Key Takeaways

- Strategic AEIs and lease refreshes aim to boost rental income, maintain high occupancy, and enhance operational efficiency for revenue growth.

- Robust financial positioning with hedged debt supports earnings growth through effective cost management and operational flexibility.

- Slight drops in occupancy and increased gearing pose revenue risks, while market slowdowns and travel trends may impact tenant sales and footfall.

Catalysts

About Frasers Centrepoint Trust- Frasers Centrepoint Trust ("FCT") is a leading developer-sponsored retail real estate investment trust ("REIT") and one of the largest suburban retail mall owners in Singapore with assets under management of approximately S$6.9 billion.

- The ongoing asset enhancement initiative (AEI) at Hougang Mall, targeting a 7% ROI on a $51 million CapEx, indicates potential for increased rental income and foot traffic, which could positively impact revenue and earnings.

- The limited new retail space supply expected from 2025 to 2027, with less than 1% overall stock coming to the market, suggests strong demand for existing prime suburban malls, leading to potential rental growth and enhanced net margins.

- Proactive management through continuous small-scale AEI and tenancy curation, such as the 20% to 30% refresh of expiring leases, aims to improve the retail offering and maintain high occupancy rates, directly supporting revenue growth and operational efficiency.

- Expected population and income growth in the catchment areas, supported by government policies like the progressive wage model, promises increased shopper spending capacity, thus boosting sales and revenue potential for the malls.

- Favorable financial positioning, evidenced by a hedged debt ratio of 65.5%, reduced cost of debt, and a well-managed debt maturity profile, provides a stable foundation for earnings growth through cost management and operational flexibility.

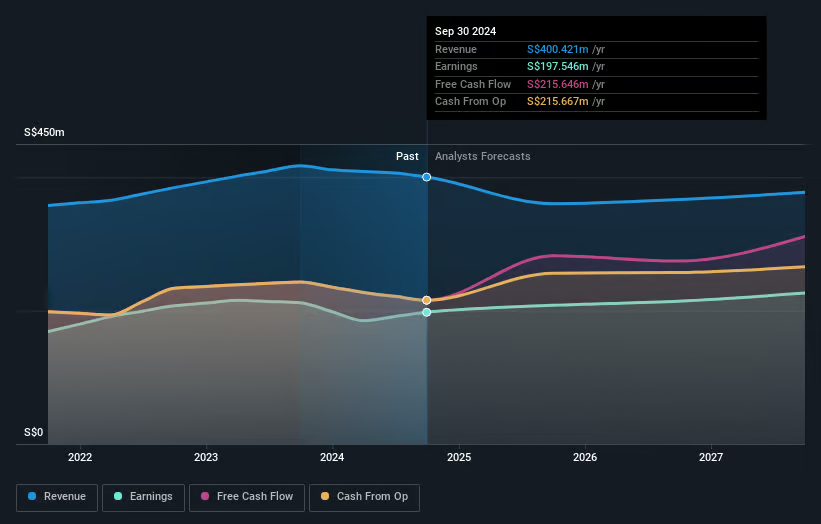

Frasers Centrepoint Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Frasers Centrepoint Trust's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 50.5% today to 56.5% in 3 years time.

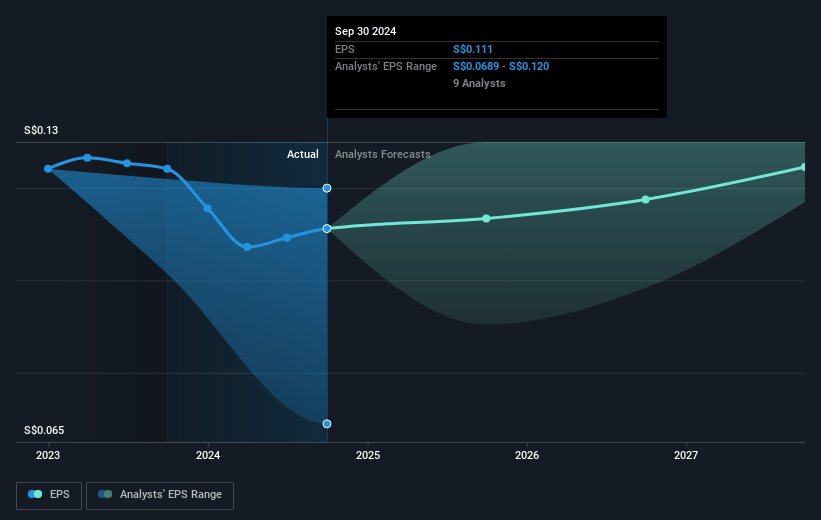

- Analysts expect earnings to reach SGD 252.2 million (and earnings per share of SGD 0.13) by about May 2028, up from SGD 208.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SGD317 million in earnings, and the most bearish expecting SGD221.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.6x on those 2028 earnings, up from 20.9x today. This future PE is greater than the current PE for the SG Retail REITs industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Frasers Centrepoint Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A slight drop in occupancy rates, from 99.7% to 99.5%, indicates a potential risk of decreased revenue if this trend continues or worsens.

- The gearing level has slightly increased to 39.3%, which could increase financial risk and impact net margins and earnings, especially in an environment of rising interest rates.

- The overall retail sales growth is mixed, and a broader market slowdown, with the RSI showing a 1.4% dip, could negatively impact tenant sales, affecting revenue.

- Increased outbound travel among Singaporeans could lead to lower footfall and tenant sales during peak holiday periods, potentially impacting revenue.

- Temporary disruptions and occupancy drops are expected during the asset enhancement initiatives at Hougang Mall, which might temporarily reduce revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SGD2.493 for Frasers Centrepoint Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD2.79, and the most bearish reporting a price target of just SGD2.15.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SGD446.6 million, earnings will come to SGD252.2 million, and it would be trading on a PE ratio of 23.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of SGD2.26, the analyst price target of SGD2.49 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.