Last Update 15 Dec 25

2327: Future Profit Margins And Market Conditions Will Shape Share Performance

Analysts have nudged their price target on Yageo slightly higher to approximately $252.08 per share, citing marginally lower discount rate assumptions and a nearly unchanged outlook for revenue growth, profit margins, and future valuation multiples.

Valuation Changes

- The fair value estimate remains unchanged at NT$252.08 per share, indicating no material reassessment of intrinsic value.

- The discount rate has fallen slightly from 7.75 percent to 7.74 percent, reflecting a marginally lower perceived risk profile or cost of capital.

- The revenue growth forecast is essentially unchanged, moving fractionally from 10.14 percent to 10.14 percent, signaling a stable growth outlook.

- The net profit margin expectation is virtually flat, ticking up from 20.99 percent to 21.0 percent, suggesting no meaningful shift in profitability assumptions.

- The future P/E multiple has edged down slightly from 18.15 times to 18.14 times, implying a marginally more conservative valuation multiple applied to forward earnings.

Key Takeaways

- Yageo's strategic positioning in AI server components and the EV market could drive future revenue growth and diversification.

- Global production sites and operational efficiency improvements support revenue consistency and enhanced net margins amidst geopolitical risks.

- Persistent industrial weakness, high inventory levels, and geopolitical risks threaten Yageo’s revenue consistency and margin stability amidst cautious automotive growth outlook.

Catalysts

About Yageo- Engages in the manufacture and sale of passive components in China, Europe, the United States, and rest of Asia.

- Yageo is strategically positioned to benefit from growth in computing and enterprise segments, particularly through its MLCC, tantalum polymer capacitors, and inductors, which are increasingly used in AI servers and applications. This could drive future revenue growth.

- The company's strong presence across multiple production sites globally allows it to effectively manage potential geopolitical risks such as tariffs, positioning it favorably with customers and potentially aiding consistent revenue and margin stability.

- With continued integration and optimization following recent acquisitions, Yageo has shown improvements in operating expenses and operating margins. This focus on operational efficiency is likely to enhance net margins and earnings.

- Yageo's engagement with the growing EV market in China, along with its diversified footprint in the automotive sector, provides a catalyst for revenue growth, especially as automotive technology becomes more electronically advanced.

- The company's exploration in active components and strategic alliances, while preliminary, suggests potential revenue diversification and growth opportunities in the coming years, supported by strong synergies with its current passive components lineup.

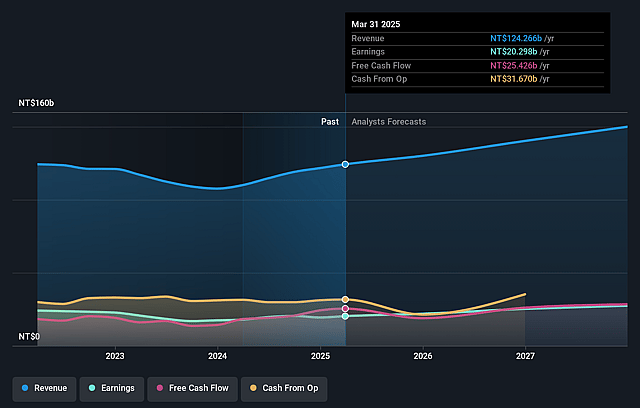

Yageo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yageo's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.8% today to 18.3% in 3 years time.

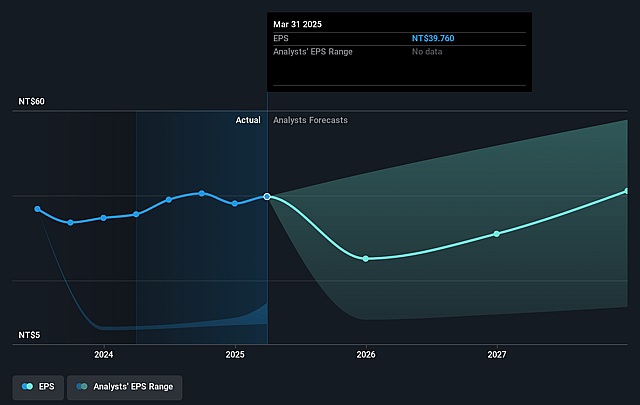

- Analysts expect earnings to reach NT$28.3 billion (and earnings per share of NT$14.08) by about September 2028, up from NT$19.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 14.0x today. This future PE is lower than the current PE for the TW Electronic industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

Yageo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The guidance for Q4 suggests a low seasonal revenue decline, which could affect earnings and pressure Yageo’s ability to achieve consistent revenue growth.

- Persistent weakness in the industrial sector, particularly in Europe, poses risk to net income as the segment is a significant contributor to Yageo’s sales mix.

- Inventory levels remain on the higher side globally, especially with global distributors maintaining 5 to 5.5 months on hand, which could impact revenue recognition if demand fluctuations occur.

- A cautious outlook on automotive growth, especially with challenges in Western brands’ EV sectors, may lead to decreased contributions from a historically vital revenue segment.

- Geopolitical risks like potential tariffs and regional production shifts could disrupt Yageo’s operational efficiency and increase operating expenses, affecting margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$146.729 for Yageo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$180.25, and the most bearish reporting a price target of just NT$37.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$154.5 billion, earnings will come to NT$28.3 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 8.1%.

- Given the current share price of NT$135.0, the analyst price target of NT$146.73 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Yageo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.