Last Update 10 Dec 25

2395: New Edge AI Alliances Will Drive Long Term Market Leadership

Analysts have modestly raised their price target on Advantech, citing a slightly higher assumed future price-to-earnings multiple and stable long-term growth and margin forecasts that together support a valuation now hovering around $358 per share.

What's in the News

- Announced a collaboration with D3 Embedded to integrate Advantech AFE R360/R760 platforms with advanced GMSL2 camera systems, enhancing AI powered vision and object recognition for autonomous mobile robots in manufacturing, warehouse, and retail settings (client announcement).

- Formed a strategic collaboration with Qualcomm Technologies and Edge Impulse to build an edge AI ecosystem around the Dragonwing IQ 9075 processor, powering new AIR 055 and AFE A503 platforms for vision AI, robotics, and AMR deployments (strategic alliance).

- Introduced a new portfolio of NVIDIA Jetson Thor based edge AI solutions targeting robotics, medical AI, and data AI, including specialized robotic controllers, surgical robotics systems, and multi camera traffic and factory analytics platforms (product announcement).

- Launched the AOM 5721 SMARC Arm module based on Qualcomm Dragonwing QCS6490, delivering 12 TOPS edge AI performance, four camera support, and multi OS flexibility for industrial, commercial, and medical applications (product announcement).

- Issued fourth quarter 2025 revenue guidance of USD 550 million to USD 570 million, reinforcing expectations of steady top line growth in its core industrial and edge computing markets (corporate guidance).

Valuation Changes

- Fair Value Estimate remains unchanged at approximately $357.60 per share, indicating no material revision to the intrinsic value assessment.

- The Discount Rate has risen slightly from 6.62 percent to about 6.63 percent, reflecting a marginally higher required return in the valuation model.

- Revenue Growth is effectively unchanged at around 10.84 percent, signaling stable expectations for Advantech’s long term top line expansion.

- Net Profit Margin is effectively unchanged at roughly 16.29 percent, indicating steady assumptions on long term profitability.

- The Future P/E has risen slightly from about 24.55x to 24.55x, supporting a modestly higher valuation multiple on future earnings.

Key Takeaways

- Advantech's investments in production facilities and edge computing are expected to enhance capacity, drive revenue growth, and improve gross margins.

- Strategic local assembly expansion and potential M&A could mitigate tariff impacts, stabilize margins, and accelerate AI-driven growth.

- Political and economic challenges across key markets may compress margins, increase risks, and potentially destabilize future revenue growth for Advantech.

Catalysts

About Advantech- Manufactures and sells embedded computing boards, industrial automation products, and applied and industrial computers.

- Advantech is planning significant CapEx investments in the U.S. and China production facilities, which could enhance their production capacity and drive future revenue growth. (Impact: Revenue)

- The company's push into edge computing and IoT through high-performance product offerings and software integration, particularly with enhanced AI solutions, is expected to boost gross margins by 2-3% over the next few years. (Impact: Gross Margins)

- Advantech's strategic focus on expanding its local assemblies in the U.S. and leveraging local supply chains in China could mitigate international tariff impacts and support margin stability. (Impact: Operating Margins)

- Sector-driven growth, especially in healthcare, semiconductor, and energy markets in various regions such as North America, Europe, and China, suggests strong demand driving future revenue gains. (Impact: Revenue)

- Plans for potential M&A to expand AI capabilities and regional presence might accelerate growth by complementing organic expansion, improving net margins through synergies and operational efficiencies. (Impact: Net Margins)

Advantech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Advantech's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.5% today to 16.3% in 3 years time.

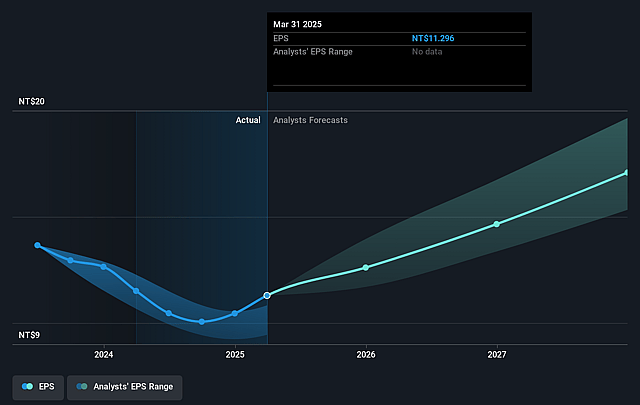

- Analysts expect earnings to reach NT$14.8 billion (and earnings per share of NT$17.13) by about September 2028, up from NT$9.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NT$16.5 billion in earnings, and the most bearish expecting NT$11.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, down from 30.2x today. This future PE is greater than the current PE for the TW Tech industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Advantech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- North Asia's slow growth due to political uncertainty in the Korean market could dampen regional revenue growth, impacting overall global revenues.

- A potential decline in demand driven by high tariffs in the U.S. might postpone shipments, affecting revenue and margins in the second half of the year.

- Competitive pressures in the China market and the need to leverage local supply chains could lead to tighter margins, impacting profitability.

- The reliance and plans for production expansion in geopolitically sensitive regions may lead to increased operational risks and costs, potentially affecting net margins.

- The volatility in the semiconductor and healthcare sectors, while providing short-term demand surges, could lead to future instability in revenues if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$372.143 for Advantech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$432.0, and the most bearish reporting a price target of just NT$278.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$90.8 billion, earnings will come to NT$14.8 billion, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of NT$336.5, the analyst price target of NT$372.14 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Advantech?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.