Key Takeaways

- Strategic diversification and acquisitions, like the Tata brand and Toyota dealership, aim to boost international market share and revenue growth.

- Disposing of underperforming segments and investing in high-margin areas focuses on optimizing net margins and return on investment.

- New entrants and exchange rate fluctuations threaten Motus Holdings' market share, margins, and profitability amidst rising costs and a challenging economic environment.

Catalysts

About Motus Holdings- Provides automotive mobility solutions in South Africa, the United Kingdom, Australia, and Asia.

- The introduction of Tata as a new brand for Motus is expected to boost their entry-level and small SUV market in South Africa, leveraging Tata's strong position in India. This could positively impact revenue and market share in the automotive segment.

- Motus's initiative to diversify international operations, with 35% of the business now international, coupled with strategic acquisitions like the Toyota dealership in Australia, is aimed at driving international revenue growth.

- The launch and operationalization of the FAI Pro private label in the UK, with significant market acceptance and dedicated warehouse capacity, is anticipated to contribute positively to earnings by expanding the company's footprint in high-margin aftermarket parts.

- The strategic disposal of less dominant business segments, like the Mercedes Truck dealership in the UK, and reinvestment of proceeds into high-performing areas, is likely to optimize the business portfolio and improve net margins and return on investment.

- Continued investment in Mobility Solutions, including partnerships like the VAF alliance with ABSA for annuity income streams, and leveraging digital channels for new product innovations, is expected to enhance Motus's earnings potential and reduce the volatility linked to vehicle sales.

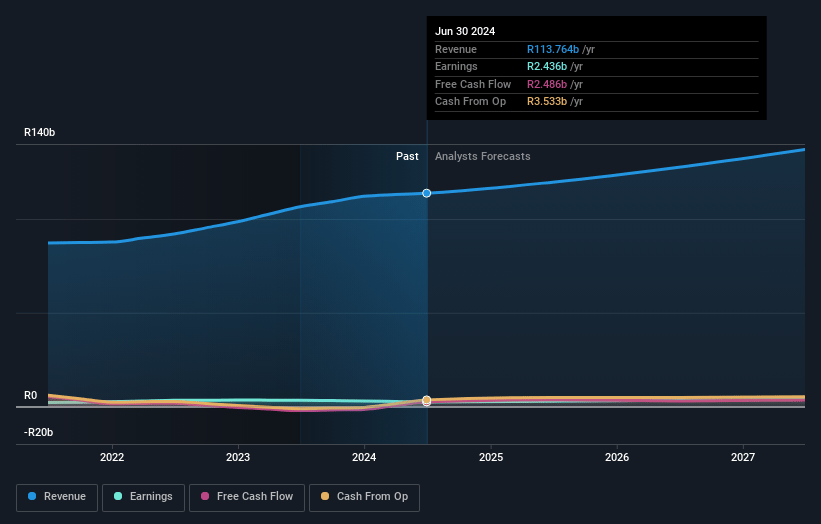

Motus Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Motus Holdings's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 2.6% in 3 years time.

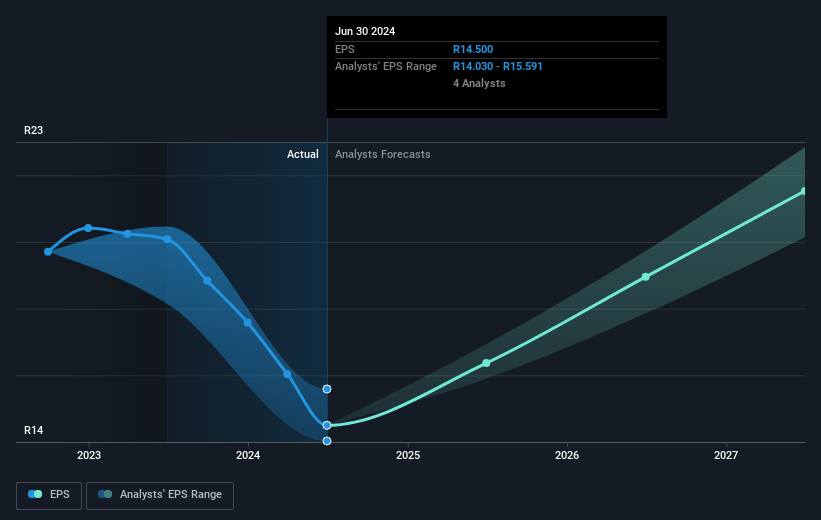

- Analysts expect earnings to reach ZAR 3.5 billion (and earnings per share of ZAR 20.04) by about May 2028, up from ZAR 2.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ZAR4.1 billion in earnings, and the most bearish expecting ZAR2.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from 6.4x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 8.0x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 26.44%, as per the Simply Wall St company report.

Motus Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive pressure from new Chinese and Indian brands entering the South African market could erode Motus Holdings' market share and compress margins, impacting revenue and profits.

- The volatility in foreign exchange rates presents a significant risk, especially given Motus Holdings' exposure to imported products, potentially affecting operating profits due to unfavorable currency movements.

- The softer economic environment and weaker consumer confidence in key markets like the UK could reduce vehicle sales and dampen revenue and profit growth.

- Rising costs for parts and vehicles have not been fully passed on to consumers, leading to margin compression and potentially lower operating profits.

- Increased market competition, particularly aggressive pricing strategies in the retail sector, could pressure sales volumes and margins, affecting overall profitability and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR123.206 for Motus Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR170.03, and the most bearish reporting a price target of just ZAR95.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR137.0 billion, earnings will come to ZAR3.5 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 26.4%.

- Given the current share price of ZAR88.09, the analyst price target of ZAR123.21 is 28.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.