Key Takeaways

- Expansion into advanced, high-margin PCB applications and successful cost pass-through are supporting resilience and robust profitability amid market pressures.

- M&A-driven consolidation and sectoral shifts toward digitalization and electrification are broadening the customer base and underpinning long-term organic growth.

- Reliance on external manufacturing, FX volatility, pricing pressure, tariff uncertainty, and risky M&A threaten margins, earnings, and operational stability amid global supply chain shifts.

Catalysts

About NCAB Group- Engages in the manufacture and sale of printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

- Recovery in European and Nordic manufacturing is beginning to take hold, supported by rising order intake and signs of bottoming in key markets like Germany, and stimulus measures may further accelerate this trend; this can improve top-line revenue growth and drive better operating leverage as volumes recover.

- NCAB is successfully passing tariff-related costs onto customers in North America, maintaining strong EBITA margins and demonstrating pricing power and supplier network flexibility-key for sustaining net margins amidst supply chain volatility.

- Continued execution of the M&A-driven consolidation strategy-evidenced by the integration of B&B Leiterplattenservice and a robust acquisition pipeline-positions NCAB to expand its customer base and realize cost/scale synergies, supporting both revenue and earnings growth over the medium term.

- Ongoing shift towards high-value, complex, and engineering-supported PCB applications (especially in segments like aerospace, defense, and high-tech) is resulting in higher-margin business and better gross margin resilience, even as standard product pricing remains under pressure.

- The accelerating adoption of digitalization, IoT, and electrification across industrial, transportation, and telecom sectors underpins sustained future demand for advanced PCBs, expanding NCAB's addressable market and supporting long-term organic revenue growth.

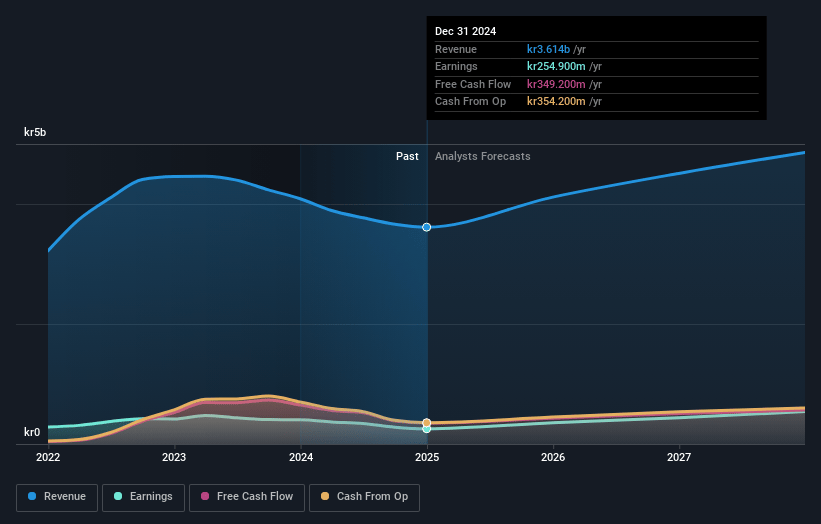

NCAB Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NCAB Group's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 10.9% in 3 years time.

- Analysts expect earnings to reach SEK 534.6 million (and earnings per share of SEK 2.26) by about July 2028, up from SEK 184.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, down from 56.0x today. This future PE is lower than the current PE for the SE Electronic industry at 27.9x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.38%, as per the Simply Wall St company report.

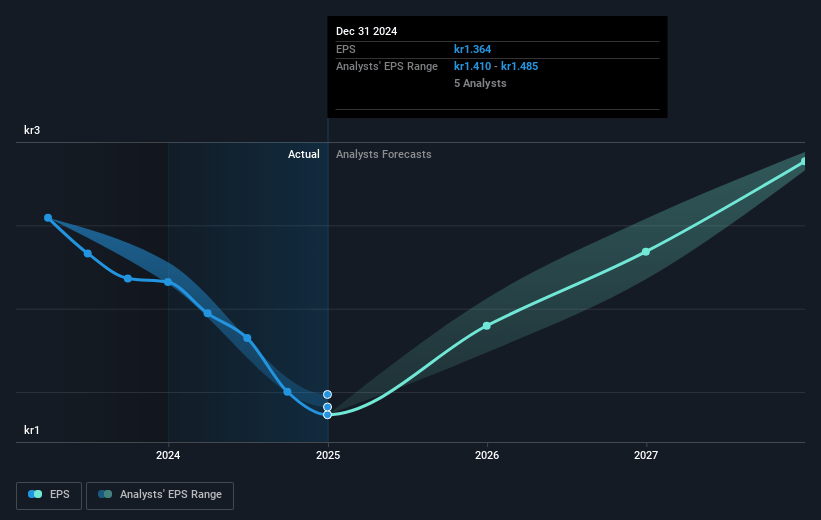

NCAB Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent foreign exchange (FX) volatility, particularly a weaker U.S. dollar, significantly impacted revenues and EBITA in the current quarter and is expected to continue if exchange rates remain unfavorable, potentially depressing reported earnings and margins.

- The company relies solely on external manufacturing partners, lacking in-house production capacity, which exposes it to supply chain risks and limits operational control at a time when global onshoring/nearshoring trends threaten its Asia-centric sourcing model, increasing vulnerability to disruptions and margin compression.

- Price pressure and industry commoditization are apparent, especially in Europe, where subdued demand and aggressive competition are driving down gross margins and EBITA, with no immediate sign of strong volume or margin recovery, risking sustained profitability decline.

- Tariff uncertainty, particularly in North America, is impacting customer sentiment and order timing, while ongoing trade tensions and potential for new or expanded tariffs could lead to unpredictable costs, disrupt supply chains, and pressure revenue growth.

- Successful execution of the M&A strategy is critical but increasingly risky; as highlighted by recent acquisitions raising working capital and debt, poor integration or overpayment could dilute margins, harm earnings, and erode shareholder value if synergy targets are not achieved.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK58.4 for NCAB Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK69.0, and the most bearish reporting a price target of just SEK51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK4.9 billion, earnings will come to SEK534.6 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK55.1, the analyst price target of SEK58.4 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.