Key Takeaways

- Strategic international expansion and investments in new sectors enhance revenue potential and future earnings growth.

- Diversification and ESG initiatives improve margins and operational efficiency, while cost management boosts profitability and return on equity.

- Significant headwinds in agriculture and chemicals, along with climate effects and tax issues, may impact Omnia's revenue, margins, and cash flows negatively.

Catalysts

About Omnia Holdings- Researches, develops, manufactures, and supplies chemicals, specialised services, and solutions for the agriculture, mining, and chemical application industries in South Africa, rest of Africa, and internationally.

- Omnia's investment in infrastructure projects, such as additional storage tanks and road/rail transport, is designed to ensure supply chain reliability, enhancing the company's ability to meet customer demands without disruption. This improves the company's revenue potential by securing customer contracts and loyalty through dependable service.

- The strategic focus on international expansion, with robust contract wins in regions like Indonesia, Canada, and Australia, positions Omnia for significant revenue growth. New investments, such as detonator plants and expansion in the AgriBio sector, are expected to drive future earnings as these operations ramp up.

- Omnia’s emphasis on diversifying its portfolio, particularly the growth of its mining segment, is expected to boost operating margins. With mining operations providing higher-margin services compared to traditional agriculture, this shift aligns with market demand for critical minerals and enhances profitability.

- Significant ongoing investments in environmental, social, and governance (ESG) initiatives, including solar capacity expansion and water recycling efforts, not only improve operational efficiency but are also likely to enhance net margins by reducing resource costs and potentially attracting ESG-focused investors.

- The rigorous cost management and capital allocation strategy, including restructuring efforts in underperforming segments like the Chemicals division, are expected to improve overall return on equity by reallocating resources to higher-margin, growth-oriented sectors, ultimately boosting long-term earnings.

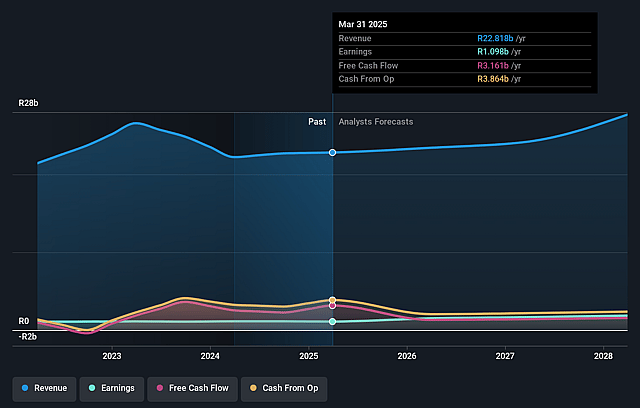

Omnia Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Omnia Holdings's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 6.7% in 3 years time.

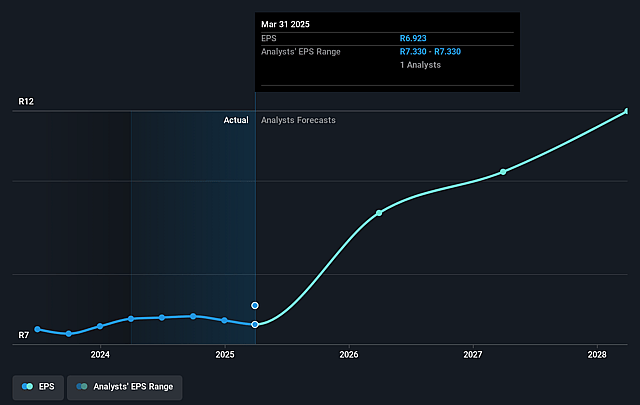

- Analysts expect earnings to reach ZAR 1.9 billion (and earnings per share of ZAR 11.49) by about September 2028, up from ZAR 1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the ZA Chemicals industry at 11.2x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.03%, as per the Simply Wall St company report.

Omnia Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant headwinds faced by the agriculture sector in Southern Africa due to drought, currency fluctuations, and regulatory issues could negatively impact the revenue and profitability in that region.

- The Chemicals segment continues to face challenges from the macro environment and subdued manufacturing demand, resulting in restructuring costs and an operating loss which may drag net margins down further.

- Exposure to unpredictable climate change effects, such as the severe drought in Brazil, can lead to fluctuations in selling prices and earnings for Agri international operations.

- The need for continued investment in supply chain infrastructure, such as rail wagons and storage tanks, suggests significant capital expenditure that could potentially strain cash flows.

- The increase in effective tax rate due to provisions, like the Zimra matter, and potential for further disputes could impact net earnings and return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR93.3 for Omnia Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR27.7 billion, earnings will come to ZAR1.9 billion, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 18.0%.

- Given the current share price of ZAR72.27, the analyst price target of ZAR93.3 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Omnia Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.