Key Takeaways

- Growth in high-speed segments like USB4 and server-related products could significantly boost revenue and diversify the earnings base.

- Heavy investment in integrated products and deep submicron processes aims to increase market share and drive future growth.

- Increased competition and reliance on high-speed product development pose risks to profit margins and revenue, with potential delays in revenue boosts and market penetration.

Catalysts

About Parade Technologies- Operates as a fabless semiconductor company in South Korea, China, Taiwan, Japan, and internationally.

- Parade Technologies anticipates that its high-speed product segment, particularly USB4 retimers, will continue to dominate and grow due to extensive design wins across non-Intel platforms, potentially boosting revenue significantly.

- The company's transition towards more integrated products, such as the adoption of in-cell panels with integrated touch and gaming certifications, is expected to increase market share and maintain or improve gross margins due to higher ASPs and reduced competition in this niche.

- Parade is heavily investing in deep submicron process development for ASIC-like solutions targeting Tier 1 customers in the data center sector, which could drive significant revenue growth in the coming years.

- The anticipated growth in the automotive segment, leveraging high-speed devices and entering ADAS systems, could provide a substantial revenue stream as these projects are expected to ramp up in the second half of 2025 and into 2026.

- The company's strategic push into server-related high-speed products, notably PCIe redrivers, and expansion into the cable sector for data centers could further diversify its revenue base and enhance earnings stability.

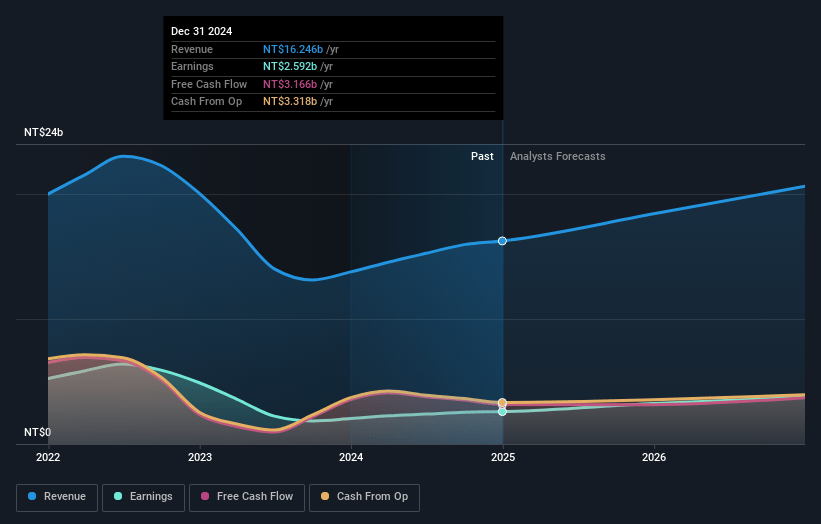

Parade Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Parade Technologies's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 19.2% in 3 years time.

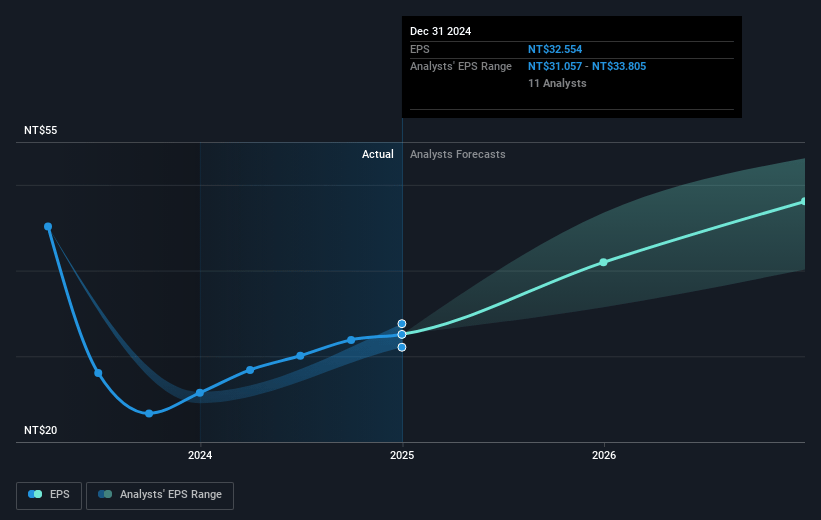

- Analysts expect earnings to reach NT$4.4 billion (and earnings per share of NT$57.31) by about March 2028, up from NT$2.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, down from 20.7x today. This future PE is lower than the current PE for the TW Semiconductor industry at 27.9x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Parade Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing increased competition in the panel industry, particularly on the pricing of low to mid-tier products. This competitive pressure could lead to narrower profit margins. (Impact: Net margins)

- Most of the company's growth expectations hinge on high-speed products like USB4 retimer and making inroads in non-Intel platforms, but success is reliant on market expectations and further developments which may not materialize in the short term. (Impact: Revenue)

- High exposure to notebook segment with single-digit growth forecasts poses a risk as a slowdown in this sector could negatively affect the company’s future revenue prospects. (Impact: Revenue)

- The work on ASIC products tied to a 6-nanometer process has a long lead time, so new revenue generation from these developments may not occur until the year after next, delaying potential revenue boosts. (Impact: Earnings)

- While there are significant efforts to drive high-speed products towards new markets such as automotive and servers, these strategies are time-intensive and carry risk if the desired market penetration is not achieved soon enough. (Impact: Earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$782.462 for Parade Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$1200.0, and the most bearish reporting a price target of just NT$635.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$23.1 billion, earnings will come to NT$4.4 billion, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of NT$675.0, the analyst price target of NT$782.46 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.