Key Takeaways

- The divestment and debt reduction efforts improve balance sheet strength, potentially reducing interest expenses and enhancing net margins.

- Strategic asset enhancements and tenant shifts increase potential for higher occupancy, rental income growth, and revenue stability.

- Reduced gross revenue from divestment and regional headwinds threaten earnings, while high debt levels amplify financial risks amid potential interest rate hikes.

Catalysts

About Mapletree Pan Asia Commercial Trust- Mapletree Pan Asia Commercial Trust (“MPACT”) is a real estate investment trust (“REIT”) positioned to be the proxy to key gateway markets of Asia.

- The divestment of Mapletree Anson and the application of proceeds to reduce borrowings improved MPACT’s balance sheet by lowering its gearing ratio from 40.5% to 37.7%, which can lead to lower interest expenses and improved net margins in the future.

- The strong performance and valuation uplift of Singapore properties, particularly VivoCity, indicate a potential for increased rental income, which could drive future revenue and earnings growth.

- The continuous asset enhancement initiatives at VivoCity, such as kiosk upgrades and retail space expansion, are expected to boost tenant engagement and sales, potentially enhancing revenue in the long run.

- The shift of tenants from CBD to more cost-effective locations like MBC and mTower positions MPACT to benefit from higher occupancy rates and stable rental income, positively impacting future revenues.

- The issuance of a 7-year green bond and maintaining a high percentage of fixed-rate debt provides MPACT with financial stability and flexibility, allowing for potential future cost savings and improved earnings.

Mapletree Pan Asia Commercial Trust Future Earnings and Revenue Growth

Assumptions

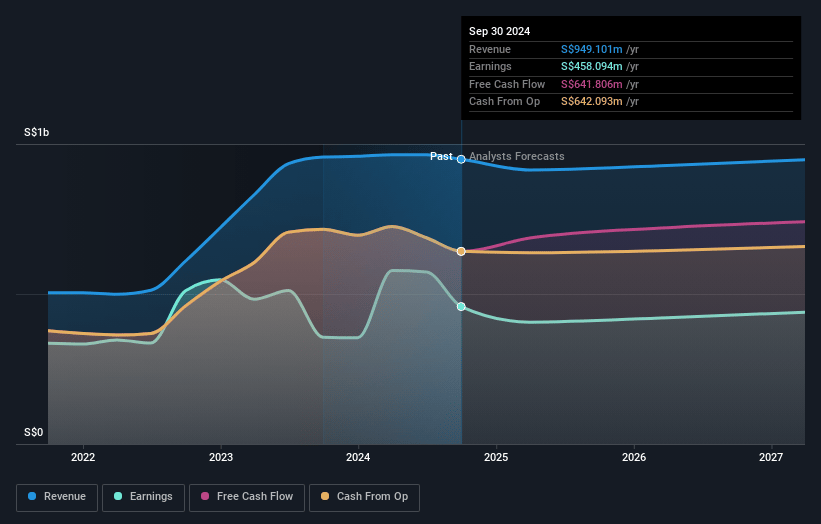

How have these above catalysts been quantified?- Analysts are assuming Mapletree Pan Asia Commercial Trust's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 63.7% today to 50.4% in 3 years time.

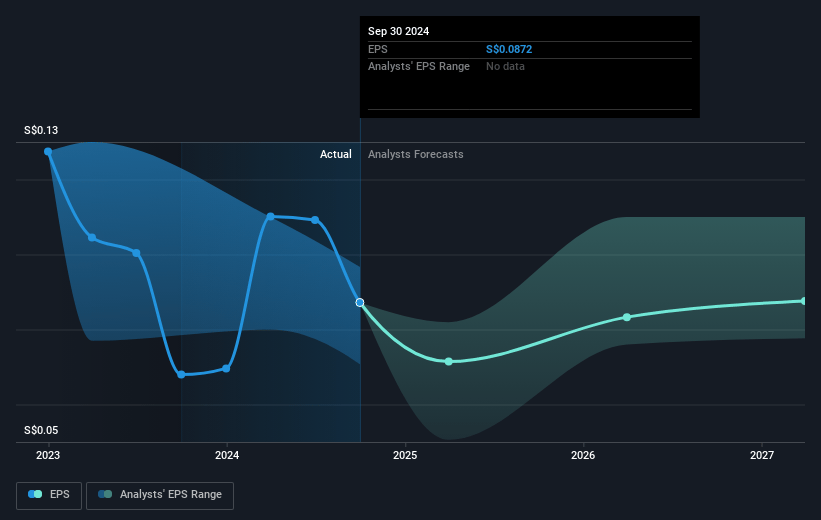

- Analysts expect earnings to reach SGD 483.9 million (and earnings per share of SGD 0.09) by about May 2028, down from SGD 584.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SGD589.8 million in earnings, and the most bearish expecting SGD398 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 11.0x today. This future PE is lower than the current PE for the SG REITs industry at 25.4x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Mapletree Pan Asia Commercial Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent divestment of Mapletree Anson has led to a decrease in both gross revenue and net property income, posing a risk of decreasing future revenues without replacement investments.

- Headwinds in overseas markets, particularly in Greater China and Japan, have resulted in lower property valuations, which poses a risk to overall earnings and revenue stability.

- Negative rental reversions in China and Hong Kong due to economic and trade tensions may impact future net margins and earnings if unfavorable leasing terms persist.

- Weaker leasing demand and non-renewals in Japan, specifically in the Makuhari area, can negatively affect occupancy rates and revenues, and compounded by Fujitsu's upcoming lease termination, may lead to further occupancy and financial declines.

- High debt levels, despite reduced borrowings, face risks from potential increases in interest rates, which could impact net margins and distribution per unit through higher net finance costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SGD1.407 for Mapletree Pan Asia Commercial Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD1.62, and the most bearish reporting a price target of just SGD1.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SGD959.5 million, earnings will come to SGD483.9 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of SGD1.22, the analyst price target of SGD1.41 is 13.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.