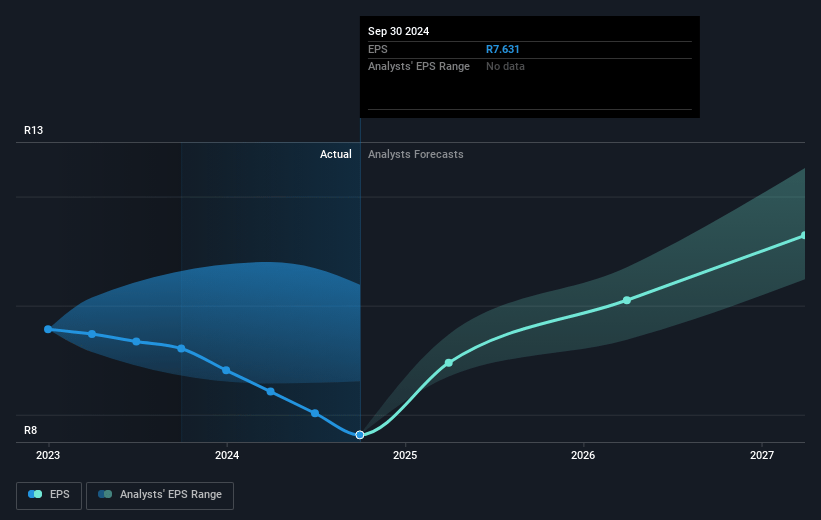

- Analysts expect earnings to reach ZAR 27.3 billion (and earnings per share of ZAR 11.47) by about May 2028, up from ZAR 14.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ZAR21.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 18.0x today. This future PE is lower than the current PE for the ZA Wireless Telecom industry at 17.9x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.42%, as per the Simply Wall St company report.

Vodacom Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vodacom's earnings are negatively impacted by currency devaluations in Egypt and Ethiopia, which have a material impact on reported results and earnings, potentially affecting net margins and overall profitability.

- The competition tribunal's prohibition of the fiber deal (CIVH transaction) in South Africa could hinder Vodacom's strategic expansion plans, impacting revenue and possibly leading to inefficiencies in market positioning.

- The international business segment is facing challenges with foreign exchange pressures, high inflation, and one-off costs in markets like the DRC and Mozambique, which have resulted in disappointing EBITDA performance and could impact Vodacom's ability to maintain healthy net margins.

- The decline in prepaid revenue growth in South Africa, potentially due to strong competition and price sensitivity, poses a risk to top-line growth and suggests challenges in sustaining revenue and profit from this market segment.

- The effective tax rate remains high at 38%, with factors such as withholding taxes on dividends from Egypt and Safaricom, affecting net income and potentially limiting earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR126.909 for Vodacom Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR180.0, and the most bearish reporting a price target of just ZAR110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR185.3 billion, earnings will come to ZAR27.3 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 16.4%.

- Given the current share price of ZAR136.95, the analyst price target of ZAR126.91 is 7.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.