Last Update 30 Oct 25

Fair value Increased 2.42%Analysts have raised their price target for United Microelectronics from $45.87 to $46.98. This change is attributed to updated expectations for stronger revenue growth and improved profit margins.

What's in the News

- United Microelectronics launched its 55nm Bipolar-CMOS-DMOS (BCD) platform, enhancing performance and power efficiency for mobile, consumer, automotive, and industrial applications (Company Announcement).

- The new 55nm BCD platform supports smaller chip area, lower power consumption, and superior noise reduction. It combines analog, digital, and power functions on a single chip (Company Announcement).

- The platform includes Non-Epitaxy, Epitaxy, and Silicon-on-Insulator (SOI) processes and meets stringent automotive reliability standards such as AEC-Q100 Grade 0 and Grade 1 (Company Announcement).

- Integrated technologies such as ultra-thick metal (UTM), embedded flash, and resistive random-access memory (RRAM) have been added to enhance performance and functionality (Company Announcement).

- A Board Meeting has been scheduled for October 29, 2025, to consider and approve third quarter 2025 financial results (Company Announcement).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from NT$45.87 to NT$46.98.

- Discount Rate has increased marginally from 9.43% to 9.59%.

- Revenue Growth forecast is up from 6.89% to 8.60%.

- Net Profit Margin estimate has improved from 19.57% to 20.26%.

- Future Price-to-Earnings (P/E) ratio is projected to decline from 13.39x to 12.77x.

Key Takeaways

- Strategic investments in specialty and mature node technologies position UMC to capture growth from trends in digitalization, electric vehicles, and edge computing.

- Capacity expansions, stable demand, and advanced packaging partnerships support improved utilization, revenue growth, and margin resilience in future high-growth markets.

- Heavy reliance on mature nodes, slow advanced technology adoption, and macroeconomic pressures threaten UMC's margins, revenue growth, and long-term competitiveness amid rising global uncertainties.

Catalysts

About United Microelectronics- Operates as a semiconductor wafer foundry in Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and internationally.

- The ramp-up of new capacity at UMC's Singapore Fab 12i (Phase 3), set to start production in 2026 and focused on 22nm/28nm, positions UMC to capitalize on growing customer demand for supply chain resilience and regionalized manufacturing, likely supporting higher utilization rates and revenue growth into 2026 and beyond.

- Continued strong adoption and market share gains for UMC's differentiated 22nm and 28nm products-driven by robust wireless communications, imaging, and controller applications-signal UMC's alignment with accelerating digitalization across industries, offering a long-lasting growth engine and improved revenue visibility.

- UMC's specialty leadership in mature nodes and high-voltage technologies, particularly for automotive, industrial, IoT, and power management applications, enables the company to benefit directly from global trends in electric vehicles, renewables, and edge computing, supporting stable ASPs and bolstering long-term net margins.

- Strategic partnerships (e.g., with Intel on 12nm) and investments in advanced and specialty packaging for high-performance and AI applications expand UMC's addressable market in future high-growth segments, providing new revenue streams and ASP resilience over the next several years.

- Decelerating depreciation growth after 2025, combined with a shift toward higher-value technology mix and stable customer demand, points to a pathway for gross margin improvement and a stronger earnings outlook as utilization rises and cost pressures abate.

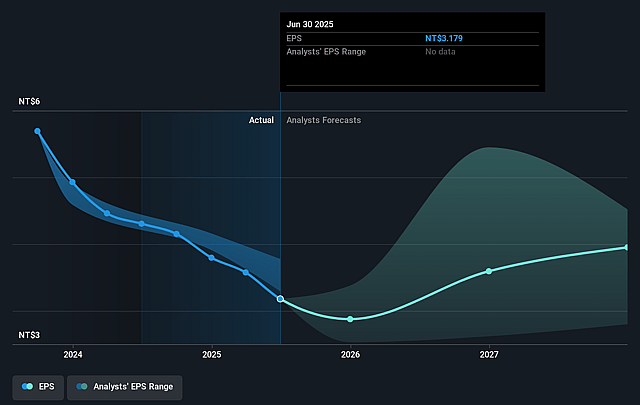

United Microelectronics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming United Microelectronics's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.7% today to 19.6% in 3 years time.

- Analysts expect earnings to reach NT$56.8 billion (and earnings per share of NT$4.53) by about September 2028, up from NT$39.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NT$34.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.43%, as per the Simply Wall St company report.

United Microelectronics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UMC's reliance on mature nodes (22/28nm) for the bulk of its revenue exposes it to margin pressure and commoditization as competition at these technology levels, particularly from Chinese foundries, intensifies-potentially constraining future revenue growth and eroding net margins.

- The company's slow progress in advanced technology nodes (sub-12nm) could result in a sustained loss of competitiveness as customer demand increasingly shifts toward leading-edge foundries, risking long-term revenue and average selling price declines.

- Persistent appreciation of the NT dollar against the US dollar significantly impacts UMC's reported revenue and gross margins, as every 1% NT appreciation cuts gross margin by 0.4–0.5 percentage points and reduces reported sales, pressuring overall earnings.

- Rising depreciation costs driven by aggressive capital expenditures and fab expansions are already compressing gross margin-if utilization rates dip or industry overcapacity emerges, fixed costs may outpace revenue growth and squeeze net income further.

- Ongoing geopolitical and macroeconomic uncertainties, including US-China trade tensions and evolving global tariff policies, create operational risks and unpredictable customer behavior that may disrupt supply chains, lead to inventory corrections, and impact both revenue stability and earnings predictability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$45.873 for United Microelectronics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$60.0, and the most bearish reporting a price target of just NT$32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$290.0 billion, earnings will come to NT$56.8 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 9.4%.

- Given the current share price of NT$40.9, the analyst price target of NT$45.87 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on United Microelectronics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.