Key Takeaways

- Rapid scaling of the 3P business and investments in momoAds could drive significant revenue and profit margin growth.

- Enhanced logistics and customer engagement initiatives are expected to improve operational efficiency and support long-term growth.

- Slowing e-commerce growth, declining media revenue, and increased expenses challenge momo.com's profitability and diversification efforts amidst changing consumer behavior and spendings.

Catalysts

About momo.com- Engages in the TV and radio production, radio and TV program distribution, radio and TV commercial, video program distribution, issuing of magazine, and retailing businesses in Taiwan.

- momo.com's 3P business is rapidly scaling, with significant GMV growth expected, which could drive overall GMV and revenue growth in 2025.

- Investment in momoAds, the company's retail media network, is seeing increased traction with merchants. This could potentially enhance revenue and profit margins due to its high-margin nature.

- The integration of the Southern and Northern Distribution Centers and streamlined 2-hub operations aim to enhance logistics efficiency and customer service, potentially improving operational costs and net margins.

- Ongoing focus on enhancing customer engagement and increasing user activity, demonstrated by rising average monthly users and purchase frequency, could boost future sales and revenue growth.

- Strategic priorities for 2025, such as market share growth in 1P and 3P businesses, leverage of customer service and logistics, and use of technology to drive operational excellence, are expected to support long-term revenue and earnings growth.

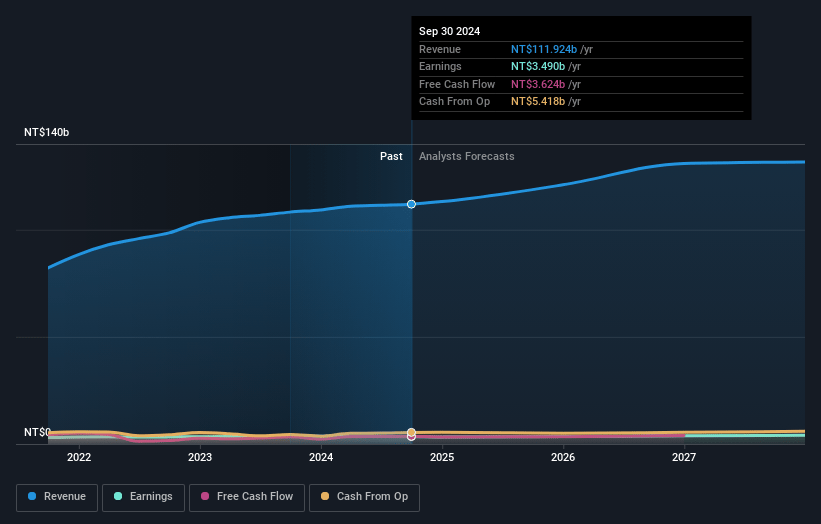

momo.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming momo.com's revenue will grow by 5.6% annually over the next 3 years.

- Analysts are assuming momo.com's profit margins will remain the same at 3.1% over the next 3 years.

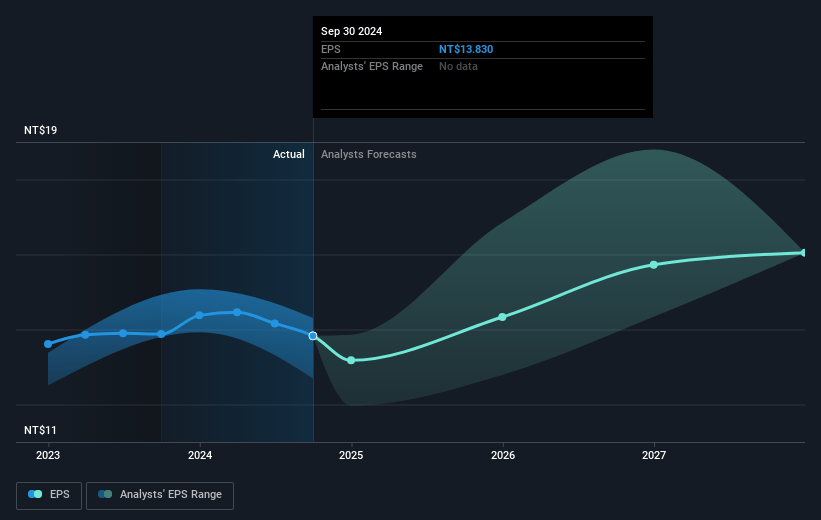

- Analysts expect earnings to reach NT$4.1 billion (and earnings per share of NT$18.57) by about April 2028, up from NT$3.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, up from 23.3x today. This future PE is greater than the current PE for the TW Multiline Retail industry at 19.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.79%, as per the Simply Wall St company report.

momo.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing growth in the e-commerce industry and modest revenue increase of only 3% year-over-year could indicate challenges in sustaining revenue growth.

- Media revenue declined by 12.4% year-over-year, reflecting potential difficulties in diversifying revenue streams beyond core e-commerce operations.

- Investment in new business initiatives led to increased operating expenses, which could pressure net margins if not offset by sufficient revenue growth.

- The decreased take rate due to changes in product sales mix and customer trading down behavior may adversely impact net income and profitability.

- Weak consumer spending and shift towards low-price alternatives might limit the growth potential of higher-margin product categories, affecting overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$368.143 for momo.com based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$430.0, and the most bearish reporting a price target of just NT$315.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$132.5 billion, earnings will come to NT$4.1 billion, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of NT$319.0, the analyst price target of NT$368.14 is 13.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.