Key Takeaways

- Acquisitions and aggressive expansion plans could drive revenue growth through improved market presence and increased penetration across new territories and cellular formats.

- Enhanced financial services and improved logistics are likely to boost net margins and operating income through increased earnings and reduced operational costs.

- Supply chain disruptions, underperformance in segments, reliance on financial services, and currency risks could impact revenue, margins, cash flow, and earnings stability.

Catalysts

About Pepkor Holdings- Operates as a retailer focusing on discount, value, and specialized goods in Angola, Botswana, Brazil, Eewatini, Lesotho, Mozambique, Malawi, Namibia, South Africa, and Zambia.

- The introduction of new acquisitions such as Choice Clothing and OK Furniture is expected to drive revenue growth and improve market presence in new territories. This could result in higher revenues and improved operating margins due to synergies and cross-selling opportunities.

- Expansion in Brazil and an aggressive store opening plan across different brands, including a focus on cellular formats, suggests potential revenue growth from increased market penetration and footprint expansion.

- Enhanced FinTech and financial services contributions, particularly through innovations like the FoneYam handset rental product, are expected to substantially increase earnings and operating profits, improving net margins due to higher product and service uptake.

- The strategic focus on increasing insurance capabilities, backed by an existing extensive distribution and collection network, is anticipated to create a sizable insurance business, boosting net margins and operating income through embedded financial service products.

- Continued cost control measures, along with operational efficiencies achieved from integrating and upgrading logistics and distribution networks (such as the opening of a second distribution center in Brazil), may improve net margins by reducing operational costs over time.

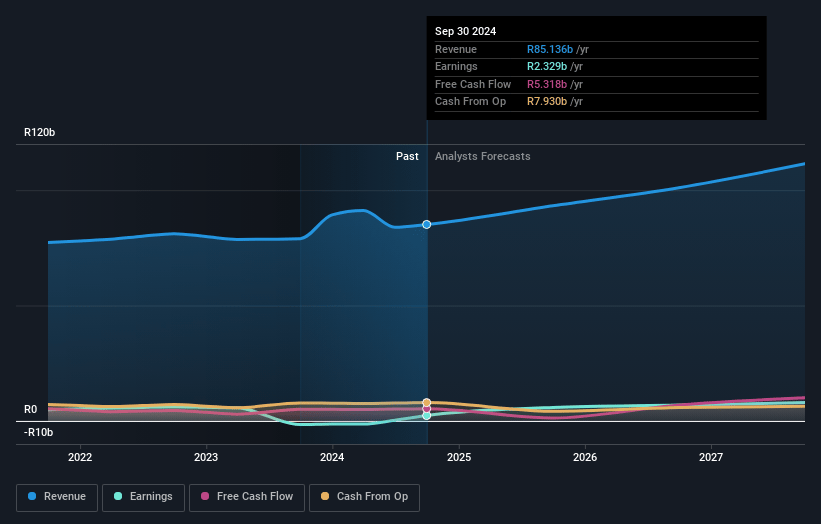

Pepkor Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pepkor Holdings's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 7.0% in 3 years time.

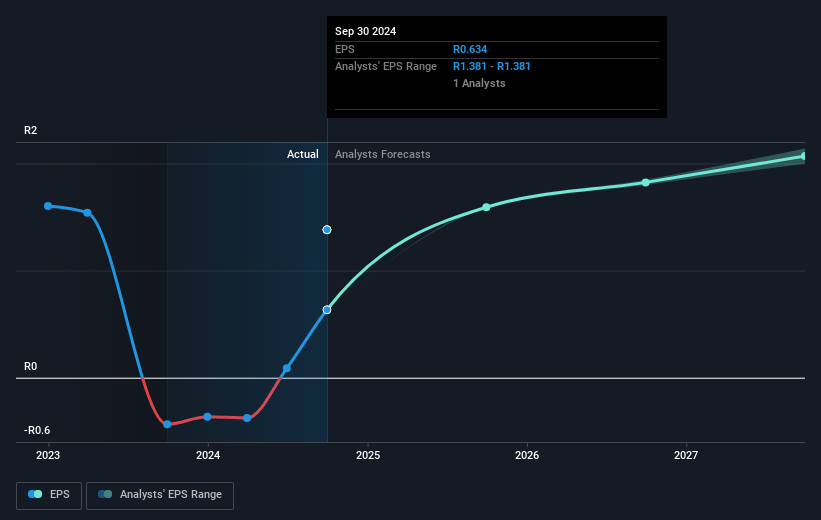

- Analysts expect earnings to reach ZAR 7.9 billion (and earnings per share of ZAR 2.07) by about April 2028, up from ZAR 2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, down from 41.6x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 7.8x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.71%, as per the Simply Wall St company report.

Pepkor Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There are supply chain challenges, notably port disruptions and lack of container availability, impacting store openings and product availability. This could affect revenue growth if it continues.

- There were instances of underperformance in certain business segments, such as Tekkie Town due to high market competition and discounts, and issues with the new store maturity curve in Brazil. These could suppress net margins and profits if not resolved.

- The reliance on financial service growth through products like FoneYam and A+ card may mean the core retail business isn't growing as robustly, potentially affecting long-term earnings stability.

- Increased investment in inventory might strain cash flow if sales don't meet expectations, evidenced by the increased inventory levels in response to supply chain issues, which can impact cash conversion rates.

- Currency fluctuations, particularly affecting PEP Africa operations, could impact revenue when converted to rand, adding a foreign exchange risk to financial results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR29.904 for Pepkor Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR113.3 billion, earnings will come to ZAR7.9 billion, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 19.7%.

- Given the current share price of ZAR26.3, the analyst price target of ZAR29.9 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.