Key Takeaways

- Strong demand for connectivity and IoT is driving revenue growth in both consumer and business segments, with ongoing 5G investments enhancing opportunities for premium services.

- Cost-cutting, digital transformation, and prudent capital allocation are improving margins and financial flexibility, supporting long-term growth and shareholder returns.

- Margin and revenue growth are threatened by intense competition, regulatory delays, over-reliance on cost savings, geographic risks, and challenges adapting to industry disruption.

Catalysts

About Tele2- Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

- Tele2 is well positioned to benefit from robust demand for broadband and mobile connectivity, as ongoing digitalization and remote/hybrid work continue to drive higher data consumption in both consumer and enterprise segments. This trend supports sustained end-user service revenue growth, notably demonstrated by double-digit growth rates in Baltics and B2B Sweden.

- Expansion in IoT and connected devices is materially boosting B2B growth, with strong IoT adoption cited as a main factor behind mobile revenue increases in Sweden Business. As societies increasingly integrate smart devices and infrastructure, Tele2's capabilities in these areas should continue to lift ARPU and revenue in the medium-to-long term.

- The company's accelerated transformation program-including significant workforce reductions, systematic contract renegotiations, and a shift to digital-first/direct channels-is driving substantial, sustainable operating expense reductions, with positive momentum for net margin and EBITDAaL expansion observed and expected to continue.

- Ongoing 5G investments and rollout position Tele2 to capture a growing share of value-added and premium services, both in consumer (enhanced mobile and broadband) and business offerings (network slicing, high-capacity solutions), with medium-term expectations for improved ARPU and earnings as network usage intensifies.

- High cash generation, reduced leverage, and disciplined CapEx spending-through targeted network upgrades and operational prioritization-strengthen financial flexibility. This may enable further M&A/consolidation or accelerate capital returns, supporting long-term earnings growth and returns to shareholders.

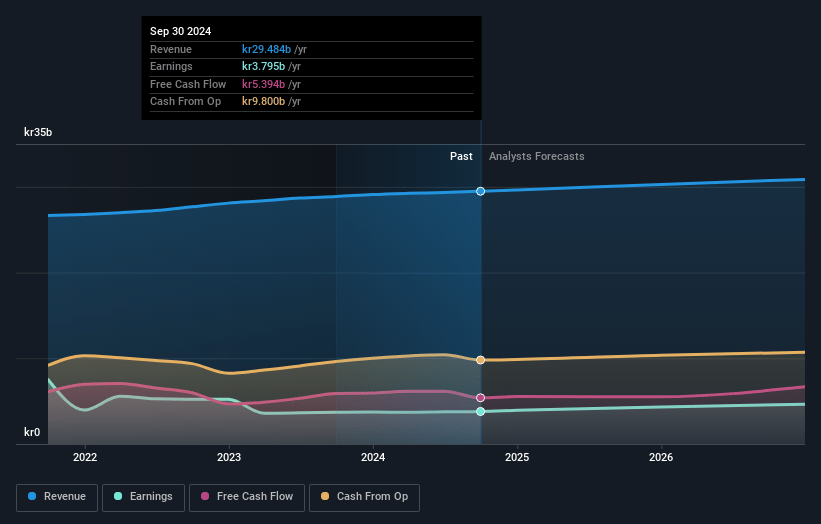

Tele2 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tele2's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 17.5% in 3 years time.

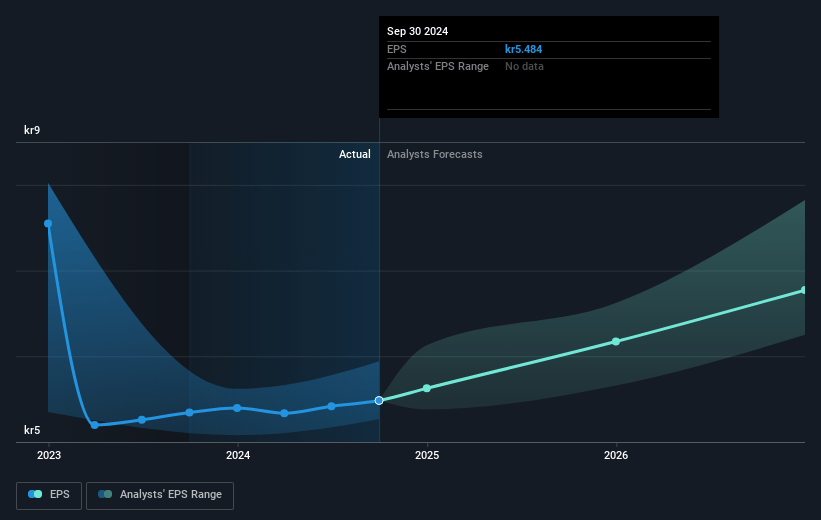

- Analysts expect earnings to reach SEK 5.5 billion (and earnings per share of SEK 7.95) by about July 2028, up from SEK 4.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK6.4 billion in earnings, and the most bearish expecting SEK4.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, down from 25.2x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.91%, as per the Simply Wall St company report.

Tele2 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tele2's long-term revenue growth is constrained by intense competition and aggressive pricing in Swedish consumer broadband and open fiber networks, leading to persistent ARPU compression and potential top-line stagnation, especially as regulatory action to improve wholesale access is proceeding slower than required (impact: revenue, EBITDA margin).

- The company's strategic transformation has aggressively harvested cost savings through workforce and contract reductions, but management admits that most "low-hanging fruit" has already been realized; future cost-outs will be harder to achieve and may not match the magnitude of recent savings, risking margin reversion or weaker earnings growth as sustainable efficiencies plateau (impact: EBITDA, net margin).

- Tele2's geographic concentration in Sweden and the Baltics exposes it to heightened macroeconomic and regulatory risks, including ongoing high SME bankruptcy rates, weak consumer confidence, and incremental regulatory actions in broadband pricing/access or landlord negotiations that can adversely affect revenue and profitability stability (impact: recurring revenue, EBITDA).

- The surge in profitability is heavily reliant on temporary cost deferrals, marketing pullbacks, and phased reinvestments, with management indicating that higher commercial and network expenses (especially for 5G) will be needed in the second half and beyond, likely diluting current margin gains unless offset by stronger revenue growth

- which faces clear headwinds (impact: EBITDA, net margin).

- Structural threats from secular industry trends-such as the commoditization of connectivity, the rise of Wi-Fi-first, satellite offerings, and value erosion in traditional services-combined with Tele2's execution risk in adapting business models and innovating beyond legacy revenue streams, presents long-term downside risk to market share and earnings power if not addressed proactively (impact: revenue, long-term earnings).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK146.505 for Tele2 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK190.0, and the most bearish reporting a price target of just SEK102.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK31.4 billion, earnings will come to SEK5.5 billion, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK150.75, the analyst price target of SEK146.51 is 2.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.