Key Takeaways

- Successful TRaaS strategy and significant backlog enhance revenue stability and indicate potential margin improvement.

- Strategic expansion in high-potential markets, including the US and Saudi Arabia, fuels future revenue and earnings growth.

- Legislative changes and project completions impact revenue and margins, with higher expenses and delayed growth targets posing risks to profitability and investor confidence.

Catalysts

About Sensys Gatso Group- Designs, develops, owns, operates, markets, and sells traffic management and enforcement solutions to nations, cities, and fleet owners worldwide.

- Sensys Gatso has successfully implemented a strategy to increase its recurring TRaaS (Traffic as a Service) revenue, which is expected to stabilize and grow future revenue streams. This significantly impacts the company's future revenue stability and predictability.

- The Swedish and Dutch contracts, worth SEK 1,250 million, have an ongoing backlog of more than SEK 1,000 million. This indicates a future revenue stream and provides the groundwork for potential margin improvement over time as the service and maintenance phases progress.

- Sensys Gatso is strategically expanding its footprint in high-potential markets, such as the United States, and has secured 100% ownership of its U.S. entity. This strategic move positions the company to capitalize on and drive future revenue and earnings growth in a key market.

- The recent framework agreements in Saudi Arabia and the ongoing interest and developments in Ghana set the stage for substantial future order intake and revenue growth. These projects are likely to contribute significantly to revenue growth and potentially increase net margins due to scale advantages and long-term service agreements.

- Investments in expanding fixed assets to support managed services programs and a solid bond issue to fund future growth suggest that Sensys Gatso is well-positioned to capitalize on future growth opportunities, driving potential increases in overall earnings and scaling efficiencies.

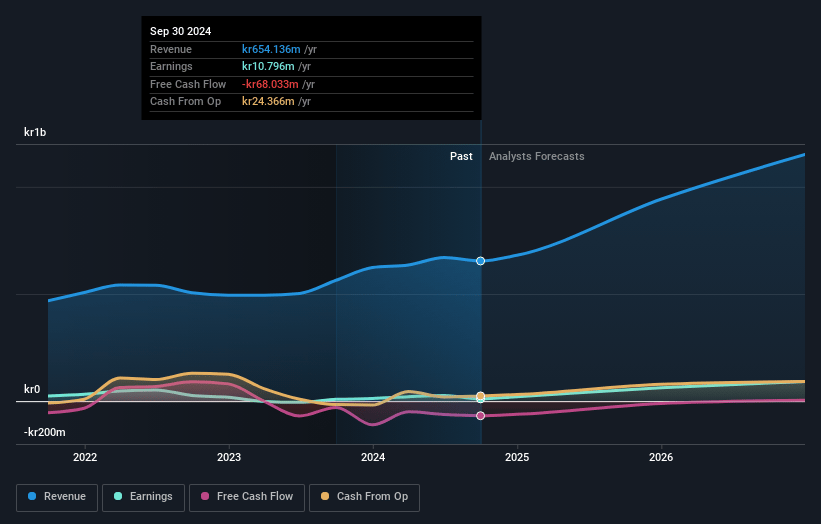

Sensys Gatso Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sensys Gatso Group's revenue will grow by 18.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 6.6% in 3 years time.

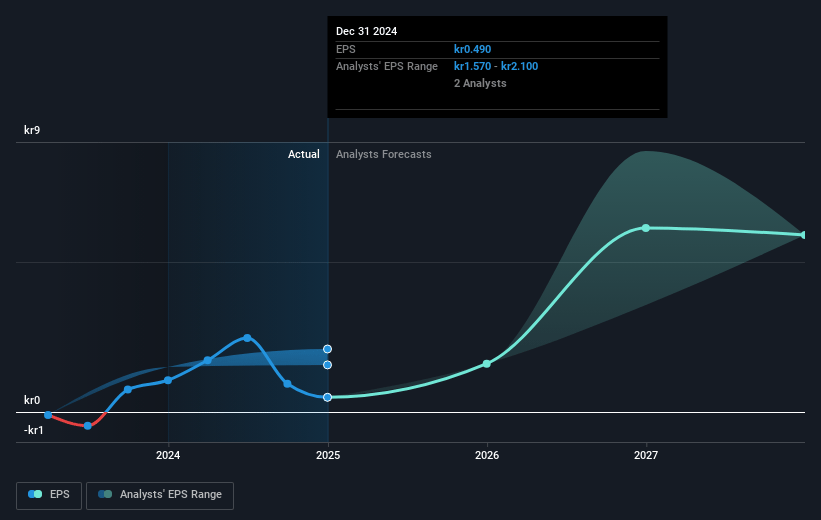

- Analysts expect earnings to reach SEK 68.0 million (and earnings per share of SEK 5.9) by about March 2028, up from SEK 5.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 79.8x today. This future PE is lower than the current PE for the GB Electronic industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Sensys Gatso Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Legislative changes in Iowa have negatively impacted revenue, with only a small fraction of fixed speed permits approved, and the process to resolve this is time-consuming, posing a risk to revenue recovery. Revenue.

- The completion of deliveries to Saudi Arabia in 2024 led to decreased contributions from the APAC-MEA region, which previously bolstered revenue growth, suggesting potential variability in regional revenue streams. Revenue.

- The overall gross margin has decreased, partly due to lower-margin system sales preceding higher-margin service and maintenance revenues, which could affect profitability in the near term until higher-margin phases kick in. Gross margins.

- Increased operating expenses, including those for sales and share acquisition activities, have contributed to declining operating profits, which could pressure net income if revenue growth does not offset these costs. Net margins.

- The delay in achieving the company's financial ambition of SEK 1 billion in revenue with >15% EBITDA margin by 2025 reflects potential challenges in meeting growth targets, which could impact investor confidence and earnings forecasts. Earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK71.0 for Sensys Gatso Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK90.0, and the most bearish reporting a price target of just SEK52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.0 billion, earnings will come to SEK68.0 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of SEK41.0, the analyst price target of SEK71.0 is 42.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.